Page 172 - CW E-Magazine (17-12-2024)

P. 172

Available from Ready Stock LARGEST MANUFACTURER OF Special Report

ALUM-AMMONIA / FERRIC / POTASH CALCIUM HYDROXIDE (Hydrated Lime) 4 BROMO ANILINE

AMMONIUM CHLORIDE Tech / Pure CALCIUM SULPHATE / PLASTER OF PARIS Salicylic Acid ( Technical)

AMMONIUM BISULPHITE CREAM OF TARTAR Ortho Xylene Value Creation in Chemicals 2024:

AMMONIUM THIOSULPHATE COPPER SULPHATE ACETATE / CARBONATE Mono Chloro Benzene

AMMONIUM BROMIDE / MOLYBDATE DI/MONO AMMONIUM PHOSPHATE Aluminium Chlorohydrate 50% Regional Challenges Persist,

ANILOZYME GH / ANILOZYME S (Desizing) Poly Aluminium Chloride Liquid

BARIUM CHLORIDE / SULPHATE EDTA ACID / EDTA DI / TETRA SODIUM SALT But Clear Strategies Win

Can also offer our supply to SEZ Units against LUT

BARIUM CARBONATE / HYDROXIDE FERROUS SULPHATE without Payment of IGST & EXPORT ENQUIRES

Tech / Sugar / Crystal / Dried

BORAX Granular / Crystal / Anhydrous WE ARE LOOKING FOR SALES PROFESSIONALS FOR

BORIC ACID Tech. HYDROGEN PEROXIDE CHEMICAL DISTRIBUTION BUSINESS INTERESTED Hard on the heels of one of its worst found a meaningful improvement in Andreas Gocke

CALCIUM CARBONATE PRECIPITATED HYFLOSUPERCELL (Decalite Speed Plus) CANDIDATES PLEASE SEND YOUR CV TO MAIL ID value creation performances in recent TSR performance. The industry deli-

CALCIUM CHLORIDE Fused / Anhydrous MAGNESIUM NITRATE years, the global chemicals industry vered average annual TSR for the fi ve Managing Director & Senior Partner

Email: gocke.andreas@bcg.com

UNION CHEMICAL AGENCY / TEX DYES (AN ISO 9001-2015 certified Company) delivered a reassuringly respectable years to December 2023 of 12%, com- Hubert Schönberger

JUBILEE INDUSTRIES

231, Samuel Street, Vadgadi, Masjid Bunder (W), Mumbai 400 003. ISHWAR CHEMICALS AND GASES total shareholder return (TSR) between pared with just 7% between 2018 and Managing Director & Partner

2019 and 2023. Within the overall 2022. TSR from 2019 to 2023 was bet-

Tel.: +91-22-23421462, 66312763 Mob: +91-8888862805 / 8007655155 Tel: 02572220300 picture, there were pockets of notable ter than the prior period for all regions Email: schoenberger.hubert@bcg.com

Email: sales@ishwargroup.in / ramgas1@hotmail.com

Email: unionchemicalagency@gmail.com (AD-2) marketing@ishwargroup.in / ashish.chhajed@ishwargroup.in strength and weakness as marked and sectors. Indian and South Korean Frederik Flock

Website: www.ishwargroup.in

regional differences continued. companies, industrial gas companies, Senior Knowledge Director

and focused specialty chemical players Email: fl ock.frederik@bcg.com

CARDKEM PHARMA PVT. LTD. Certified Company by ISO 9001:2015 QMS Standards Furthermore, some chemical com were the standout performers. PJ Juvekar

panies performed exceptionally well in

Intermediate of APIs' CAS NO. End Use FINE CHEMICALS CAS NO. weak subsectors, while others signifi cantly Senior Advisor

L-proline benzyl ester hydrochloride 16652-71-4 Lisinopril Pyridine Hydrobromide 18820-82-1 underperformed in strong subsectors. Large-cap chemical companies out- Email: juvekar.pj@advisor.bcg.com

