Page 183 - CW E-Magazine (11-3-2025)

P. 183

Special Report Special Report

which is viewed by the government activity at existing plants. No new from integrated oil refi ning opera- domestic gas production has seen overall growth will be tempered by The government has introduced

as vital for the country’s agricultural greenfi eld fertiliser projects using tions when it is available. Companies a resurgence. In 2023, total net gas plateauing output from the KG-D6 several policy initiatives to support

sector and food security. natural gas are expected within the like Reliance Industries, Petronet and production reached 35-bcm, meet- fi elds and declining production from CBG production. As of September

2030 forecast horizon. A recently GAIL are also expanding the use of ing about half of the country’s gas legacy assets like ONGC’s Mumbai 2024, approximately 90 CBG plants

Domestic gas allocations to announced gas-based urea plant in imported ethane and NGLs as feed- demand. This growth is primarily offshore fi elds, leaving production were operational, with an additional

the fertiliser sector have steadily Namrup (Assam) was included in the stock for their petrochemical plants. driven by the deepwater fi elds in the in 2030 (at just under 38-bcm) only 508 plants under various stages of

declined, falling to approximately 2025 Union Budget but had no clear Krishna-Godavari basin, which now around 8% higher than 2023 levels. development. By 2030, CBG produc-

3-bcm/yr by 2023. As a result, reli- timeline at the time of writing and is Incremental gas demand growth is account for nearly 25% of India’s tion could reach 0.8-bcm/yr. However,

ance on imported LNG has surged, likely to contribute to fertiliser sector limited to recovering activity at exist- total production. CBG production potential remains challenges such as land availability,

covering 85% of the sector’s gas gas demand only after 2030. Mean- ing gas connected facilities. This is largely untapped limited offtake, seasonal biomass

needs in 2023, up from less than 50% while, the upcoming Talcher plant in projected to drive petrochemical sector Between 2024 and 2030, only India’s compressed biogas (CBG) supply and inadequate logistics con-

in 2016. Odisha state will rely on coal gasifi - gas demand to around 3.5-bcm/yr by moderate growth is expected, supported production potential remains largely tinue to hinder the consistent avail-

cation technology and use coal as its 2030, representing a 5% annual by increasing onshore production untapped, with annual output expec- ability and commercial viability of

Urea is sold to farmers at a highly feedstock. increase from 2023. from coal bed methane (CBM) and ted to reach 0.8-bcm by 2030. India’s CBG production.

subsidised price of Rs. 242 (per 45-kg discovered small fi elds (DSF). Off- CBG potential is estimated at approxi-

bag). To cover the gap between mar- Petrochemicals sector gas demand Targeted strategies and policy shore production will also rise with mately 87-bcm/yr, while the installed The government has provided

ket prices and this discounted rate, to see 5% annual increase interventions could boost gas additional supplies from ONGC’s capacity currently represents less fi nancial support for pipeline con-

the government provides signifi cant India’s demand for petrochemical consumption to around 120-bcm/yr deepwater KG-D5 project. However, than 1% of this potential. nectivity for CBG plants, biomass

subsidies to urea producers and im- products is rapidly growing, fuelled by 2030

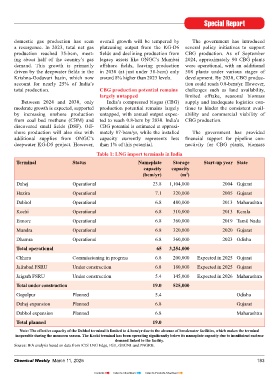

porters. This presents a substantial by urbanisation, rising incomes and Targeted strategies and policy inter- Table 1: LNG import terminals in India

fi scal burden for the budget. In FY23, infrastructure expansion. To meet this ventions could boost gas consump- Terminal Status Nameplate Storage Start-up year State

urea subsidies peaked at Rs. 2.5-tril- demand, the country is boosting pro- tion beyond the forecasted trajectory capacity capacity

