Page 181 - CW E-Magazine (23-7-2024)

P. 181

World Chlor-Alkali Conference 2024 World Chlor-Alkali Conference 2024

able energy and certifi cation to produce over 2-mt of PVC in 2023 with almost driver. Electricity prices have fallen in PARADIGM SHIFT

‘green’ chlor-alkali products. There are half of the volume being exported to 2024, but ECU value (the combined

also efforts to utilise by-product hydro- India. However, the rising container value for chlorine and caustic soda) is India heading towards a more balanced caustic-

gen instead of venting it by installing costs from China to PVC export desti- also lower than 2022,” he said.

hydrogen-fi red steam boilers to reduce nations have impacted exports. Exports chlorine market

carbon footprint. to the Indian market could also be hit Capacity utilisation in Europe in

as the Indian government has ordered 2023 fell to 62% on average, which is The developments in the Indian

Another emerging trend, is the ris- the implementation of Bureau of Indian lower than during the fi nancial crisis in chlor-alkali industry were discussed

ing demand for lithium-ion batteries Standards (BIS) quality certifi cation on 2008/2009. Even though capacity utili- by Mr. Ankur Singh, Vice President &

driving up consumption in caustic soda. PVC imports effective from August this sation in 2024 has averaged 69.5%, it Head Strategy – Chemical Business,

Caustic soda is used in lithium extrac- year. Chinese PVC exporters are now is still lower than in 2008/2009. DCM Shriram Ltd.

tion and in the purifi cation of lithium engaged in the process of applying for

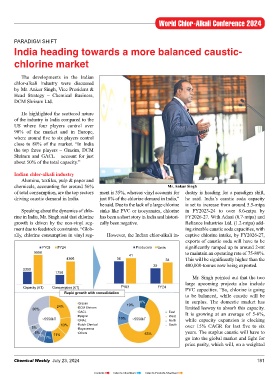

battery cathodes. In Europe there are this certifi cation to continue exporting “European chlorine production in He highlighted the scattered nature

some lithium extraction plants planned to India, she informed. 2023 was the lowest ever recorded,” he of the industry in India compared to the

to start by 2030. said and added that demand for chlor- US where four players control over

Europe struggles alkali products fell by around 15% in 90% of the market and in Europe,

China subdued Mr. Chris Barker, Senior Editor, 2022 as compared to 2021. where around fi ve to six players control

Ms. Carol Li, Senior Consultant, Europe, ICIS, noted that Europe has close to 80% of the market. “In India

Tecnon OrbiChem Ltd. gave an over- been the market to suffer the most “In the current situation for Europe, the top three players – Grasim, DCM

view of China’s chlor-alkali & vinyls because of geopolitical events. competition is the elephant in the room. Shriram and GACL – account for just

export market. Prices for European products are very about 50% of the total capacity.”

For the European chlor-alkali in- high and production costs are also very

She noted the downtrend in Chinese dustry, margins have been squeezed as high,” he said. Indian chlor-alkali industry

liquid caustic soda exports in the past the products are sold at the same prices, Alumina, textiles, pulp & paper and

two years. The 2023 fi gure of 1.96-mt but production costs have gone up. The Mr. Barker also highlighted the ris- chemicals, accounting for around 56% Mr. Ankur Singh

was 27% lower than 2022, while the Jan- basic issue has been the volatile prices ing imports of caustic soda and PVC of total consumption, are the top sectors ment is 35%, whereas vinyl accounts for dustry is heading for a paradigm shift,

Apr 2024 fi gure was 24% lower than the for both inputs and outputs. “Margins from US to Europe. “Europe histori- driving caustic demand in India. just 8% of the chlorine demand in India,” he said. India’s caustic soda capacity

corresponding 2023 period. Australia reached negative territory in 2023 cally imports the equivalent of 5-10% he said. Due to the lack of a large chlorine is set to increase from around 5.5-mtpa

remained the largest export destination with record electricity prices being the of domestic PVC production from the Speaking about the dynamics of chlo- sinks like PVC or isocyanates, chlorine in FY2023-24 to over 8.6-mtpa by

for China’s liquid caustic soda. Solid US,” he informed. rine in India, Mr. Singh said that chlorine has been a short story in India and histori- FY2026-27. With Adani (0.7-mtpa) and

caustic soda exports also dipped 8% in growth is driven by the non-vinyl seg- cally been negative. Reliance Industries Ltd. (1.2-mtpa) add-

2023 compared to 2022, while the Jan- The European chlor-alkali industry ment due to feedstock constraints. “Glob- ing sizeable caustic soda capacities, with

Apr 2024 exports were 24% lower than has sought to respond to this situation ally, chlorine consumption in vinyl seg- However, the Indian chlor-alkali in- captive chlorine intake, by FY2026-27,

the corresponding 2023 period. by attempts to consolidate or sell assets exports of caustic soda will have to be

and by launching anti-dumping investi- FY03 FY24 Producers Units signifi cantly ramped up to around 2-mt

In 2024, demand for Chinese liquid gations against imports from the US 5556 41 to maintain an operating rate of 75-80%.

caustic soda is expected to come from and Egypt. He noted that the large 4305 36 34 This will be signifi cantly higher than the

the alumina industry in Australia and duties proposed in the range of 58-100% 25 400,000-tonnes now being exported.

Indonesia. The growing lithium battery is a tacit acknowledgment of the issues 2350 1750

industry in Australia and fast rising nickel facing the region. Mr. Singh pointed out that the two

industry in Indonesia will also look at FY03 large upcoming projects also include

importing from China. “The imposition of anti-dumping Capacity (KT) Consumption (KT) FY24 PVC capacities. “So, chlorine is going

Rapid growth with consolidation

duties is unlikely to cause a great deal to be balanced, while caustic will be

While new capacities are starting of change in the longer term; there is Grasim 8% in surplus. The domestic market has

up in 2024 in China – over 2-mtpa of no real future in anti-dumping. These 30% 24% DCM Shriram 19% limited leeway to absorb this capacity.

caustic soda and PVC – the country is types of ‘moats’ won’t really fi x funda- GACL East It is growing at an average of 5-6%,

Epigral

West

likely to face competition from Indian mental issues. These require funda- ~5556kT GNAL 10% ~5556kT North while capacity expansion is clocking

and South Korean producers who are mental change. The region’s competi- 5% 13% Kutch Chmical South over 15% CAGR for last fi ve to six

Rayaseema

also expanding capacities. tiveness needs to be fi xed. Fundamental 5% 11% Others 63% years. The surplus caustic will have to

problems can only be solved by funda- 5% 7% go into the global market and fi ght for

Ms. Li noted that China exported Mr. Chris Barker mental solutions,” he concluded. price parity, which will, on a weighted

180 Chemical Weekly July 23, 2024 Chemical Weekly July 23, 2024 181

Contents Index to Advertisers Index to Products Advertised