Phenyl Ethyl Chloride 622-24-2 Lisinopril Pyridinium bromide per Bromide 39416-48-3 performed mid-cap fi rms for the third Boston Consulting Group

N-Methyl Carbazolone 27387-31-1 Ondansetron Pyridine Hydrochloride 628-13-7 To navigate this uncertain and fi ve-year period in a row. (See Exhibit 1.) cap players’ performance was driven by

1,2,3,4-Tetrahydro-4-oxo-carbazole 15128-52-6 Carvedilol/ Ondansetron Sodium 2-ethylhexanoate (SEHA) 19766-89-3 diverse landscape – and secure success Large-cap players delivered higher revitalized top-line growth and multi-

Ethyltriphenylphosphonium Bromide (ETPB)

1530-32-1

Bromo-OTBN 114772-54-2 Losartan Benzyltriethylammonium chloride (TEBA) 56-37-1 in the industry – companies need a TSR, aided by generous dividends – ple expansion, signaling greater inves-

2-Chloro-5-Nitrobenzoic Acid 2516-96-3 Mesalamine Tetrabutyl Ammonium Chloride (TBAC) 1112-67-0 value creation strategy that prioritizes underscoring the benefi ts of their scale tor confi dence in their future prospects.

5-Nitro Salicylic Acid 96-97-9 Mesalamine Triethylamine HCL (TEA HCL) 554-68-7 revenue growth, innovation, and pro- and more effi cient resource allocation.

2-[(1-hydroxycyclohexyl)-2-(4-methoxyphenyl)] 93413-76-4 Venlafaxine Hcl 1,3-Dibromo-5,5-Dimethyl Hydantoin (DBDMH) 77-48-5 active portfolio management. However, fi ve-year TSR among mid- For this report, we have analyzed

1100-88-5

Benzyl triphenyl phosphonium chloride (BTPC)

acetonitrile Tetrabutylammonium bromide (TBAB) 1643-19-2 cap companies improved signifi cantly, data from 344 publicly listed chemical

Propyl Paraben Sodium 35285-69-9 Tetra Butyl ammonium Hydrogen Sulphate (TBS) 32503-27-8 An Improving Five-Year Performance rising from 5% between 2018 and companies. We have classifi ed large-cap

Sodium Bromide 7647-15-6 Our latest report on value creation 2022 to 12% between 2019 and 2023. players as having a market value of more

“We have dedicated facility for custom synthesis & High value speciality products”. Ethyl Bromide 74-96-4 in the global chemical industry has Despite weak EBITDA margins, mid- than $6 billion and mid-cap players

Corporate Office : 2301/02, GIDC Industrial Estate, Ankleshwar - 393 002, Gujarat, INDIA. Iso Butyl Bromide 78-77-3

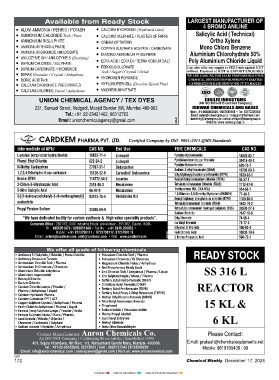

Ph : 8866051978 / 8866051980 • Fax No : +91 2646 250052 • Ethylene Di Bromide 106-93-4 Exhibit 1 - Large-Cap Chemical Companies Outperformed Once Again

Mobile : +91 9723708111 / 9723708112, 9723708119 Hydrobromic Acid 10035-10-6

Email : aniket@cardkem.com, amit@cardkem.com • Web : www.cardkem.com KNS ADI 2 Bromo Propanoic Acid 598-72-1 Five-year TSR per year 2019–2023

40

We offer all grade of following chemicals

• Anti mony Tri Sulphide / Chloride / Penta Chloride • Potassium Chloride Tech / Pharma READY STOCK 30 27

