Page 190 - CW E-Magazine (17-12-2024)

P. 190

Special Report

Investment opportunity in ultrapure chemicals

for electronic/semiconductor industries

What are ultrapure chemicals and for 5G smartphones,

the application areas? personal computers N.S. VENKATARAMAN

lectronic product and semicon- and data centre- Nandini Consultancy Centre

ductor devices require good related equipment, as Chennai

Eproduct consistency and the well as analogue inte- Email: nandinichemical@gmail.com

highest purity. grated circuits such industry was valued at $34.3-bn and is

as signal conversion, expected to reach $100.2-bn by 2032,

Semiconductors are all about preci- automotive-specifi c analogue applica- driven by an increasing demand for

sion manufacturing, zero error and gett- tions, and power management. smartphones, wearables, automotive

ing everything down to the atomic level. parts and computers.

China is now one of the largest

In the fabrication process of elec- semiconductor markets in the world and is

Currently, India relies largely on

tronic and semiconductor devices, continuing to grow. More than $500-bn import of semiconductors, mainly from

several materials must be cleaned of investments have been announced Taiwan, China, Korea and Vietnam.

and etched. Ultrapure chemicals such for chip expansions over the next fi ve To reduce this dependence on imports,

as acids/bases, ammonium fl uoride, years around the world, of which more the Ministry of Electronics and Infor-

hydrogen peroxide and others, are used than $130-bn is planned for the US. mation Technology has launched the

as cleansers and etchants in semiconductor A strong growth cycle is expected to start ‘India Semiconductor Mission’ with a

and microprocessor manufacturing. in 2025 and into the next decade. $10-bn commitment. This includes

incentives for manufacturing and

Classifi cation of ultrapure chemicals Indian electronics/semiconductor the Design Linked Incentive (DLI)

Ultrapure chemicals, which are wet industry

electronic chemicals, can be mainly In 2023, the Indian semiconductor scheme to support semiconductor

startups.

divided into general chemicals and

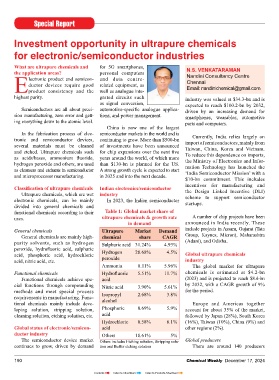

functional chemicals according to their Table 1: Global market share of

uses. ultrapure chemicals & growth rate A number of chip projects have been

in demand announced in India recently. These

General chemicals Ultrapure Market Demand include projects in Assam, Gujarat (Tata

General chemicals are mainly high- chemical share CAGR Group, Kaynes, Micron), Maharashtra

purity solvents, such as hydrogen Sulphuric acid 31.24% 4.93% (Adani), and Odisha.

peroxide, hydrofl uoric acid, sulphuric

acid, phosphoric acid, hydrochloric Hydrogen 28.68% 4.5% Global ultrapure chemicals

acid, nitric acid, etc. peroxide industry

Ammonia 8.11% 5.96% The global market for ultrapure

Functional chemicals Hydrofl uoric 5.51% 11.7% chemicals is estimated at $4.2-bn

Functional chemicals achieve spe- acid (2023) and is projected to reach $8.4-bn

cial functions through compounding Nitric acid 3.90% 5.61% by 2032, with a CAGR growth of 9%

methods and meet special process Isopropyl 2.68% 3.8% for the period.

requirements in manufacturing. Func- alcohol

tional chemicals mainly include deve- Europe and Americas together

loping solution, stripping solution, Phosphoric 0.69% 5.9% account for about 35% of the market,

cleaning solution, etching solution, etc. acid followed by Japan (28%), South Korea

Hydrochloric 0.58% 6.1% (16%), Taiwan (10%), China (9%) and

Global status of electronic/semicon- acid other regions (2%).

ductor industry Others 18.61% 5%

The semiconductor device market Others includes Etching solution, Stripping solu- Global producers

continues to grow, driven by demand tion and Buffer etching solution There are around 140 producers

190 Chemical Weekly December 17, 2024

Contents Index to Advertisers Index to Products Advertised