Page 176 - CW E-Magazine (26-11-2024)

P. 176

Special Report Special Report

Bio/Pharma watchlist: Small-molecule drugs

pecialty small-molecule drugs Within small molecules, specialty

are growing more than twice as small-molecule drugs are growing PATRICIA VAN ARNUM

Sfast as those of traditional small- more than twice as fast as those of tradi- Editorial Director, DCAT

molecule drugs. What are some key tional small-molecule drugs. However,

drugs contributing to this growth? traditional small-molecule drugs still 69% of new drug approvals (Figure 2).

dominate the small-molecule sector, The percentage of small-molecule

Market share and growth rates of accounting for 71% of small-molecule approvals in 2023 was in line with

small-molecule drugs drugs in 2023. Specialty medicines, recent years, except in 2022, which repre-

In looking at market share and as defi ned by the IQVIA, are those sented a recent low. In 2022, 59% of the

growth rates on a modality basis, small- medicines that treat specifi c, complex new drug approvals by FDA’s CDER

molecules drugs versus biologics, there diseases with four or more of the fol- were small molecules or 22 of the 37 Fig. 2: Percentage of new drug approvals by the CDER that were small molecules, 2019-2023

is a mixed story for small-molecule lowing attributes: initiated only by a new drug approvals. Between 2018 and Source: CDER

drugs. Although small-molecules still specialist; administered by a practitio- 2021, small molecules averaged 74% small molecules’ share of new drug mechanism of action than existing sclerosis (ALS, i.e., Lou Gehrig’s

account for the largest market share in ner; requires special handling; unique of new drug approvals. In 2021, small approvals in 2022 was largely due to the drugs. disease);

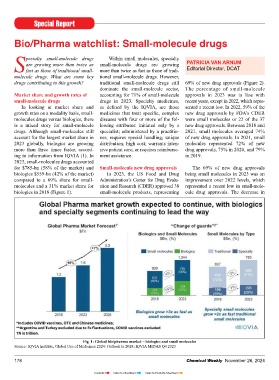

2023 globally, biologics are growing distribution; high cost; warrants inten- molecules represented 72% of new overall decline in new drug approvals 5. GlaxoSmithKline’s Jesduvroq

more than three times faster, accord- sive patient care; or requires reimburse- drug approvals, 75% in 2020, and 79% in 2022 and a corresponding decline In 2023, FDA’s CDER approved 20 (daprodustat) for treating anaemia

ing to information from IQVIA (1). In ment assistance. in 2019. in small-molecule drug approvals and new drugs that it characterized as fi rst- due to chronic kidney disease;

2023, small-molecules drugs accounted a rise in new biologic drug approvals. in-class, which represented approxi- 6. Novartis’ Fabhalta (iptacopan) for

for $785-bn (58% of the market) and Small-molecule new drug approvals The 69% of new drug approvals In 2022, FDA’s CDER approved 22 mately 36% of new drug approvals. Of treating paroxysmal nocturnal haemo-

biologics $559-bn (42% of the market) In 2023, the US Food and Drug being small molecules in 2023 was an new small-molecule drugs and 15 new these 20 fi rst-in-class new drug appro- globinuria, a rare blood disorder;

compared to a 69% share for small- Administration’s Center for Drug Evalu- improvement over 2022 levels, which biologics. The 17 new biologics appro- vals, 17 were small molecules, repre- 7. Novo Nordisk’s Rivfl oza (nedosiran)

molecules and a 31% market share for ation and Research (CDER) approved 38 represented a recent low in small-mole- vals in 2023 surpassed 2022 levels and senting 85% of fi rst-in-class new drug for treating primary hyperoxaluria, a

biologics in 2018 (Figure 1). small-molecule products, representing cule drug approvals. The decrease in matched a recent high in 2018, when approvals in 2023 by FDA’s CDER. Of rare condition characterized by recur-

17 new biologics were also approved these 17 fi rst-in-class, small-molecule rent kidney and bladder stones; and

by FDA’s CDER. The 17 new biologic new drug approvals in 2023, eight were 8. Pfi zer’s Paxlovid (nirmatrelvir tab-

drug approvals in 2023 far exceeded from large to mid-sized bio/pharma lets; ritonavir tablets, co-packaged)

approvals of new therapeutic biologics companies. These eight drugs were: for treating COVID-19.

by FDA’s CDER of 14 in 2021, 13 in 1. Astellas’ Veozah (fezolinetant) for

2020, and 10 in 2019. reducing moderate-to-severe vaso- Although small-molecule drugs

motor symptoms due to menopause; were well represented with 85% of

Product innovation: small-molecules 2. AstraZeneca’s Truqap (capivasertib) the fi rst-in-class new drug approvals

and fi rst-in-class drugs for treating advanced HR-positive in 2023, more than half of these drugs

Aside from just the overall number breast cancer; were for niche indications. Of the 17

of new drug approvals, product innova- 3. Bausch and Lomb’s Miebo (per- small-molecule first-in-class drug

tion can also be evaluated by the num- fl uorohexyloctane ophthalmic solu- approvals in 2023, nine, or 53%, were for

ber of new drug approvals classifi ed as tion) for treating dry-eye disease; treating orphan/rare diseases, defi ned as

“fi rst-in-class,” which FDA’s CDER 4. Biogen’s Qalsody (tofersen) a disease affecting 200,000 individuals

characterizes as drugs with a different for treating amyotrophic lateral or less in the US.

Chemical Weekly | Import-Export Data | Market Surveys

Directories | Business Forums | Expositions

The only organisation in India catering exclusively to the needs of the entire chemical industry

Contact:

SEVAK PUBLICATIONS PVT. LTD.

602-B, Godrej Coliseum, K.J. Somaiya Hospital Road, Behind Everard Nagar, Sion (E), Mumbai 400 022.

Fig. 1: Global bio/pharma market – biologics and small molecules Phone: +91-22-24044471 / 72; Email: admin@chemicalweekly.com

Source: IQVIA Institute, Global Use of Medicines 2024: Outlook to 2028; IQVIA MIDAS Q4 2023

176 Chemical Weekly November 26, 2024 Chemical Weekly November 26, 2024 177

Contents Index to Advertisers Index to Products Advertised