Page 183 - CW E-Magazine (18-3-2025)

P. 183

Special Report Special Report

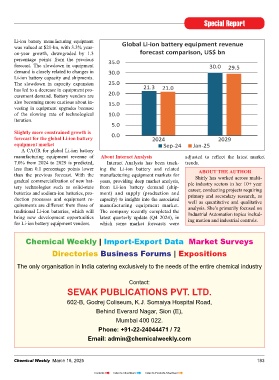

Li-ion battery shipments: Short-term uptick, followed Li-ion battery manufacturing equipment Global Li-ion battery equipment revenue

was valued at $21-bn, with 3.3% year-

by longer-term slowdown forecast on-year growth, downgraded by 1.3 forecast comparison, US$ bn

percentage points from the previous

forecast. The slowdown in equipment 35.0

n 2024, global lithium (Li)-ion forecast to grow SHIRLY ZHU 30.0 29.5

battery shipments reached an esti- a compound an- Principal Analyst, Interact Analysis demand is closely related to changes in 30.0

Imated 1,353 GWh. This is a year- nual growth rate E-mail: shirly.zhu@interactanalysis.com Li-ion battery capacity and shipments. 25.0

on-year increase of 23% and 1.7 per- (CAGR) of 20.6%. The slowdown in capacity expansion 21.3 21.0

centage points higher than the fi gure This has been re- Li-ion battery short- and long-term has led to a decrease in equipment pro- 20.0

we presented in September 2024. The vised down by 0.8 production capacity expectations curement demand. Battery vendors are

positive change is mainly due to stronger percentage points downgraded also becoming more cautious about in- 15.0

demand for energy storage. from the previous In 2024, we estimate global Li-ion vesting in equipment upgrades because

forecast. Important infl uencing factors battery capacity reached 2,967 GWh. of the slowing rate of technological 10.0

In key markets such as China and include the uncertainty of new energy This is a year-on-year increase of iteration. 5.0

the US, the installed capacity of energy industry policies in Europe and the US, 27.6%, which is 2.1 percentage points

storage, especially large-scale energy particularly the change in attitude of lower than the previous forecast. Dur- Slightly more constrained growth is 0.0

storage projects, exceeded previous the new US government towards new ing the period from 2024 to 2029, the forecast for the global Li-ion battery 2024 2029

market expectations, therefore provid- energy. As a major global market for CAGR of total capacity has also been equipment market Sep-24 Jan-25

ing a strong boost for Li-ion battery new energy vehicles and energy stor- revised down by 0.2 percentage points A CAGR for global Li-ion battery

demand. However, in the fi eld of new age, the policy orientation of the US to an estimated 17.6%. This follows on manufacturing equipment revenue of About Interact Analysis adjusted to refl ect the latest market

energy vehicles, the performance of plays a crucial role in the development from the downgraded previous predic- 7.0% from 2024 to 2029 is predicted, Interact Analysis has been track- trends.

European and American markets was of the industry. If policy support weak- tion and is largely due to the dual pres- less than 0.1 percentage points lower ing the Li-ion battery and related ABOUT THE AUTHOR

much slower. Factors in Europe such ens, the investment and construction sures of overcapacity and a slowdown than the previous forecast. With the manufacturing equipment markets for Shirly has worked across multi-

as subsidy policy adjustments and slug- progress of new energy projects will be in demand. gradual commercialization of new bat- years, providing deep market analysis, ple industry sectors in her 10+ year

gish economic growth have contributed hindered, affecting demand for Li-ion tery technologies such as solid-state from Li-ion battery demand (ship- career, conducting projects requiring

to a decline in demand for electric batteries in the downstream market. In the past few years, there has been batteries and sodium-ion batteries, pro- ment) and supply (production and primary and secondary research, as

vehicle (EV) batteries. an investment boom in the Li-ion bat- duction processes and equipment re- capacity) to insights into the associated well as quantitative and qualitative

Global shipments of Li-ion batteries tery industry, and the infl ux of a large quirements are different from those of manufacturing equipment market. analysis. She’s primarily focused on

Over the forecast period covered by are expected to more than double amount of capital has led to rapid capa- traditional Li-ion batteries, which will The company recently completed the Industrial Automation topics includ-

our Li-ion Battery and Manufacturing between 2024 and 2029, although city expansion. However, the growth bring new development opportunities latest quarterly update (Q4 2024), in ing motion and industrial controls.

for Li-ion battery equipment vendors.

which some market forecasts were

Equipment – 2024 report (2024-2029), our forecasts have been revised down of market demand, especially in the

fi eld of EV batteries, has failed to keep

global Li-ion battery shipments are slightly.

up with capacity expansion, resulting

Global Li-ion battery shipment forecast in insufficient capacity utilization. Chemical Weekly | Import-Export Data Market Surveys

consumption, GWh According to our statistics, the EV battery Directories Business Forums | Expositions

4,000 capacity utilization rate in 2024 was

estimated to be around 57%, which

3,516 3,447 undoubtedly intensifi es market compe- The only organisation in India catering exclusively to the needs of the entire chemical industry

tition and expedites the phasing out of

3,000 outdated production capacity. In addi-

tion, the energy storage market in some Contact:

regions faces problems such as slow SEVAK PUBLICATIONS PVT. LTD.

2,000 policy implementation and project

1,335 1,354 development challenges, which to some 602-B, Godrej Coliseum, K.J. Somaiya Hospital Road,

extent restrains the utilization of Behind Everard Nagar, Sion (E),

1,000 existing production capacity.

Mumbai 400 022.

Li-ion battery manufacturing equip- Phone: +91-22-24044471 / 72

0 ment: Amid slowing growth, oppor-

2024 2029 tunities still exist Email: admin@chemicalweekly.com

Sep-24 Jan-25 In 2024, the global market for

182 Chemical Weekly March 18, 2025 Chemical Weekly March 18, 2025 183

Contents Index to Advertisers Index to Products Advertised