Page 178 - CW E-Magazine (23-7-2024)

P. 178

World Chlor-Alkali Conference 2024

SUBDUED TRENDS

Chlor-alkali industry faces headwinds as EU, Chinese

economy falter and US remains indifferent; India among

few bright spots

he global chlor-alkali industry In his comments on the overall the largest market for caustic soda

has remained fairly subdued global economy trends, Mr. Brian Tan, followed by USA and Europe.

Tthrough a challenging period Senior Regional Economist, Barclays

of past two years when the world wit- Bank PLC, pointed out that while over- He underlined the regional dispa-

nessed geopolitical tensions in Ukraine all US consumer spending has been rity in growth with regions with weaker

and Israel, leading to high energy prices holding up well, economic activity in cost position (like Europe and Latin

and consequent economic slowdowns China is losing steam. “After a fairly America) set to witness cheap imports

in different regions. strong fi rst quarter, a slowdown is being from Asia and Middle East. “Asia will

witnessed in China. Home sales have continue to add capacity keeping up the

Industry experts who gathered at the not bottomed out yet and it is highly oversupply situation for next couple of

27th edition of ‘ICIS & Tecnon Orbi- unlikely that the Chinese economy will years,” he said.

Chem World Chlor-Alkali Conference’ function as well as in the past,” he said.

in Singapore recently, sought to decode According to Ms. Saeed, US caustic

the implications of these diverse trends Global trends soda production is forecast to grow from

on the future prospects of the sector. In her overview of the global chlor- around 13-mt in 2024 to over 14-mt

The general consensus was that China, alkali market, Ms. Hira Saeed, Senior in 2029, while demand is expected to

one of the key global markets, would Consultant, Tecnon OrbiChem Ltd., grow from 10-mt to just over 11-mt

struggle to revive economic activities now part of ResourceWise, expected during the same period. “US is expec-

in the short term, while Europe would the growth of caustic soda industry and ted to remain a net exporter into 2029

try to tide over its uncompetitive posi- GDP growth to be on similar lines till and beyond,” she said. In the US, the

tion through protectionism and US will 2029. chemical sector comprising organic

intensify efforts to fi nd markets outside and inorganic chemicals accounts for

its shores as supplies rise and domestic Mr. Ankur Singh Vice President & a large percentage of overall consump-

demand remains sluggish. India would Head Strategy – Chemical Business, tion of caustic soda.

remain a bright spot with demand con- DCM Shriram Ltd., estimated the

tinuing to remain strong even as capa- global chlor-alkali installed capacity In Europe, monthly chlor-alkali

city additions begin to take shape. at around 106-mtpa with China being operating rates started to see a decline

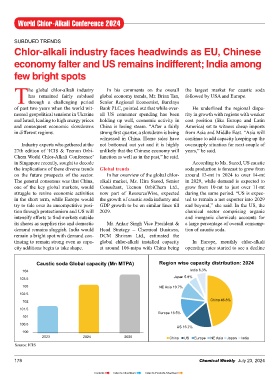

Caustic soda Global capacity (Mn MTPA) Region wise capacity distribution: 2024

104 India 6.3%

103.5 Japan 5.8%

103 NE Asia 10.7%

102.5

102 China 46.8%

101.5

Europe 13.5%

101

100.5

US 16.7%

100

2023 2024 2025 China US Europe NE Asia Japan India

Source: ICIS

178 Chemical Weekly July 23, 2024

Contents Index to Advertisers Index to Products Advertised