Page 181 - CW E-Magazine (11-3-2025)

P. 181

Special Report

India Gas Market Report: Outlook to 2030

he history of gas in India’s

energy system has a mixed track 110

Trecord, with periods of rapid 100

expansion followed by episodes of

decline. After steep demand declines 90

in the wake of the 2022 global energy 80

crisis, total gas consumption in India 70

in 2023 was only slightly higher

than in 2011. However, this report – 60

grounded in comprehensive data 50

analysis and extensive consultations 40

with Indian stakeholders – argues that 2023 Power CGD Others 2030

gas use in India has reached an infl ec- Oil refining Petrochemicals Fertilisers LNG vehicles

tion point and is on course to increase

substantially between 2023 and 2030.

This growth is driven by three major

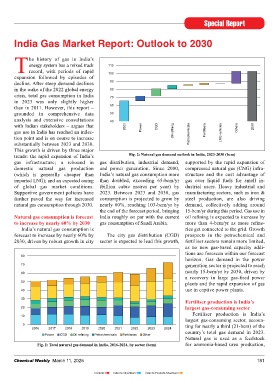

trends: the rapid expansion of India’s Fig. 2: Natural gas demand outlook in India, 2023-2030 (bcm)

gas infrastructure; a rebound in gas distribution, industrial demand, supported by the rapid expansion of

domestic natural gas production and power generation. Since 2000, compressed natural gas (CNG) infra-

(which is generally cheaper than India’s natural gas consumption more structure and the cost advantage of

imported LNG); and an expected easing than doubled, exceeding 65-bcm/yr gas over liquid fuels for small in-

of global gas market conditions. (billion cubic metres per year) by dustrial users. Heavy industrial and

Supportive government policies have 2023. Between 2023 and 2030, gas manufacturing sectors, such as iron &

further paved the way for increased consumption is projected to grow by steel production, are also driving

natural gas consumption through 2030. nearly 60%, reaching 103-bcm/yr by demand, collectively adding around

the end of the forecast period, bringing 15-bcm/yr during this period. Gas use in

Natural gas consumption is forecast India roughly on par with the current oil refi ning is expected to increase by

to increase by nearly 60% by 2030 gas consumption of Saudi Arabia. more than 4-bcm/yr as more refi ne-

India’s natural gas consumption is ries get connected to the grid. Growth

forecast to increase by nearly 60% by The city gas distribution (CGD) prospects in the petrochemical and

2030, driven by robust growth in city sector is expected to lead this growth, fertiliser sectors remain more limited,

as no new gas-based capacity addi-

tions are foreseen within our forecast

80

horizon. Gas demand in the power

70 generation sector is projected to reach

60 nearly 15-bcm/yr by 2030, driven by

a recovery in large gas-fi red power

50 plants and the rapid expansion of gas

40 use in captive power plants.

30

Fertiliser production is India’s

20 largest gas-consuming sector

Fertiliser production is India’s

10

largest gas-consuming sector, accoun-

0 ting for nearly a third (21-bcm) of the

2016 2017 2018 2019 2020 2021 2022 2023 2024

Power CGD Oil refining Petrochemicals Fertilisers Other country’s total gas demand in 2023.

Natural gas is used as a feedstock

Fig. 1: Total natural gas demand in India, 2016-2024, by sector (bcm) for ammonia-based urea production,

Chemical Weekly March 11, 2025 181

Contents Index to Advertisers Index to Products Advertised