Page 188 - CW E-Magazine (10-10-2023)

P. 188

Special Report Special Report

which will need systemic solutions,” MEETING FUTURE ENERGY NEEDS

he observed. Packaging

Construction/infrastructure ‘World will continue to need investments in fossil fuels’

18% 35%

Among the commodity thermoplas-

tics, HDPE has the highest potential In the past ten years, out of the is no way we can take so much hydro- and Japan – as it is a cheaper feedstock

for incorporation of recycled resin, $2.4 trillion spend in energy globally, carbons out of the energy mix to than even locally produced naphtha.

followed by PP, due the fact that both as much as 74% went into fossil fuels, achieve the 1.5°C,” he noted. “More LPG is exported out of Houston

have higher percentage of rigid applica- Single use 3% and only 26% in non-fossil energy. While- than from Saudi Arabia,” he quipped.

tions, compared to LDPE and LLDPE Consumer goods future scenarios call for a greater real- ‘World has never transitioned from

that have higher exposure to fl exibles. 23% location to green energy, a material any fuel’ ‘Decarbonisation and sustainability

Other 3% portion of investments will still be Mr. Jim Teague, CEO, Enterprise has to be profi table’

Mr. Benny Mermans, Vice Presi- Transportation needed in fossil fuels. Products Partners LP, noted that the Ms. Emma Lewis, Senior Vice Presi-

dent Sustainability, Chevron Phillips Medical/Personal 10% world has never transitioned from any dent, USGC Chemicals, Shell, noted

Chemical, highlighted the need to care 8% “There is a massive need for ‘new fuel – be it wood, oil, or gas. “The qua- that while the chemicals business is in

decouple plastic waste growth from oil’ all in all scenarios, else production lity of life is related to energy use. Three an ugly downcycle, the refi ning side

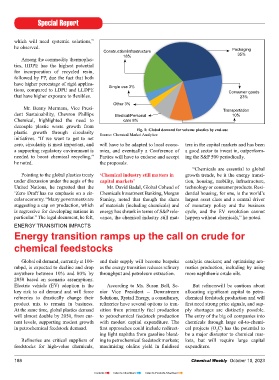

Fig. 1: Global demand for volume plastics by end-use

plastic growth through circularity Source: Chemical Market Analytics of existing assets will drop signifi cant- billion people in the world still have looks strong. “Decarbonisation and sus-

initiatives. “If we want to get to net ly,” Mr. Nick Livingstone, Managing limited access to energy. It has to be tainability has to be profi table. Different

zero, circularity is most important, and will have to be adapted to local econo- ters in the capital markets and has been Partner, Rystad Energy, warned. While energy addition – we need it all.” Not- regions are moving at a different pace.

a supporting regulatory environment is mies, and eventually a Conference of a good sector to invest in, outperform- in a 2.5°C global warming scenario, the ing that Enterprise will not build a busi- FMCG companies are less enthusiastic

needed to boost chemical recycling,” Parties will have to endorse and accept ing the S&P 500 periodically. energy mix does not change radically, ness based on government subsidies, he when posed with higher costs for green

he noted. the proposals. at 2°C, a signifi cant contribution has added that there is a huge appetite for products. The challenge is to make

“Chemicals are essential to global be taken by non-fossil energy sources US ethane in global markets, notably in capital decisions given the market and

Pointing to the global plastics treaty ‘Chemical industry still matters in growth trends, be it the energy transi- (wind and solar, in the main). “There South America, Europe, India, China, policy uncertainties,” she noted.

under discussion under the aegis of the capital markets’ tion, housing, mobility, infrastructure,

United Nations, he regretted that the Mr. David Badal, Global Cohead of technology or consumer products. Resi- VINYLS OUTLOOK

‘Zero Draft’has no emphasis on a cir- Chemicals Investment Banking, Morgan dential housing, for one, is the world’s

cular economy. “Many governments are Stanley, noted that though the share largest asset class and a central driver PVC demand growth to shift to India and South East

suggesting a cap on production, which of materials (including chemicals) and of monetary policy and the business

is regressive for developing nations in energy has shrunk in terms of S&P rele- cycle, and the EV revolution cannot Asia

particular.” The legal document, he felt, vance, the chemical industry still mat- happen without chemicals,” he noted.

ENERGY TRANSITION IMPACTS The global polyvinyl chloride Table 1: Mainland China PVC demand growth vs GDP growth

(PVC) market has for long been driven 2000-2009 2010-2019 2020-2032

Energy transition ramps up the call on crude for by the supply-demand dynamics in the PVC demand, annual average (%) 11.5 6.6 2.6

North East Asia (NEA), principally in GDP growth, annual average (%) 10.3 7.7 4.4

chemical feedstocks China, but that will change over the Elasticity (PVC demand/GDP) 1.1 0.9 0.6

next few decades, with the emergence Source: Chemical Market Analytics

Global oil demand, currently at 100- and their supply will become bespoke catalytic crackers; and optimising aro- of new demand growth centres includ-

mbpd, is expected to decline and drop as the energy transition reduces refi nery matics production, including by using ing the Indian subcontinent (ISC) and PVC projects expected to come up the new capacity additions likely from

anywhere between 10% and 80% by throughput and petroleum extraction. more naphthenic crude oils. the countries of South East Asia (SEA). in India include Reliance’s 1.5-mtpa 2026 onwards. While socioeconomic

2050 based on scenario assumptions. expansion in 2025-26; Chemplast’s and demographic changes in Main-

Electric vehicle (EV) adoption is the According to Ms. Susan Bell, Se- But refi nerswill be cautious about According to Mr. Eddie Kok, Exe- potential plan for VCM-PVC expan- land China over the next decade will

key risk to oil demand and will force nior Vice President – Downstream allocating signifi cant capital to petro- cutive Director, Global Vinyls, CMA, sion; Adani’s potential carbide-based decelerate the growthrate, CMA does

refi neries to drastically change their Solutions, Rystad Energy, a consultancy, chemical feedstock production and will while the population of mainland China PVC project; as well as a potential not expect any demand contraction

product mix to remain in business. refi neries have several options to tran- fi rst need strong price signals, and sup- is expected to shrink by about 15-mn project from Indian Oil Corporation for PVC, and the excess supply in

At the same time, global plastics demand sition from primarily fuel production ply shortages are distinctly possible. over the next 10 years, that in ISC and around the end of this decade. the country may persist over the next

will almost double by 2050, from cur- to petrochemical feedstock production The entry of the big oil companies into SEA will continue to expand, requiring 2-3 years.

rent levels, supporting modest growth with modest capital expenditure. The chemicals through large oil-to-chemi- greater infrastructure and housing – all Demand growth in ISC is expected

in petrochemical feedstock demand. fi rst approaches could include redirect- cal projects (O C) has the potential to supporting PVC demand. “The Indian to average about 6.8% annually, while Unlike in the past when most new

2

ing light naphtha from gasoline blend- be a major disruptor to chemical mar- subcontinent has the largest demand that in SEA is expected to be about 5%. PVC projects in China were coal-

Refi neries are critical suppliers of ing to petrochemical feedstock markets; kets, but will require large capital growth potential, albeit from a low By 2032.the ISC is expected to need based, using acetylene as feedstock,

feedstocks for high-value chemicals, maximising olefi ns yield in fl uidised expenditure. base,” he noted. about 2.55-mt in net imports, despite the post-COVID era expansions are

188 Chemical Weekly October 10, 2023 Chemical Weekly October 10, 2023 189

Contents Index to Advertisers Index to Products Advertised