Page 182 - CW E-Magazine (28-1-2025)

P. 182

Special Report

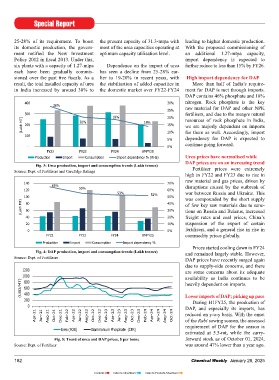

25-28% of its requirement. To boost the present capacity of 31.3-mtpa with leading to higher domestic production.

its domestic production, the govern- most of the urea capacities operating at With the proposed commissioning of

ment notifi ed the New Investment optimum capacity utilisation level. an additional 1.27-mtpa capacity,

Policy 2012 in fi scal 2013. Under this, import dependency is expected to

six plants with a capacity of 1.27-mtpa Dependence on the import of urea further reduce to less than 15% by FY26.

each have been gradually commis- has seen a decline from 25-28% ear-

sioned over the past fi ve fi scals. As a lier to 19-20% in recent years, with High import dependency for DAP

result, the total installed capacity of urea the stabilisation of added capacities in More than half of India’s require-

in India increased by around 30% to the domestic market over FY22-FY24 ment for DAP is met through imports.

DAP contains 46% phosphate and 18%

400 30% nitrogen. Rock phosphate is the key

28% raw material for DAP and other NPK

25%

300 19% 20% fertilisers, and due to the meagre natural

(Lakh MT) 200 20% 14% 15% resources of rock phosphate in India,

we are majorly dependent on imports

100 10% for them as well. Accordingly, import

5% dependency for DAP is expected to

continue going forward.

- 0%

FY22 FY23 FY24 8MFY25

Production Import Consumption Import dependency % (RHS) Urea prices have normalised while

DAP prices are on an increasing trend

Fig. 3: Urea production, import and consumption trends (Lakh tonnes)

Source: Dept. of Fertilisers and CareEdge Ratings Fertiliser prices were extremely

high in FY22 and FY23 due to rise in

raw material and gas prices, driven by

140 70%

65% disruptions caused by the outbreak of

120 55% 60%

53% 52% war between Russia and Ukraine. This

100 50% was compounded by the short supply

(Lakh MT) 80 40% of few key raw materials due to sanc-

tions on Russia and Belarus, increased

30%

60

40 20% freight rates and coal prices, China’s

20 10% suspension of the export of certain

0 0% fertilisers, and a general rise in rise in

FY22 FY23 FY24 8MFY25 commodity prices globally.

Production Import Consumption Import dependency %

Prices started cooling down in FY24

Fig. 4: DAP production, import and consumption trends (Lakh tonnes) and remained largely stable. However,

Source: Dept. of Fertilisers DAP prices have recently surged again

due to supply-side concerns, and there

1200 are some concerns about its adequate

1000 availability as India continues to be

(USD/MT) 600

800 heavily dependent on imports.

400

200 Lower imports of DAP; picking up pace

During H1FY25, the production of

0 DAP, and especially its imports, has

Apr-21 Jun-21 Aug-21 Oct-21 Dec-21 Feb-22 Apr-22 Jun-22 Aug-22 Oct-22 Dec-22 Feb-23 Apr-23 Jun-23 Aug-23 Oct-23 Dec-23 Feb-24 Apr-24 Jun-24 Aug-24 Oct-24 reduced on y-o-y basis. With the onset

of the Rabi sowing season, the assessed

requirement of DAP for the season is

Urea (FOB) Diammonium Phosphate (CFR)

estimated at 5.5-mt, while the carry-

Fig. 5: Trend of urea and DAP prices, $ per tonne forward stock as of October 01, 2024,

Source: Dept. of Fertilizer was around 47% lower than a year ago.

182 Chemical Weekly January 28, 2025

Contents Index to Advertisers Index to Products Advertised