Page 185 - CW E-Magazine (24-10-2023)

P. 185

Special Report

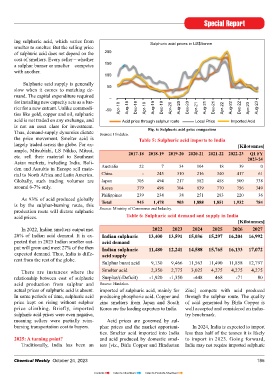

ing sulphuric acid, which varies from Sulphuric acid prices in US$/tonne

smelter to smelter. But the selling price

of sulphuric acid does not depend on the 200

cost of smelters. Every seller – whether

a sulphur burner or smelter – competes 150

with another.

100

Sulphuric acid supply is generally

slow when it comes to matching de- 50

mand. The capital expenditure required –

for installing new capacity acts as a bar-

rier for a new entrant. Unlike commodi- -50 Apr-18 Aug-18 Dec-18 Apr-19 Aug-19 Dec-19 Apr-20 Aug-20 Dec-20 Apr-21 Aug-21 Dec-21 Apr-22 Aug-22 Dec-22 Apr-23 Aug-23

ties like gold, copper and oil, sulphuric

acid is not traded on any exchange, and Acid price through sulphur route Local Price Imported Acid

is not an asset class for investment. Fig. 6: Sulphuric acid price comparison

Thus, demand-supply dynamics dictate Source: Hindalco.

the price movement. Smelter acid is Table 5: Sulphuric acid imports to India

largely traded across the globe. For ex- [Kilotonnes]

ample, Mitsubishi, LS Nikko, Mitsui, 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 Q1 FY

etc. sell their material to Southeast 2023-24

Asian markets, including India. Boli-

den and Aurubis in Europe sell mate- Australia 22 7 34 104 18 39 0

rial to North Africa and Latin America. China - 245 310 216 340 417 61

Globally, such trading volumes are Japan 305 494 217 582 458 500 338

around 6-7% only. Korea 379 498 304 839 770 756 349

Philippines 239 234 38 251 283 220 36

As 93% of acid produced globally

is by the sulphur-burning route, this Total 945 1,478 903 1,888 1,851 1,932 784

production route will dictate sulphuric Source: Ministry of Commerce and Industry.

acid prices. Table 6: Sulphuric acid demand and supply in India

[Kilotonnes]

In 2022, Indian smelters output met 2022 2023 2024 2025 2026 2027

20% of Indian acid demand. It is ex- Indian sulphuric 13,400 13,591 15,036 15,297 16,204 16,992

pected that in 2025 Indian smelter out- acid demand

put will grow and meet 27% of the then Indian sulphuric 11,480 12,241 14,588 15,765 16,133 17,072

expected demand. Thus, India is diffe- acid supply

rent from the rest of the globe.

Sulphur burnt acid 9,130 9,466 11,563 11,490 11,858 12,797

There are instances where the Smelter acid 2,350 2,775 3,025 4,275 4,275 4,275

relationship between cost of sulphuric Surplus/(-Deficit) -1,920 -1,350 -448 468 -71 80

acid production from sulphur and Source: Hindalco.

actual prices of sulphuric acid is absent. imported of sulphuric acid, mainly for Zinc] compete with acid produced

In some periods of time, sulphuric acid producing phosphoric acid. Copper and through the sulphur route. The quality

price kept on rising without sulphur zinc smelters from Japan and South of acid generated by Birla Copper is

price climbing. Briefly, imported Korea are the leading exporters to India. well accepted and considered an indus-

sulphuric acid prices were even negative, try benchmark.

meaning sellers were partially reim- Acid prices are governed by sul-

bursing transportation cost to buyers. phur prices and the market opportuni- In 2024, India is expected to import

ties. Smelter acid imported into India less than half of the tonnes it is likely

2025: A turning point? and acid produced by domestic smel- to import in 2023. Going forward,

Traditionally, India has been an ters [viz., Birla Copper and Hindustan India may not require imported sulphuric

Chemical Weekly October 24, 2023 185

Contents Index to Advertisers Index to Products Advertised