Page 177 - CW E-Magazine (17-12-2024)

P. 177

Special Report

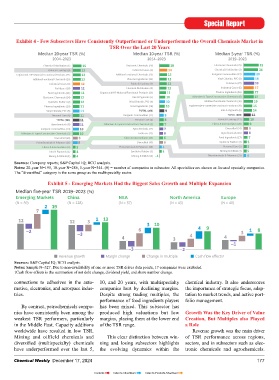

Exhibit 4 - Few Subsectors Have Consistently Outperformed or Underperformed the Overall Chemicals Market in

TSR Over the Last 20 Years

Median 20-year TSR (%) Median 10-year TSR (%) Median 5-year TSR (%)

2004–2023 2014–2023 2019–2023

Chemical Distribution (1) 15 Electronic Chemicals (26) 18 Electronic Chemicals (35) 25

Paints & Coatings (9) 13 Industrial Gases (6) 14 Chemical Distribution (3) 24

Engineered /HP Material /Functional Products (11) 13 Additive/Functional Chemicals (23) 13 Inorganic Commodities (17) 20

Additive/Functional Chemicals (16) 13 Pharma Ingredients (13) 13 Vinyl Chloride, PVC (9) 18

Industrial Gases (6) 12 Paints & Coatings (9) 13 Fertilizers (27) 18

Fertilizers (18) 12 Chemical Distribution (2) 13 Industrial Gases (6) 17

Food Ingredients (11) 12 Engineered/HP Material/Functional Products (23) 11 Pharma Ingredients (16) 17

Electronic Chemicals (14) 12 Inks & Pigments (5) 10 Adhesives & Tapes/Construction Chemicals (6) 17

Synthetic Rubber (2) 12 Vinyl Chloride, PVC (9) 10 Additive/Functional Chemicals (30) 16

Pharma Ingredients (10) 11 Food Ingredients (16) 10 Engineered/HP Material/Functional Products (28) 15

Vinyl Chloride, PVC (6) 11 TOTAL (286) 9 Inks & Pigments (6) 14

Personal Care (4) 11 Inorganic Commodities (12) 8 TOTAL (344) 12

TOTAL (195) 11 Personal Care (4) 8 Paints & Coatings (12) 10

Agrochemicals (8) 11 Adhesives & Tapes/Construction Chemicals (5) 7 Fibers & Intermediates (20) 9

Inorganic Commodities (10) 10 Agrochemicals (12) 7 Diversified (54) 8

Adhesives & Tapes/Construction Chemicals (5) 10 Fertilizers (25) 6 Agrochemicals (16) 8

Diversified (38) 8 Fibers & Intermediates (14) 6 Food Ingredients (17) 7

Petrochemicals & Polymers (18) 8 Diversified (49) 6 Synthetic Rubber (3) 5

Fibers & Intermediates (6) 5 Petrochemicals & Polymers (28) 4 Personal Care (5) 5

Inks & Pigments (1) 4 Synthetic Rubber (3) 4 Mining & Oilfield (3) 5

Mining & Oilfield (1) 4 Mining & Oilfield (2) –1 Petrochemicals & Polymers (31) 4

Sources: Company reports; S&P Capital IQ; BCG analysis.

Notes: 20-year N=195, 10-year N=286, 5-year N=344. (#) = number of companies in subsector. All specialties are shown as focused specialty companies.

Industrial Gases

Multispecialty

Agrochemical and Fertilizer

Focused Specialties

Base Chemicals & Basic Plastics

The “diversifi ed” category is the same group as the multispecialty sector.

Exhibit 5 - Emerging Markets Had the Biggest Sales Growth and Multiple Expansion

Median five-year TSR 2019–2023 (%)

Emerging Markets China NEA North America Europe

(N = 59) (N = 128) (N = 57) (N = 43) (N = 40)

2 19

7

12 12 3 1 13 3 10

–2 –3 6 4 9 3 1 8

4 3 4 4

–1

–3 –2

Revenue growth Margin change Change in multiple Cash flow effects1

Sources: S&P Capital IQ; BCG analysis.

Notes: Sample N=327. Due to non-availability of one or more TSR driver data points, 17 companies were excluded.

1Cash fl ow effects is the summation of net debt change, dividend yield, and share number change.

connections to adhesives in the auto- 10, and 20 years, with multispecialty chemical industry. It also underscores

motive, electronics, and aerospace indus- companies hurt by declining margins. the importance of strategic focus, adap-

tries. Despite strong trading multiples, the tation to market trends, and active port-

performance of food ingredients players folio management.

By contrast, petrochemicals compa- has been mixed. This subsector has

nies have consistently been among the produced high valuations but low Growth Was the Key Driver of Value

weakest TSR performers, particularly margins, placing them at the lower end Creation, But Multiples also Played

in the Middle East. Capacity additions of the TSR range. a Role

worldwide have resulted in low TSR. Revenue growth was the main driver

Mining and oilfield chemicals and This clear distinction between win- of TSR performance across regions,

diversifi ed (multispecialty) chemicals ning and losing subsectors highlights sectors, and in subsectors such as elec-

have underperformed over the last 5, the evolving dynamics within the tronic chemicals and agrochemicals.

Chemical Weekly December 17, 2024 177

Contents Index to Advertisers Index to Products Advertised