Page 183 - CW E-Magazine (24-10-2023)

P. 183

Special Report

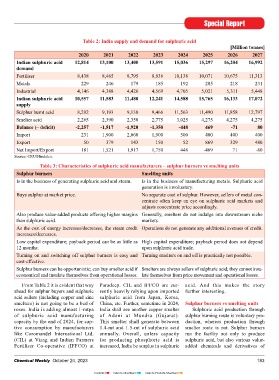

Table 2: India supply and demand for sulphuric acid

[Million tonnes]

2020 2021 2022 2023 2024 2025 2026 2027

Indian sulphuric acid 12,814 13,100 13,400 13,591 15,036 15,297 16,204 16,992

demand

Fertiliser 8,438 8,465 8,795 8,836 10,138 10,071 10,675 11,313

Metals 229 246 179 185 192 205 218 231

Industrial 4,146 4,388 4,426 4,569 4,705 5,021 5,311 5,448

Indian sulphuric acid 10,557 11,583 11,480 12,241 14,588 15,765 16,133 17,072

supply

Sulphur burnt acid 8,292 9,193 9,130 9,466 11,563 11,490 11,858 12,797

Smelter acid 2,265 2,390 2,350 2,775 3,025 4,275 4,275 4,275

Balance (– deficit) -2,257 -1,517 -1,920 -1,350 -448 469 -71 80

Import 231 1,900 2,060 1,900 500 400 400 400

Export 50 379 143 150 52 869 329 480

Net Import/Export 181 1,521 1,917 1,750 448 -469 71 -80

Source: CRU/Hindalco.

Table 3: Characteristics of sulphuric acid manufacturers – sulphur burners vs smelting units

Sulphur burners Smelting units

Is in the business of generating sulphuric acid and steam. Is in the business of manufacturing metals. Sulphuric acid

generation is involuntary.

Buys sulphur at market price. No separate cost of sulphur. However, sellers of metal con-

centrate often keep an eye on sulphuric acid markets and

adjusts concentrate price accordingly.

Also produce value-added products offering higher margins Generally, smelters do not indulge into downstream niche

than sulphuric acid. markets.

As the cost of energy increases/decreases, the steam credit Operations do not generate any additional avenues of credit.

increases/decreases.

Low capital expenditure; payback period can be as little as High capital expenditure; payback period does not depend

12 months. upon sulphuric acid trade.

Turning on and switching off sulphur burners is easy and Turning smelters on and off is practically not possible.

cost-effective.

Sulphur burners can be opportunistic; can buy smelter acid if Smelters are always sellers of sulphuric acid; they cannot insu-

economical and insulate themselves from operational losses. late themselves from price movement and operational losses.

From Table 2 it is evident that way Paradeep. CIL and IFFCO are cur- acid. And this makes the story

ahead for sulphur buyers and sulphuric rently heavily relying upon imported further interesting.

acid sellers (including copper and zinc sulphuric acid from Japan, Korea,

smelters) is not going to be a bed of China, etc. Further, sometime in 2024, Sulphur burners vs smelting units

roses. India is adding almost 1-mtpa India shall see another copper smelter Sulphuric acid production through

of sulphuric acid manufacturing of Adani at Mundra (Gujarat). sulphur burning route is voluntary pro-

capacity by the end of 2024, for cap- This smelter shall generate between duction, whereas production through

tive consumption by manufacturers 1.4-mt and 1.5-mt of sulphuric acid smelter route is not. Sulphur burners

like Coromandel International Ltd. annually. Overall, unless capacity run the facility not only to produce

(CIL) at Vizag and Indian Farmers for producing phosphoric acid is sulphuric acid, but also various value-

Fertiliser Co-operative (IFFCO) at increased, India be surplus in sulphuric added chemicals and derivatives of

Chemical Weekly October 24, 2023 183

Contents Index to Advertisers Index to Products Advertised