Page 181 - CW E-Magazine (2-1-2024)

P. 181

Special Report

CAREEDGE REPORT

Soda ash industry FY24 margins likely to moderate

by 400-550 bps, but long-term growth intact

Synopsis Turkey, Russia, and Inner Mongolia (in anticipated to be a contributing factor to

he global soda ash market is China) have created short-term surplus. the slowdown in production growth.

valued at around $21.5-bn in However, in the medium to long term,

TCY2023 and is expected to grow increased demand from the glass and The demand for soda ash mainly arises

at a compounded annual growth rate electric vehicle (EV) sectors is expected from industries such as soaps and deter-

(CAGR) of 6.6% between 2024 and to fuel industry growth. gents, glass, textiles, and paper & pulp.

2032. The global soda ash market is In the past few years, the aggressive focus

estimated to be 63.2-mt in 2022, with Production and consumption trends on green energy has driven the increased

a projected CAGR of around 3.0-3.3% in India usage of glass for solar panels and lithium

between 2022 and 2030.The current The production of soda ash is ex- carbonate for EV battery applications,

global soda ash capacity, which stands at pected to grow at a sluggish rate in FY24, with a consequent sharp demand growth

71-mtpa in CY2023, is expected to grow around 0% to -1% as compared to 4.6% for soda ash, which is a vital ingredient

at a CAGR of 3% by 2030. growth seen in FY23. The slowdown in these two sectors. The healthy demand

is likely due to muted demand from most for glass from real estate, automobile, and

The Indian soda ash market is ex- of the end-user industries. glass-packaging sectors is expected to

pected to grow at a CAGR of 2-3% from augur well for the soda ash industry. Further-

current annual consumption of 3.5-mt to The muted demand and the capacity more, the surge in EV demand in FY24

3.6-mt in FY23, to 3.7-mt to 3.8-mt over additions in China have resulted in an (soda ash is used in lithium-ion batteries)

the period FY24 and FY25. Current pro- excess supply of soda ash, which is also is expected to support the demand for soda

duction capacity is 4.2-mt (FY23). The

growing use of soda ash in solar glass,

electric mobility, battery manufacturing,

metallurgical processes, synthetic deter-

gents and wastewater treatment is antici-

pated to drive its demand in India.

Post the robust operating margins

witnessed in FY23, the Indian soda ash

industry is expected to record moderation

in its operating margins by 400-550 bps

in FY24, likely due to lower realisation

amid the oversupply of soda ash glob-

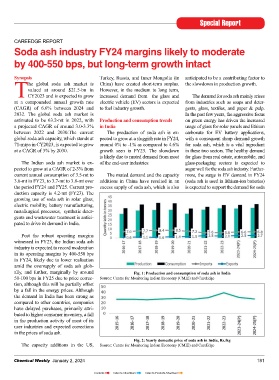

ally, and further, marginally by around Fig. 1: Production and consumption of soda ash in India

50-100 bps in FY25 due to price correc- Source: Centre for Monitoring Indian Economy (CMIE) and CareEdge

tion, although this will be partially offset

by a fall in the energy prices. Although

the demand in India has been strong as

compared to other countries, companies

have delayed purchases, primarily attri-

buted to higher consumer inventory, a fall

in the production activity of most of its

user industries and expected corrections

in the prices of soda ash.

Fig. 2: Yearly domestic price of soda ash in India, Rs./kg

The capacity additions in the US, Source: Centre for Monitoring Indian Economy (CMIE) and CareEdge

Chemical Weekly January 2, 2024 181

Contents Index to Advertisers Index to Products Advertised