Page 196 - CW E-Magazine (14-11-2023)

P. 196

Special Report Special Report

Real demand for construction raw material costs. Growth in volume The Asia/Pacifi c region will account Low-income countries – such 9

chemicals depends on the following terms was more restrained. for the largest absolute gains due to the as Brazil, India, and those in the

trends: presence of China, which will represent Africa/Mideast region – tend to rely 8

The type and size of buildings being Demand by region 30% of new global construction chemi- more heavily on natural and other 7

constructed; Global demand for construction cal demand. Demand in China will be generally lower priced, less high- 6

Preferences in the materials used to chemicals is expected to increase 3.4% boosted by moderate gains in construc- performance products.

construct buildings or infrastruc- per year to $92.3-bn in 2027. While tion activity, most notably residential Comparatively low prices in 5

ture; market value will decelerate signifi - building construction and non-building emerging economies also weigh on 4

The location of construction and cantly due to moderation in construc- construction, boosting demand for growth in average global prices, as 3

local climate and storm activity; and tion chemicals pricing, real demand protective coatings and sealers, caulks these countries – especially China –

Economic conditions and political will grow steadily alongside ongoing and adhesives. Other countries in the account for a growing share of 2

considerations affecting the com- increases in construction activity region, including India and smaller the world market for construction 1

mencement and completion of con- throughout the world. markets such as Vietnam and Thailand, chemicals. Nevertheless, rapid 0

struction projects. will see above-average gains. Growth expansion of manufacturing fa- 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

In the developing countries of the in the region will refl ect not only cilities in developing nations are

In addition to trends in the volume Africa/Mideast, Central and South increasing construction activity, but boosting requirements for better Protective Coatings & Sealers Caulks & Adhesives

of chemicals used in construction, the America, and Asia/Pacifi c regions, also increasing construction chemical performing construction chemi- Cement & Concrete Chemical Additives Grouts & Mortars

value of the construction chemicals construction chemical demand will be usage rates, which remain well below cals, contributing to gains in average Asphalt Additives Spray Polyurethane Foam

market is also infl uenced by changes driven by: the usage rates seen in more develo- price levels.

in product pricing and the impact of Growing urbanisation and invest- ped countries such as Australia and Rising demand for high-perfor- Fig. 3: Global construction chemicals product prices ($/kg)

changing raw material, energy, and ment in public infrastructure; Japan. mance products is also expected to Source: Freedonia Group.

labour costs. Average prices are also More frequent use of construction benefi t from price gains in high- which drove increases in raw mate- ABOUT THE REPORT

impacted by changes in the overall chemicals; and Pricing patterns income areas such as the US, Japan, rial purchases to meet pent-up de- This Freedonia industry study analy-

product mix toward higher or lower Shifts to more advanced and more The pricing of construction chemi- and Western Europe. mand and boosted infl ation rates; ses the $79.30-bn global construction

cost products. expensive products. cals primarily depends on the: Uncertainty surrounding import chemicals industry. It presents his-

Supply-demand balance and cost of In general, prices rose over the his- markets, which may face enhanced torical demand data (2012, 2017, and

While demand for construction In North America, Western Europe, raw materials; torical period as end users increasingly scrutiny for safety and environmen- 2022) and forecasts (2027 and 2032)

chemicals fell in 2020 due to the im- and Japan, the maturity of those mar- Mix of formulations and grades; employed higher-value construction tal impact; and by product (protective coatings &

pact of the COVID-19 pandemic, de- kets will restrain faster advances; how- Intended application and construc- chemicals and governmental regula- Supply chain bottlenecks arising sealers, caulks & adhesives, cement &

mand skyrocketed in 2021 and 2022, ever, the preference for more advanced tion location; and tions put further scrutiny on the use of from both raw materials shortages concrete additives, polymer fl ooring,

due primarily to a surge in prices re- formulations will support notable levels Level of other input costs, including certain raw materials such as solvents and transportation issues. grouts & mortars, asphalt additives,

lated to supply chain issues and rising of demand. labour, electricity, and fuel. with high volatile organic compound spray polyurethane foam, cleaners and

(VOC) content. In 2021 and 2022, Going forward, prices will mode- other construction chemicals) and

Construction chemical prices vary most construction chemicals experienced rate signifi cantly following easing of market (building markets, infrastruc-

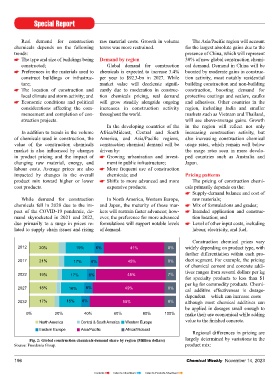

2012 20% 19% 6% 41% 8% widely depending on product type, with signifi cant price increases, with gains or resolution of many of these supply ture markets). The study also evaluates

further differentiation within each pro- driven by: chain and raw material issues. Price company market share and competi-

2017 21% 17% 6% 45% 8% duct segment. For example, the pricing Severe weather, most notably in growth has already slowed, and in some tive analysis on industry competitors

of chemical cement and concrete addi- Texas, which caused the shuttering instances declined, in 2023, a trend that including Arkema, BASF, HB Fuller,

tives ranges from several dollars per kg of oil refi neries and chemical manu- will continue in 2024. Pressure from Henkel, Mapei, Mohawk, Oriental

2022 19% 17% 6% 48% 7%

for specialty products to less than $1 facturing plants; customers will force companies to limit Yuhong Waterproof Technology, and

per kg for commodity products. Chemi- Rebounding economies worldwide, further price increases. Sika.

2027 18% 16% 6% 49% 8% cal additive effectiveness is dosage-

dependent – which can increase costs – Chemical Weekly | Import-Export Data | Market Surveys

2032 17% 15% 6% 50% 8% although most chemical additives can

be applied in dosages small enough to Directories | Business Forums | Expositions

0% 20% 40% 60% 80% 100% make their use economical while adding The only organisation in India catering exclusively to the needs of the entire chemical industry

North America Central & South America Western Europe value to the fi nished concrete. Contact:

Eastern Europe Asia/Pacifi c Africa/Mideast

Regional differences in pricing are SEVAK PUBLICATIONS PVT. LTD.

Fig. 2: Global construction chemicals demand share by region (Million dollars) largely determined by variations in the 602-B, Godrej Coliseum, K.J. Somaiya Hospital Road, Behind Everard Nagar, Sion (E), Mumbai 400 022.

Source: Freedonia Group. product mix: Phone: +91-22-24044471 / 72; Email: admin@chemicalweekly.com

196 Chemical Weekly November 14, 2023 Chemical Weekly November 14, 2023 197

Contents Index to Advertisers Index to Products Advertised