Page 180 - CW E-Magazine (11-3-2025)

P. 180

Special Article 1 (11.03.2025)

FIG. 2: CHINA DEMAND FOR IPDI, BY END-USE

FIG. 2: CHINA DEMAND FOR IPDI, BY END-USE

Others

Others

Textile

Textile

finishes

finishes

4% 4%

Leather

Auto refinis

Auto refinish h

Leather

finishing

finishing

coatings

coatings

32% 32%

5% 5%

Auto OEM

Auto OEM

coatings

coatings

6%

6%

Glove

Glove

wetting

wetting

6%

6%

Inks

Inks

9%

9%

Adhesives/se

Adhesives/se

alants

alants

Synthetic

13%

Synthetic

Wood

13%

leather 9% 9% Special Article 1 (11.03.2025)

Wood

leather coatings

9%

9% coatings

9%

9%

Special Report Special Report

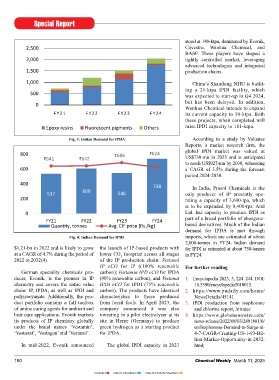

FIG. 3: INDIAN DEMAND FOR IPDA

2,500 stood at 140-ktpa, dominated by Evonik, India Gas Market Report: Outlook to 2030

2,500 Covestro, Wanhua Chemical, and

2,000 BASF. These players have shaped a

2,000 tightly controlled market, leveraging he history of gas in India’s

1,500 advanced technologies and integrated energy system has a mixed track 110

1,500 production chains. Trecord, with periods of rapid

1,000 expansion followed by episodes of 100

1,000 China’s Shandong NHU is build- decline. After steep demand declines 90

500 ing a 21-ktpa IPDI facility, which in the wake of the 2022 global energy 80

500 was expected to start-up in Q4 2024, crisis, total gas consumption in India

0 in 2023 was only slightly higher 70

0 F Y 21 F Y 22 F Y 23 F Y 24 but has been delayed. In addition, than in 2011. However, this report – 60

Wanhua Chemical intends to expand

F Y 21 F Y 22 F Y 23 F Y 24 its current capacity to 50-ktpa. Both grounded in comprehensive data 50

Epoxy resins Fluorescent pigments Others these projects, when completed will analysis and extensive consultations 40

Epoxy resins Fluorescent pigments Others raise IPDI capacity to 181-ktpa. with Indian stakeholders – argues that 2023 Power CGD Others 2030

gas use in India has reached an infl ec- Oil refining Petrochemicals Fertilisers LNG vehicles

Fig. 3: Indian Demand for IPDA According to a study by Valuates tion point and is on course to increase

Reports, a market research fi rm, the substantially between 2023 and 2030.

800 FIG. 4: Indian demand for IPDI ` 624 global IPDI market was valued at This growth is driven by three major Fig. 2: Natural gas demand outlook in India, 2023-2030 (bcm)

686

trends: the rapid expansion of India’s

`

` 641 ` 642 US$730-mn in 2023 and is anticipated

800 ₹686 to reach US$927-mn by 2030, witnessing gas infrastructure; a rebound in gas distribution, industrial demand, supported by the rapid expansion of

600 ₹641 ₹642 ₹624 a CAGR of 3.5% during the forecast domestic natural gas production and power generation. Since 2000, compressed natural gas (CNG) infra-

600 period 2024-2030. (which is generally cheaper than India’s natural gas consumption more structure and the cost advantage of

imported LNG); and an expected easing than doubled, exceeding 65-bcm/yr gas over liquid fuels for small in-

400 738 In India, Prasol Chemicals is the of global gas market conditions. (billion cubic metres per year) by dustrial users. Heavy industrial and

400 537 609 546 only producer of IP presently ope- Supportive government policies have 2023. Between 2023 and 2030, gas manufacturing sectors, such as iron &

200 609 738 rating a capacity of 3,600-tpa, which further paved the way for increased consumption is projected to grow by steel production, are also driving

