Page 179 - CW E-Magazine (24-12-2024)

P. 179

Special Report Special Report

demand-supply imbalance created were at around 148-ktpa, 33% lower quarter’s time lag. Domestic players

because of the European Union limiting than that during FY19-FY21. largely depend on imports to meet raw

the procurement from Russian carbon material requirements.

black producers and limited Chinese India’s imports are primarily from

output on account of reduced cost China, South Korea, Turkey, the UAE and A similar price trend is seen in crude

competitiveness on account of higher Netherlands; these countries accounted oil prices and carbon black prices (both

environmental and input costs. India’s for around 75% of the imports in FY24. domestic and international). Crude oil

average exports over FY22-FY24 were prices in October 2024 were around

at around 250-ktpa, 85% higher than China continues to dominate global $75/bbl, which is on par with the past

during FY19-FY21. India’s exports market fi ve-year average but 8% lower than the

remained elevated over 4MFY25 at In 2023, China accounted for around past year average. However, crude oil

129-ktpa, around 40% higher y-o-y. 60% of the global capacity share and is prices are well below the peak levels of

the largest carbon black producer. It is above $100/bbl witnessed over 1H22

India turned a net exporter of car- also a net exporter of carbon black with on account of the Russia-Ukraine war.

bon black in FY22 after being a net its export markets being South Korea Despite the correction in crude oil prices

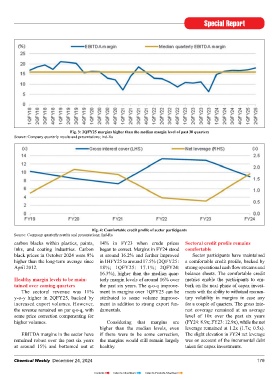

importer over FY18-FY21. This was and Japan where domestic consump- over the past couple of years, prices Fig. 3: 2QFY25 margins higher than the median margin level of past 30 quarters

led by incremental capacity additions tion outweighs production. in October 2024 were on par with the Source: Company quarterly results and presentations; Ind-Ra

and limited import volumes, despite long-term average since April 2012.

the lapse of anti-dumping duties on Global carbon black usage is also

carbon black in January 2021 (imposed dominated by its application in tyres, Chinese carbon black prices were at

in November 2015) due to the reduced although the dependence is lower than $1,264/tonne in October 2024, slightly

cost competitiveness of Chinese players. in India at around 70% with higher below the past fi ve-year average of

However, the basic custom duty of usage in pigments (inks & toners, paints & around $1,320/tonne and 4% lower

7.5% on carbon black imports acts as a coatings). than the past year average. Producers

partial deterrent to imports. typically record inventory gains during

Domestic carbon black prices remain an uptrend in prices.

India’s key export destinations in- healthy

clude Thailand, Sri Lanka, the US, Carbon black prices are linked to Domestic carbon black Wholesale

Vietnam, the UAE and Poland, which crude oil prices since it is manufactured Price Index is at around 150x, still

account for around 55% of India’s using a mix of carbon black feedstock higher than the past fi ve-year average

exports. India’s imports are minimal at (CBFS) and carbon black oil which are of around 112x but 3% lower than the

around 158-ktpa in FY24 and have been crude oil derivatives. The movement past year average. Domestic prices are Fig. 4: Comfortable credit profi le of sector participants

on the decreasing trend with imports in raw material prices typically gets supported by the strong end-use Source: Company quarterly results and presentations; Ind-Ra

being primarily of specialty carbon blacks, refl ected in carbon black prices with demand from the auto sector which uses carbon blacks within plastics, paints, 14% in FY23 when crude prices Sectoral credit profi le remains

which cannot be met domestically. producers passing on the raw material carbon black in tyre manufacturing and inks, and coating industries. Carbon began to correct. Margins in FY24 stood comfortable

India’s average imports over FY22-FY24 price movement to customers with a from newer applications of specialty black prices in October 2024 were 8% at around 16.2% and further improved Sector participants have maintained

higher than the long-term average since in 1HFY25 to around 17.5% (2QFY25: a comfortable credit profi le, backed by

April 2012. 18%; 1QFY25: 17.1%; 2QFY24: strong operational cash fl ow streams and

16.3%), higher than the median quar- balance sheets. The comfortable credit

Healthy margin levels to be main- terly margin levels of around 16% over metrics enable the participants to em-

tained over coming quarters the past six years. The q-o-q improve- bark on the next phase of capex invest-

The sectoral revenue was 11% ment in margins over 1QFY25 can be ments with the ability to withstand momen-

y-o-y higher in 2QFY25, backed by attributed to some volume improve- tary volatility in margins in case any

increased export volumes. However, ment in addition to strong export fun- for a couple of quarters. The gross inte-

the revenue remained on par q-o-q, with damentals. rest coverage remained at an average

some price correction compensating for level of 10x over the past six years

higher volumes. Considering that margins are (FY24: 8.9x; FY23: 12.9x), while the net

higher than the median levels, even leverage remained at 1.2x (1.7x; 0.5x).

EBITDA margins in the sector have if there were to be some correction, The slight elevation in FY24 net leverage

Fig. 2: Domestic players benefi tting from current geopolitical situation; India to remain net exporter remained robust over the past six years the margins would still remain largely was on account of the incremental debt

Source: AMAI, DGCIS and Ind-Ra at around 15% and bottomed out at healthy. taken for capex investments.

178 Chemical Weekly December 24, 2024 Chemical Weekly December 24, 2024 179

Contents Index to Advertisers Index to Products Advertised