3

lion ($31-bn) due to surging global duction capacity with major projects, to around 120 bcm/yr by 2030, close (bcm/yr) (m )

energy and fertiliser prices. However, including a new polyethylene unit to the current gas consumption of the Dahej Operational 23.8 1,104,000 2004 Gujarat

as long as India’s fertiliser subsidy at HPCL-Mittal Energy’s Bathinda entire continent of South America.

scheme is in place, gas demand in the refi nery, polyethylene and polypro- Incremental growth in this accelerated Hazira Operational 7.1 320,000 2005 Gujarat

fertiliser sector remains insensitive to pylene plants at HPCL’s Rajasthan demand trajectory, which requires Dabhol Operational 6.8 480,000 2013 Maharashtra

price fl uctuations, despite the sector’s refi nery and GAIL’s polypropylene additional policy support in each cate-

increasingly heavy reliance on imported facility under construction in Usar. gory, could come from higher utili- Kochi Operational 6.8 310,000 2013 Kerala

LNG. The “Make in India” initiative sup- sation of India’s stranded gas-fi red

ports this growth by driving invest- power plants, faster adoption of LNG Ennore Operational 6.8 360,000 2019 Tamil Nadu

Between 2018 and 2023, gas con- ment and infrastructure development. in heavy-duty transport, and more Mundra Operational 6.8 320,000 2020 Gujarat

sumption in the fertiliser sector grew rapid expansion of India’s CGD infra-

by 40%, reaching nearly 21-bcm in Natural gas consumption in the structure, combined with the replace- Dhamra Operational 6.8 360,000 2023 Odisha

2023, at an average annual increase of petrochemical sector reached 2.6-bcm ment of LPG with natural gas in the Total operational 65 3,254,000

7%. This expansion was driven by the in 2023, a 27% increase from the low commercial segment.

conversion of India’s last naphtha-based point of 2.0-bcm in 2022, caused by Chhara Commissioning in progress 6.8 200,000 Expected in 2025 Gujarat

fertiliser plants (operated by Madras high LNG prices and LNG supply In total, this accelerated uptake Jafrabad FSRU Under construction 6.8 180,000 Expected in 2025 Gujarat

Fertilizers, SPIC, and Mangalore disruptions from Gazprom Market- of natural gas across the residential,

Chemicals & Fertilizers) to natural ing and Trading, which was taken commercial, transport and electricity Jaigarh FSRU Under construction 5.4 145,000 Expected in 2026 Maharashtra

gas, the restart of four previously over by the German government in sectors could add another 15-bcm/yr Total under construction 19.0 525,000

idled plants (Ramagundam, Gorakh- that year. However, consumption in of gas demand by 2030.

pur, Sindri, Barauni) using natural 2023 remained about 25% below the Gopalpur Planned 5.4 Odisha

gas feedstock and the commissioning 2017-2021 average of 3.5-bcm/yr, as Domestic gas production is Dahej expansion Planned 6.8 Gujarat

of a major greenfi eld project (Matix operators have increasingly relied on expected to grow only moderately

Fertilisers). ethane and NGL-based feedstocks in through 2030 Dabhol expansion Planned 6.8 Maharashtra

recent years. India’s domestic gas production, Total planned 19.0

Between 2023 and 2030, gas which met 50% of demand in 2023,

Note: The effective capacity of the Dabhol terminal is limited to 4-bcm/yr due to the absence of breakwater facilities, which makes the terminal

demand in India’s fertiliser sector is New petrochemical projects often is expected to grow only moderately inoperable during the monsoon season. The Kochi terminal has been operating signifi cantly below its nameplate capacity due to insuffi cient end-use

projected to grow at a modest CAGR use dual natural gas and naphtha through 2030. After nearly a decade demand linked to the facility.

of around 1%, driven by increased crackers and prefer to use naphtha of decline and stagnation, India’s Source: IEA analysis based on data from ICIS LNG Edge, IGU, GIIGNL and PNGRB.

182 Chemical Weekly March 11, 2025 Chemical Weekly March 11, 2025 183

Contents Index to Advertisers Index to Products Advertised