537 546 natural gas consumption through 2030. nearly 60%, reaching 103-bcm/yr by demand, collectively adding around

200 is to be expanded by 8,400-tpa. Atul the end of the forecast period, bringing 15-bcm/yr during this period. Gas use in

0 Ltd. has capacity to produce IPDI as Natural gas consumption is forecast India roughly on par with the current oil refi ning is expected to increase by

FY21 FY22 FY23 FY24 part of a broad portfolio of phosgene-

0 Quantity, tonnes Avg. CIF price [Rs./kg] based derivatives. Much of the Indian to increase by nearly 60% by 2030 gas consumption of Saudi Arabia. more than 4-bcm/yr as more refi ne-

India’s natural gas consumption is

ries get connected to the grid. Growth

FY21 FY22 FY23 FY24 demand for IPDA is met through forecast to increase by nearly 60% by The city gas distribution (CGD) prospects in the petrochemical and

Fig. 4: Indian Demand for IPDI

Quantity, tonnes Avg. CIF price [Rs./kg] imports, which are estimated at about 2030, driven by robust growth in city sector is expected to lead this growth, fertiliser sectors remain more limited,

2,000-tonnes in FY24. Indian demand

$1.21-bn in 2022 and is likely to grow the launch of IP-based products with for IPDI is estimated at about 750-tonnes as no new gas-based capacity addi-

For further reading

at a CAGR of 4.7% during the period of lower CO footprint across all stages in FY24. 80 tions are foreseen within our forecast

2

2022 to 2032(4). of the IP production chain: Vestasol horizon. Gas demand in the power

For further reading

1 Encyclopedia 2023, 3, 224–244. DOI: 10.3390/encyclopedia3010015 70 generation sector is projected to reach

IP eCO for IP ((100% renewable

For further reading

German speciality chemicals pro- carbon); Vestamin IPD eCO for IPDA 60 nearly 15-bcm/yr by 2030, driven by

1

ducer, Evonik, is the pioneer in IP (90% renewable carbon), and Vestanat 1. Encyclopedia 2023, 3, 224–244. DOI: a recovery in large gas-fi red power

Encyclopedia 2023, 3, 224–244. DOI: 10.3390/encyclopedia3010015

chemistry and covers the entire value IPDI eCO for IPDI (75% renewable 10.3390/encyclopedia3010015. 5 50 plants and the rapid expansion of gas

chain: IP, IPDA, as well as IPDI and carbon). The products have identical 2. https://www.pudaily.com/home/ 40 use in captive power plants.

polyisocyanate. Additionally, the pro- characteristics to those produced NewsDetails/45141 5 30

duct portfolio contains a full toolbox from fossil fuels. In April 2023, the 3. IPDI production from isophorone Fertiliser production is India’s

of amine curing agents for ambient and company announced it was also and chlorine report, Intratec 20 largest gas-consuming sector

heat cure applications. Evonik markets investing in a pilot electrolyser at its 4. https://www.globenewswire.com/ 10 Fertiliser production is India’s

its products of IP chemistry globally site in Herne (Germany) to produce news-release/2022/08/03/2491881/0/ largest gas-consuming sector, accoun-

under the brand names ‘Vestamin’, green hydrogen as a starting product en/Isophorone-Demand-to-Surge-at- 0 2016 2017 2018 2019 2020 2021 2022 2023 2024 ting for nearly a third (21-bcm) of the

‘Vestanat’, ‘Vestagon’ and ‘Vestasol’. for IPDA. 4-7-CAGR-Creating-US-1-93-Bil- Power CGD Oil refining Petrochemicals Fertilisers Other country’s total gas demand in 2023.

lion-Market-Opportunity-in-2032. Natural gas is used as a feedstock

In mid-2022, Evonik announced The global IPDI capacity in 2023 html; Fig. 1: Total natural gas demand in India, 2016-2024, by sector (bcm) for ammonia-based urea production,

180 Chemical Weekly March 11, 2025 Chemical Weekly March 11, 2025 181

Contents Index to Advertisers Index to Products Advertised