Page 190 - CW E-Magazine (10-10-2023)

P. 190

Special Report Special Report

mostly ethylene-based. These projects PHENOL VALUE CHAIN

will have the advantages of larger size,

integration to chlor-alkali and ethylene, Phenol profi tability declining after pandemic peak

cleaner production (no use of mercury

as a catalyst), and the benefi ts of ope Rest of world NEA Rest of world NEA Global growth in phenolics is ex- ports into India, which rose from 52-kt

36%

rating in Chemical Parks. Mainland 50% 37% 56% pected to rebound, supported by down- in 2019 to 103-kt in 2022, are expected

China has turned from a net import ISC ISC 3% stream bisphenol A (BPA) and polycar- to fall slightly to 101-kt by 2025.

position in PVC to a signifi cant net SEA 8% bonate resin (PC) expansions mainly in

export position, and CMA projects 6% SEA 4% Mainland China, and the global eco- According to Mr. Lee, while ace-

that net exports will average between Fig. 2a: 2022 PVC demand by region Fig. 2b: 2022 PVC capacity by region nomic recovery, but overcapacity will tone demand is more diverse than that

1.5-mt and 1.6-mt annually to 2032. Source: Chemical Market Analytics continue to persist as demand growth for phenol, the increasing popularity of

2032. The next wave of ethylene expan- high interest rates weighing on con- is unlikely to catch up. While margins the ethylene production route for methyl

According to Mr. Kok, producers in sions may also provide another chance struction and housing. Operating rates will improve slowly, it will still remain methacrylate (MMA) – an important

North America will continue to enjoy a to increase PVC capacity in the US, with at producers are down to low-60%, negative amidst voluntary production end-use for acetone now – instead of

substantial cash cost advantage that will integrated producers also benefi tting though the cost position has improved cuts or shutdowns considering the the traditional acetone cyanohydrin

enable high operating rates and exports from caustic soda credit. somewhat from the unprecedented oversupplied markets. route, could pose a threat to future ace-

of about 3.3-mt annually for the next de- levels of 2022, but still remain higher tone growth and consumption. “We

cade. While in 2023, PVC demand in the Western Europe PVC demand, on than pre-COVID levels. The region According to Mr. Brian Lee, Exe- expect acetone growth to be 2.9% per

region is expected to fall 6% year-on- the other hand, is on a declining trend. remains a magnet for imports, and is ripe cutive Director, Asia Aromatics, CMA, annum, lower than capacity growth of

year, due to higher mortgage rates im- While the region has seen demand for capacity rationalisation, given the the excess capacity in phenol markets 3.4%,” he observed.

pacting residential construction, demand destruction of about 1-mt in last two modest demand growth outlooks: 1.0% will keep operating rates around 70%, region will evolve. In the ISC, for

is expected to grow at 2.6% annually to years, 2023 demand is expected to show and 1.4% for 2023-2028 and 2028-2032, as new builds in Mainland China, will example, the market defi cit of 119-kt In BPA markets too, capacity addi-

2028, and thereafter at 2.0% annually to an year-on-year decline by 10% with respectively. keep the pressure. While global profi t- in 2019, increased to 154-kt in 2022 tions have beenfaster than demand

ability will improve, it will still remain and is expected to further rise to 204-kt growth, and operating rates have fallen

ETHYLENE OXIDE & DERIVATIVES below historical levels to 2028, indica- in 2025. Supplies into the region are signifi cantly. About 1-mpta of new BPA

ting that some rationalisation may be expected to continue to come largely from capacity is upcoming in Mainland China,

MEG margins to stay depressed as supply overhang forthcoming. the Middle East and SEA – both regions most with phenol and acetone integ-

with consistent net export positions. ration, and/or with forward integration

will persist The broad pattern of phenol trade to PC or epoxy resins. As BPA produc-

Markets for monoethylene glycol The situation is only slightly better fl ows across regions are also expected Acetone markets also show a simi- tionrises, it will further aggravate the

(MEG) – a key feedstock for the poly- for high-purity (HP) ethylene oxide (EO), to remain more or less unchanged – lar trend, with the overall global excess acetone oversupply at integrated pro-

ester value chain – have faced chal- Gycol Others and HP-EO capacity additions continued though the quantum traded into each capacity rising to 28% by 2028. Im- ducers by about 0.2-kt per tonne of BPA.

16%

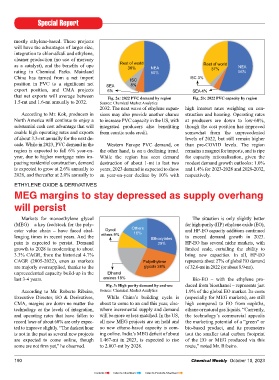

lenging times in recent years. And the ethers 9% Ethoxylates to exceed demand growth in 2023. FULL CIRCLE?

pain is expected to persist. Demand 29% HP-EO has several niche markets, with

growth to 2028 is moderating to about limited scale, curtailing the ability to Methanol market once again being driven by chemicals

3.3% CAGR, from the historical 4.7% bring new capacities. In all, HP-EO

CAGR (2005-2022), even as markets Polyethylene represents about 27% of global EO demand About one in six tonnes of metha- effi ciency, the methanol market is once

are majorly oversupplied, thanks to the glycols 28% of 32.6-mt in 2022 (or about 8.9-mt). nol currently goes into making olefi ns again being driven by chemicals. CMA

unprecedented capacity build-up in the Ethanol (MTO) – all in China – and this share expects demand to grow at a CAGR of

last 3-4 years. amines 18% Bio-EO – with the ethylene pro- is unlikely to change up to 2033. But 3.1% – signifi cant for a large volume

Fig. 3: High purity demand by end-use duced from bioethanol – represents just MTO is a high cost route to olefi ns, commodity chemical. Use as bunker

According to Mr. Roberto Ribeiro, Source: Chemical Market Analytics 1.9% of the global EO market. Its costs and operating rates of MTO units have fuel is also seen as critical for methanol

Executive Director, EO & Derivatives, While China’s building cycle is (especially for MEG markets), are still ranged in the 70% range since 2020 demand growth, though its energy

CMA, margins are down no matter the about to come to an end this year, else- high compared to EO from naphtha, and likely to stay around these levels. density is half of that of bunker fuel.

technology or the levels of integration, where incremental supply and demand ethane or natural gas liquids. “Currently, While two plants with capacity to con-

and operating rates that have fallen to will be more or less matched. In the US, the technology’s commercial appealis sume 4-mtpa of methanol are expected Most new capacity for acetic acid –

record lows of about 60% are only expec- all new MEG projects are on hold and the marketing potential of a “green” or in Mainland China in 2028, the pace of which accounts for about 8% of global

ted to improve slightly. “The darkest hour no new ethane-based capacity is com- bio-based product, and its promoters capacity build-up is slowing. rect blending component into gasoline methanol demand of 92-mt in 2023 –

is not in the past as several new projects ing online. India’s MEG defi cit of about tout the smaller total carbon footprint or for making dimethyl ether, DME) in the 2021-2027 period will be in US

are expected to come online, though 1.467-mt in 2023, is expected to rise of the EO or MEG produced via this With methanol demand into MTO being impacted by electrifi cation of (by Celanese) or China, with produc-

some are not fi rm yet,” he observed. to 2.007-mt by 2028. route,” noted Mr. Ribeiro. moderating, and fuels demand (as di- the vehicle fl eet and improved fuel tion in the latter soaked up by its use in

190 Chemical Weekly October 10, 2023 Chemical Weekly October 10, 2023 191

Contents Index to Advertisers Index to Products Advertised