• Anti mony Potassium Tartrate • Potassium Chromate / Di Chromate 20 19

• Ammonium Chloride Tech / Pharma • Magnesium Chloride Flakes / Anhydrous 20 18 18 17 16 16 15 15 14 13 13 13 13 12 12

• Ammonium Di Chromate / Chromate • Red Phosphorous Ready Stock 12 12 12 11 11 11 11 11 11 10 10 9 9 8 8 8 8 Median:

• Aluminium Chloride Anhydrous • Zinc Chloride Tech / Anhydrous / Pharma / Liquid SS 316 L 10 6 5 4 12%

• Aluminium Isopropoxide • Zinc Sulphate Hepta / Mono / Pharma

• Benzoyl Chloride • Terti ary Butyl Hydro Peroxide (TBHP) 0

• Barium Chloride • Di Terti ary Butyl Peroxide (DTBP)

• Calcium Chloride Lumps / Powder / • Terti ary Butyl Per Benzoate (TBPB) REACTOR –10

Pharma / Anhydrous / Liquid Technology Machinery Services Construction Retail Aerospace Mid-cap Insurance Oil & Gas Mid-cap Forest Consumer Real

• Calcium Hydroxide Pharma • Terti ary Butyl Proxy-2-Ethyl Hexanoate (TBPEH) Hardware & Defense Chemicals Pharma Products & Non-durables Estate

• Calcium Carbonate PPT / ACT • Methyl Ethyl Ketone Peroxide (MRKP) Packaging

• Copper Sulphate Crystals / Anhydrous / Pharma • Tetra Butyl Ammonium Bromide 15 KL & Mining Software & Multibusiness Financial Large-cap All Large-cap Consumer Medical Banks Power & Communication

Multibusiness

• Ferric Chloride Anhydrous / Pharma / Liquid • Thiophenol IT Services Infrastructure Chemicals Chemicals Pharma Durables Technology Utilities Service Provider

• Ferrous (Iron) Sulphide Lumps / Powder / Sti cks • Sodium Iodide / Potassium Iodide Providers

Travel &

Water &

Building

Fashion

Electronic

Automotive

Media &

• Ferrous Sulphate Hepta / Mono / Pharma • Phenyl Propyl Alcohol Materials Metals Components & Luxury Automotive Publishing Transportation Asset Mgmt Healthcare Components Environment Tourism

OEMs

& Logistics

Services

& Brokerage

• Lead Acetate / Nitrate / Chloride / • Cyclohexyl Salicylate 6 KL

Chromate / Carbonate / Sulphate • Methyl Abietate Top-to-bottom quartile range Industry median

• Sodium Acetate Trihydrate / Anhydrous • Meta Nitro Benzaldehyde Sources: S&P Capital IQ; LSEG Workspace; BCG Value Creators database 2024; BCG ValueScience Center.

Contact Manufacturers: Anron Chemicals Co. Please Contact:

An ISO 9001 Company | Celebrating Silver Jubilee | Established -1996 Notes: Median fi ve-year TSR per respective industry sample; N=2,611; Additional 256 Mid-cap (MV between $1bn and $6bn) chemical companies are

401, Sujata Chambers, 4th Floor, 1/3, Abhaychand Gandhi Marg, Mumbai- 400009. Email: prakash@chemicalequipments.net added; Large-cap (MV greater than $6bn) chemical category includes 88 companies; Median TSR per respective industry sample (companies with MV

Tel : +91-22-66352608, 62372003 | Cell : 9820137343 | 9152609250 Mobile: 9819193438 / 00 greater than $6bn); Russian companies were omitted. Argentinian and Turkish fi rms were eliminated because these countries’ hyperinfl ationary environment

Email: info@anronchemical.com | anronpawar@gmail.com | Visit us: www.anronchemical.com skews valuations.

23/21

172 Chemical Weekly December 17, 2024 Chemical Weekly December 17, 2024 173

Contents Index to Advertisers Index to Products Advertised