Page 182 - CW E-Magazine (17-12-2024)

P. 182

Special Report

industrial use such as green steel,

4.00 3.74 blending in city gas distribution

3.50 along with natural gas.

3.00 -0.56 -0.14 -0.16 * Long term – Application in trans-

2.50 -0.28 2.10 portation, shipping, auxiliary power

2.00 FY2023 -0.50 generation, etc.

USD/Kg 1.50 CareEdge Ratings has assessed

1.00 FY2030 demand potential from two aspects: exist-

0.50 ing market share in hydrogen demand

Reduction Reduction Reduction Reduction Benefi t of direct which is on the horizontal axis and the

Current due to fall in due to due to fall due to change production Target cost of hydrogen in overall production

LOCH electrolyzer improvement in in RE price in opex incentive LOCH cost plotted on the vertical axis.

electrolyzer

price

effi ciency

Currently, refi neries have a high

Source: CareEdge Ratings Figure 2: From current LCOH to target LCOH market share of 43% in the overall

annual hydrogen demand of 6-mt in India

Current H2 Industry Share and the cost of hydrogen in the over-

High Low all production cost of refi neries is low,

making it one of the immediate poten-

H2 cost in overall Cost High Low Ammonia Heavy Duty Vehicles GH2 over FY27-FY30 in refi neries.

tial users for GH2. It can lead to a

Methanol

potential demand of 2.70-3.00 mt of

This can further rise.

The fertiliser sector has the highest

Refinery

Steel

market share in hydrogen demand

(for desulphurization)

CGD

accounting for ~50% of the total

.

hydrogen demand in India.

Figure 3: Readiness to absorb GH2 demand However, the fertilisers are sensi-

Source: CareEdge Ratings

tive to the cost of hydrogen as in over-

all production cost its contribution is

12.00 high. Hence cost parity of GH2 with

existing alternatives, besides incentivi-

Hydrogen demnd in India MMT 8.00 site for strengthening the adoption of

10.00

sing the demand, would be a prerequi-

GH2 in ammonia production and other

non-urea-based fertilizers. Adoption of

6.00

green ammonia can lead to potential

demand of 3.75-4.25 mt of GH2 over

4.00

FY27-FY30 with about one-third of

2.00

which may be an ideal segment for

early adoption.

- demand coming from non-urea segment,

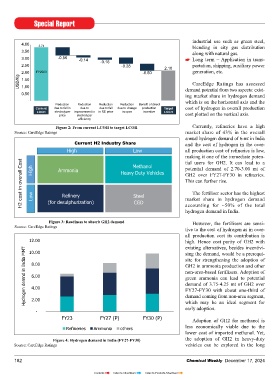

FY23 FY27 (P) FY30 (P) Adoption of GH2 for methanol is

Refineries Ammonia others less economically viable due to the

lower cost of imported methanol. Yet,

Figure 4: Hydrogen demand in India (FY27-FY30) the adoption of GH2 in heavy-duty

Source: CareEdge Ratings vehicles can be explored in the long

182 Chemical Weekly December 17, 2024

Contents Index to Advertisers Index to Products Advertised