Page 178 - CW E-Magazine (17-12-2024)

P. 178

Special Report

The Rising Importance of a TSR Strategy

In recent years, demand for a TSR business, financial, and investor strate- growth’s role as the key TSR

strategy – both as a standalone approach gies – to TSR outcomes. As a result, driver).

and as part of broader corporate strate- companies can focus on those actions * circular, bio-based, and net-zero

gies – has increased. Industry leaders that drive strong, sustainable TSR and initiatives.

and shareholders are prioritizing increase shareholder value. * using industry best practices to

medium – and long-term plans that achieve R&D and commercial

clearly articulate TSR potential and Strategies that can successfully excellence.

outline the value creation impacts of enhance TSR include: * process optimization by means

different actions. At BCG, we help * portfolio realignments that refocus of digital technologies and

companies to connect levers – across the business and drive growth (given zero-based budgeting.

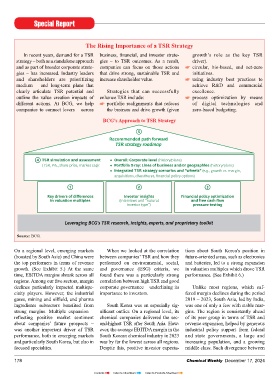

BCG’s Approach to TSR Strategy

5

Recommended path forward

TSR strategy roadmap

4 TSR simulation and assessment • Overall: Corporate level (history/plans)

(TSR, P/E, share price, market cap): • Portfolio X-ray: Lines of business and/or geographies (history/plans)

• Integrated TSR strategy scenarios and “wheels” (e.g., growth vs. margin,

acquisitions, divestitures, financial policy options)

1 2 3

Key drivers of differences Investor insights Financial policy optimization

in valuation multiples (interviews and “natural and free cash flow

investor type”) pressure testing

Leveraging BCG's TSR research, insights, experts, and proprietary toolkit

Source: BCG.

On a regional level, emerging markets When we looked at the correlation tions about South Korea’s position in

(boosted by South Asia) and China were between companies’ TSR and how they future-oriented areas, such as electronics

the top performers in terms of revenue performed on environmental, social, and batteries, led to a strong expansion

growth. (See Exhibit 5.) At the same and governance (ESG) criteria, we in valuation multiples which drove TSR

time, EBITDA margins shrank across all found there was a particularly strong performance. (See Exhibit 6.)

regions. Among our five sectors, margin correlation between high TSR and good

declines particularly impacted multispe- corporate governance – underlining its Unlike most regions, which suf-

cialty players. However, the industrial importance to investors. fered margin declines during the period

gases, mining and oilfield, and pharma 2019 – 2023, South Asia, led by India,

ingredients subsectors benefited from South Korea was an especially sig- was one of only a few with stable mar-

strong margins. Multiple expansion – nificant outlier. On a regional level, its gins. The region is consistently ahead

reflecting positive market sentiment chemical companies delivered the sec- of its peer group in terms of TSR and

about companies’ future prospects – ond-highest TSR after South Asia. How- revenue expansion, helped by generous

was another important driver of TSR ever, the average EBITDA margin in the industrial policy support from federal

performance, both in emerging markets South Korean chemical industry in 2023 and state governments, a large and

and particularly South Korea, but also in was by far the lowest across all regions. increasing population, and a growing

focused specialties. Despite this, positive investor expecta- middle class. Such divergence between

178 Chemical Weekly December 17, 2024

Contents Index to Advertisers Index to Products Advertised