Page 190 - CW E-Magazine (12-11-2024)

P. 190

Special Report Special Report

MARKET OUTLOOK

Edible oil import duty hike to increase domestic (USD/CIF Indian Port/ton) Crude palm Crude soyabean Crude sunfl ower

2,400

prices but import volumes to sustain 2,000

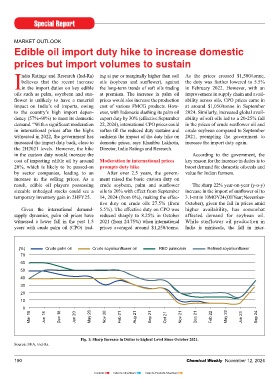

ndia Ratings and Research (Ind-Ra) ing at par or marginally higher than soft As the prices crossed $1,500/tonne, 1,600

believes that the recent increase oils (soybean and sunfl ower), against the duty was further lowered to 5.5%

Iin the import duties on key edible the long-term trends of soft oils trading in February 2022. However, with an 1,200

oils such as palm, soyabean and sun- at premium. The increase in palm oil improvement in supply chain and avail-

fl ower is unlikely to have a material prices would also increase the production ability across oils, CPO prices came in 800

impact on India’s oil imports, owing cost of various FMCG products. How- at around $1,050/tonne in September

to the country’s high import depen- ever, with Indonesia slashing its palm oil 2024. Similarly, increased global avail- 400

dency (57%-60%) to meet its domestic export duty by 30% (effective September ability of soft oils led to a 20-25% fall Jul 19 Sep 19 Nov 19 Jan 20 Mar 20 May 20 Jul 20 Sep 20 Nov 20 Jan 21 Mar 21 May 21 Jul 21 Sep 21 Nov 21 Jan 22 Mar 22 May 22 Jul 22 Sep 22 Nov 22 Jan 23 Mar 23 May 23 Jul 23 Sep 23 Nov 23 Jan 24 Mar 24 May 24 Jul 24 Sep 24

demand. “With a signifi cant moderation 22, 2024), international CPO prices could in the prices of crude sunfl ower oil and

in international prices after the highs soften till the reduced duty sustains and crude soybean compared to September

witnessed in 2022, the government has cushions the impact of the duty hike on 2021, prompting the government to Source: SEA, Ind-Ra. Fig. 2: Average Prices Over Past Five Years.

increased the import duty back, close to domestic prices, says Khushbu Lakhotia, increase the import duty again.

the 2H2021 levels. However, the hike Director, India Ratings and Research. (%) Self Suffi ciency Share of imports

in the custom duty would increase the According to the government, the

cost of importing edible oil by around Moderation in international prices key reason for the increase in duties is to 100

20%, which is likely to be passed-on prompts duty hike boost demand for domestic oilseeds and

by sector companies, leading to an After over 2.5 years, the govern- value for Indian farmers. 80 57 54 52 56 55 55 57

increase in the selling prices. As a ment raised the basic custom duty on 60 63 60 58 60

result, edible oil players possessing crude soybean, palm and sunfl ower The sharp 22% year-on-year (y-o-y) 60

sizeable unhedged stocks could see a oils to 20% with effect from September increase in the import of sunfl ower oil to

temporary inventory gain in 2HFY25. 14, 2024 (from 0%), making the effec- 3.1-mt in 10MOY24 (Oil Year; November- 40

tive duty on crude oils 27.5% (from October), given the fall in prices amid 43 47 48 44 45 45

Given the international demand- 5.5%). The effective duty on CPO was higher availability, has somewhat 20 40 37 40 42 40 43

supply dynamics, palm oil prices have reduced sharply to 8.25% in October affected demand for soybean oil.

witnessed a lower fall in the past 1.5 2021 (from 24.75%) when international While sunflower oil production in 0

years with crude palm oil (CPO) trad- prices averaged around $1,250/tonne. India is miniscule, the fall in inter- OY12 OY13 OY14 OY15 OY16 OY17 OY18 OY19 OY20 OY21 OY22 OY23 OY24P

Fig. 3: India’s Import Dependency to Remain High.

Source: SEA, D OF & PD and Ind-Ra.

(%) Crude palm oil Crude soya/sunfl ower oil RBD palmolein Refi ned soya/sunfl ower national soft oil prices coupled with low Edible oil imports to remain high, mote palm oil cultivation in northeas-

70 duties affected the prices of domestic given limited domestic availability tern states to increase the production to

soyabean oil production which stood India fulfi lls 96-98% of its palm oil 1.1-mt by 2025-26 (2023-24: 0.3-mt).

60

at Rs. 46/kg before the duty hike, and sunfl ower oil requirements by way of However, the near-term domestic avail-

50 down 5%y-o-y and lower than the imports, whereas about 75% of soybean ability would remain insignifi cant com-

40 minimum support price (Rs. 48.9/kg). oil requirement is imported. Despite the pared to the demand of over 10mnt.

30 hike in import duties, Ind-Ra believes

With imports becoming costlier overall edible oil imports will remain Domestic edible oil prices to rise,

20

after the duty hike, Ind-Ra expects between 16.0-mt and 16.2 mt in OY24 increasing cost of FMCG products

10 domestic oilseed prices to increase (OY23: 16.5-mt). Owing to the coming The increase in import duty will

0 too. Furthermore, the Basic Customs festive season, palm oil demand is likely lead to a 20% increase in the price of

Mar 18 Jun 18 Dec 18 Jan 20 May 20 Nov 20 Feb 21 Aug 21 Sep 21 Oct 21 Nov 21 Dec 21 Feb 22 May 22 Jun 23 Sep 24 Duty on refi ned palm, sunfl ower and to sustain, and import will remain high at imported oils. Ind-Ra believes edible

oil traders and processors will pass it

soybean oils has been increased to between 9.0-mt and 9.3-mt in OY24.

32.5% (from 12.5%), making the on, given the thin margins on which

effective duty 35.75% (from 13.75%), The government of India under most of them operate, making the con-

Fig. 1: Sharp Increase in Duties to highest Level Since October 2021. keeping the duty deferential between the National Mission for Edible Oils – sumers bear the burden. As a result, edi-

Source: SEA, Ind-Ra. refi ned and crude oils at 8.25%. Oil Palm (NMEO-OP) aims to pro- ble oil prices are likely to witness an

190 Chemical Weekly November 12, 2024 Chemical Weekly November 12, 2024 191

Contents Index to Advertisers Index to Products Advertised