Page 183 - CW E-Magazine (17-9-2024)

P. 183

Special Report Special Report

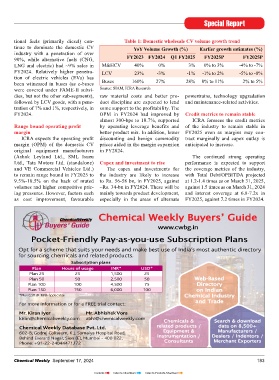

DEMAND OUTLOOK tional fuels (primarily diesel) con- Table 1: Domestic wholesale CV volume growth trend

tinue to dominate the domestic CV YoY Volume Growth (%) Earlier growth estimates (%)

Commercial vehicle industry to grow at 0-3% industry with a penetration of over

90%, while alternative fuels (CNG, FY2023 FY2024 Q1 FY2025 FY2025P FY2025P

in FY2025: ICRA LNG and electric) had ~9% sales in M&HCV 40% 0% 3% 0% to 3% -4% to -7%

FY2024. Relatively higher penetra- LCV 23% -3% -1% -1% to 2% -5% to -8%

redit ratings agency, ICRA tion of electric vehicles (EVs) has

expects the domestic commer- been witnessed in buses (as e-buses Buses 160% 27% 28% 8% to 11% 2% to 5%

Ccial vehicle (CV) industry’s were covered under FAME-II subsi- Source: SIAM, ICRA Research

wholesale volumes to witness a dies, but not the other sub-segments), raw material costs and better pro- powertrains, technology upgradation

nominal year-on-year (YoY) growth followed by LCV goods, with a pene- duct discipline are expected to lend and maintenance-related activities.

of 0-3% in FY2025, against the earlier tration of 7% and 1%, respectively, in some support to the profitability. The

estimated decline of 4-7%. This fol- FY2024. OPM in FY2024 had improved by Credit metrics to remain stable

lows a better-than-expected volume almost 300-bps to 10.7%, supported ICRA foresees the credit metrics

growth in 4M FY2025 and expecta- Range bound operating profi t by operating leverage benefits and of the industry to remain stable in

tions of a marginal uptick in demand margin better product mix. In addition, lower FY2025 even as margins may con-

in the second half of the fi scal. ICRA expects the operating profi t discounting and benign commodity tract marginally and capex outlay is

margin (OPM) of the domestic CV prices aided in the margin expansion anticipated to increase.

Second year of muted growth original equipment manufacturers in FY2024.

FY2025 will be the second con- (Ashok Leyland Ltd., SML Isuzu The continued strong operating

secutive year of muted growth after frastructure development (evidenced volumes are expected to show a Ltd., Tata Motors Ltd. (standalone) Capex and investment to rise performance is expected to support

a 1% and 3% YoY growth in whole- by retaining the higher infrastructure tepid YoY growth of (-1)% to 2% in and VE Commercial Vehicles Ltd.) The capex and investments for the coverage metrics of the industry,

sale and retail sales, respectively, in capital outlay in the July 2024 bud- FY2025 due to factors such as a high to remain range bound in FY2025 to the industry are likely to increase with Total Debt/OPBITDA projected

FY2024. getary allocation), a steady increase base effect, sustained slowdown in 9.5%-10.5% on the back of muted to Rs. 56-58 bn, in FY2025, against at 1.2-1.4 times as on March 31, 2025,

in mining activities, and the improve- e-commerce and cannibalisation from volumes and higher competitive pric- ~Rs. 34-bn in FY2024. These will be against 1.5 times as on March 31, 2024

According to Kinjal Shah, Senior ment in roads/highway connectivity.” e3Ws. The segment had witnessed a ing pressures. However, factors such mainly towards product development, and interest coverage at 6.8-7.2x in

Vice President & Co-Group Head – mild decline of 3% on a YoY basis in as cost improvement, favourable especially in the areas of alternate FY2025, against 7.2 times in FY2024.

Corporate Ratings, ICRA: “A range of Nominal growth in M&HCV FY2024, owing to the above factors,

factors such as the slowdown in infra- volumes in addition to a defi cit rainfall impacting

structure activities during the General Among the various sub-seg- the rural economy. Chemical Weekly Buyers’ Guide

Elections, as well as extreme heat- ments within the CV industry, the

waves across the country, had some medium and heavy commercial Increased total cost of ownership www.cwbg.in

bearing on demand in Q1 FY2025. vehicles (M&HCV) (trucks) volumes of LCVs has also led to a rising pre- www.cwbg.in

However, volumes in this period in FY2025 are expected to report a ference for pre-owned vehicles by Pocket-Friendly Pay-as-you-use Subscription Plans

exceeded ICRA’s expectations. Look- nominal growth of 0-3% YoY, given the small fl eet operators, which may Opt for a scheme that suits your needs and make best use of India’s most authentic directory

ing ahead, ICRA expects a recovery the high base effect and the impact of impact the demand, going forward. for sourcing chemicals and related products.

in volumes in H2 FY2025 aided by a the General Elections on infrastruc- Subscription plans

back-ended Government capex, some ture activities in the fi rst few months Scrappage policy to drive bus Plan Hours of usage INR* USD*

pick-up in private capex across manu- of the fi scal. The segment had ended demand Plan 25 25 1,500 25

facturing sectors, and an improve- FY2024 with fl attish volumes. With- The scrappage of older Govern- Plan 50 50 2,500 50 Web-Based

ment in rural demand, following visi- in this sub-segment, while the tipper ment vehicles is expected to drive Plan 100 100 4,500 75 Directory

bility around the Kharif crop output volumes reported 4% YoY contrac- replacement demand for the bus seg- Plan 150 150 6,000 100 on Indian

and farm cash fl ows. The replacement tion in Q1 FY2025, the haulage sub- ment From State Road Transport *Plus GST @ 18% applicable Chemical Industry

demand would also remain healthy segment showed a modest 3% YoY Undertakings (SRTUs) in FY2025, For more information or for a FREE trial contact: and Trade

(primarily due to the ageing fl eet) and growth for the quarter. Tractor-trailers supporting a YoY growth of 8-11%.

is expected to support the industry reported a modest 7% YoY volume The sub-segment volumes gained Mr. Kiran Iyer Mr. Abhishek Vora

volumes in the medium term.” growth in Q1 FY2025. considerable traction in FY2024 and kiran@chemicalweekly.com abhi@chemicalweekly.com Chemicals & Search & download

exceeded the pre-COVID levels. Chemical Weekly Database Pvt. Ltd. related products / data on 8,500+

“The long-term growth drivers LCV volumes to show tepid growth 602-B, Godrej Coliseum, K.J. Somaiya Hospital Road, Equipment & Manufacturers /

for the domestic CV industry remain Domestic light commercial Diesel domination continues Behind Everard Nagar, Sion (E), Mumbai - 400 022. Instrumentation / Dealers / Indentors /

Consultants

Merchant Exporters

intact, like the sustained push in in- vehicles (LCV) (trucks) wholesale In terms of powertrain mix, conven- Phone: +91-22-24044471 72

182 Chemical Weekly September 17, 2024 Chemical Weekly September 17, 2024 183

Contents Index to Advertisers Index to Products Advertised