Page 190 - CW E-Magazine (15-10-2024)

P. 190

Special Report Special Report

Asia petrochemical price pressure continues PTA generally follow the PX prices general bearish sentiment for China’s Peak turnaround will support some

products

downward movement. The end-use economy also offset consumption con-

ACN spot prices in northeast Asia

in September on weaker crude pricing product prices, PET resin and poly- fi dence, leading to a cautious stance are forecast to increase, given that cur-

ester fi bre, will be negatively impacted from end-user buyers.

as well. rent oversupply is expected to recede in

China’s manufacturing Purchasing the short term. Lower operating rates

signifi cant portion of Asia petro- commodities covered by the ICIS Asia JIMMY ZHANG Target Your Market More Effectively

chemical prices are expected Price Forecast, September average prices Industry Analyst, ICIS China Continuous tepid demand drags Managers’ Index (PMI) reached 49.1% and planned maintenance in the region

A to continue decreasing in Sep- for 26 are forecast to decrease, with down prices ChemImpex for August 2024, down by 0.3 percent- are resulting in a healthier supply/

IndiaChemTrade

tember, driven largely by the decline para-xylene (PX), Terephthalic Acid now at around $270/tonne, the highest Prevailing weak conditions in China’s age points from July, according to the demand balance.

in crude values during the month, with (PTA) and 2-ethylhexanol (2-EH) lead- level since mid-2022. At that time, real estate market has resulted in National Bureau of Statistics. Free for subscribers of Chemical Weekly

For subscribers only

market sentiment bearish. ing the falls. Prices for the other fi ve TDP run rates remained high across reduced demand for petrochemicals Similarly, heavy maintenance at

IndiaChemTrade provides consolidated trade statistics

ChemImpex, the trade database, tracks, on a daily

26 out of 31 products tracked by commodities are forecast to increase the whole Asian region, increasing PX products relating to the construction This is the fourth continuous month SBR units in northeast Asia is expected

of India. The information provided here is based on the

basis, exports and imports of chemicals and related

ICIS to post September price with acrylonitrile (ACN), styrene supply during the period, even though industry. Total investment in China’s that it has been below 50, refl ecting from late August, leading to about

annual trade data published by the Directorate General

products through the major ports in India — a vital

declines. butadiene rubber (SBR) and caprolactam the downstream PTA market remained real estate industry fell by 10.2% from the weak consumption, according to 70,000 tonnes of capacity loss, accord-

source of commercial intelligence. Find out on-line

of Commercial Intelligence and Statistics, Government

Aromatic products are facing (CPL) leading the gains. constrained. January to August year on year. Total ICIS senior analysts, Amy Yu and Joey ing to ICIS senior analyst Ann Sun.

of India. The database can be searched by: Chemical

how international markets are moving; where your

diverse market trends. real estate sales also fell by 18% during Zhou. Thus, there is limited spot Petrochina Jilin Petrochemical shut its

Name/Harmonised Code to obtain the consolidated

competitors are exporting and at what price; where

Demand is weaker than expected Healthy TDP margins lead to over- In China, PX run rates have already the same period. demand since most end-users are mainly 150,000 tonne/year SBR unit in late

during a traditional peak season. supply in PX market increased by around one percentage imports are coming from and how their prices are trade (import or export) in that item; or by Country to

buying contract cargoes, putting August for a two-month turnaround.

Prices for only fi ve products are point in August due to high TDP mar- moving. Download all this data, seamlessly, for a obtain the trade (import or export) in all chemicals and

As result, China PVC major pressure on prices of PP, PE, GPPS, ZPC shut its 600,000 tonne/year solu-

tion SBR unit in early September to

For the crude market, despite efforts forecast to increase in September and gins and are expected to remain high downstream operating rates are cur- PET resin, etc. related products between India and that country

small fee — online, anytime, with no hassles.

by OPEC+ to curb overproduction, benzene is one of them, due to a projected in September. Nevertheless, we do not rently lower, around 45%, compared end September.

many members – including Iraq, the uptick in demand following deriva- expect downstream PTA units run rates to the same period in 2023. This is ChemXchange

In southeast Asia, demand also

UAE, Kazakhstan, and Russia – con- tive plant restarts and new downstream to increase in light of cautious restock- also similar for 2-EH. This has led remains weak, as the rainy season has Besides the peak turnaround season,

Open to all registered users — no subscription required

tinue to exceed their production targets. capacities coming onstream, according ing activity from the polyester industry. to sharp decreases in prices for both slowed construction activities in key the bullish sentiment in the natural rub-

ChemXchange — the chemical exchange with a difference — is where you can identify your buyers and sup-

This persistent oversupply, coupled to ICIS senior analyst, Jenny Yi. commodities. markets such as Thailand and Viet- ber market also will support SBR prices.

The natural rubber market is forecast

nam. In India, a major export desti-

with strong non-OPEC production, is As a result, the PX spot market will plyers on-line, any time. This unique platform is free to all advertisers in the print version of Chemical Weekly.

likely to keep a cap on oil prices. Bullish benzene prices have re- be ample. Combined with the end of For EPS, even though feedstock nation for Asian producers, demand to have balanced-to-tight fundamentals

For more information contact: 022-24044477. Fax: 022-24044450

sulted in strong toluene dispropor- gasoline’s demand season, PX prices styrene prices are expected to remain has been similarly subdued, further in the remainder of the year, with low

Email: corporate@chemicalweekly.com or log on to chemicalweekly.com

Among 31 major petrochemical tionation (TDP) margins, which are are expected to drop tremendously, and fl at in September, values are still fore- impacted by the ongoing lull in the inventory, lower-than-expected produc-

cast to decrease due to scant restocking monsoon season. Related petrochemi- tion and healthy demand. Weather risks

activity from the construction sector. cal products have also been negatively continue to limit the magnitude of the

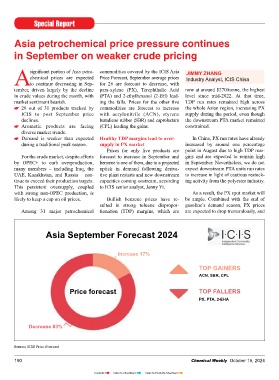

Asia September Forecast 2024 Apart from the construction sector, a impacted. natural rubber increase in H2.

Increase 17%

TOP GAINERS Missed a copy !!!

ACN, SBR, CPL

For Digital Edition of this month’s issue & all other past issues

Price forecast TOP FALLERS

PX, PTA, 2-EHA Visit www.hpicindia.com

PDF copies available for download

Register Now

Mrs. Usha S. - usha@hpicindia.com

Decrease 83%

Contact: For Subscription : Mrs. Usha S. - usha@hpicindia.com

For Advertising : Mr. Vijay Raghavan - vijay@hpicindia.com

Source; ICIS Price Forecast

190 Chemical Weekly October 15, 2024 Chemical Weekly October 15, 2024 191

Contents Index to Advertisers Index to Products Advertised