Page 139 - CW E-Magazine (12-11-2024)

P. 139

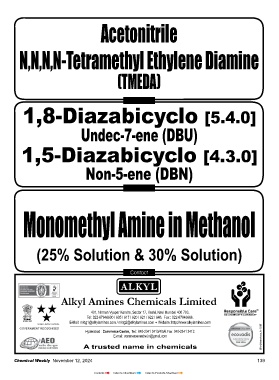

Acetonitrile

Top Stories

INDIAN PETROCHEM 2024 CONFERENCE

‘Industry rationalisation is the cure for petrochemical N,N,N,N-Tetramethyl Ethylene Diamine

pain; supply overhang to continue to put pressure

on demand growth’ (TMEDA)

The current downcycle is a unique

one for the petrochemical industry,

according to Mr. Sanjay Sharma, Vice

President & Global Head of Chemical DIETHYL HYDROXYLAMINE 85% & 98%

Consulting, S&P Global Commodity

Insights, UAE. DEHA 85% & 98%

“Some of the industry players added

capacity expecting a much higher

growth rate. Then we were impacted

on the demand-side due to COVID, and MONO, DI, TRI

then recovery of China has been

delayed. This downcycle is unique as it DIETHYL TOLUAMIDE

fi rst started with lower demand. So, this

cycle is impacted by demand as well as DEET

supply. The reaction from the industry

has got to be a bit different than what

has been in the previous cycles,” he

observed. Mr. Sanjay Sharma

Big oil companies are looking to He spoke about the signifi cant diffe-

The industry has been going through consolidate their petrochemical focus rence in urgency for decarbonisation

a cyclical downcycle for the last two because of the energy transition and between regions, with Europe leading

years, he said. “Majority of the naphtha crude oil-to-chemical strategy hinging and the chemical sector in Asia lagging

crackers are making losses, and they on the fact that majority of the growth in behind. “The upcoming CBAM regula-

have been making losses for quite some oil would come from chemicals. tions in Europe will impose penalties on

time. The outlook for 2025 doesn’t seem products with high carbon footprints,

to be very good. This pain will likely The size of these players is multiple necessitating decarbonisation efforts.

continue unless some diffi cult decisions times bigger than the typical chemical Plastic waste management and recycling

are taken on rationalisation of assets, players. For them investment in chemi- should also be a part of the plan for

especially in Europe” he noted. cals is an outlet for their crude oil and polymer players, with current recycling

not essentially to bump up their profi t- rates being very low,” he noted.

Mr. Sharma predicted that the struc- ability substantially.

ture of the chemical industry after 10 He also elaborated on the ‘China

years would be completely different “Non-integrated fi rms and smaller crisis’ where excessive capacity addi-

from now. “There will be consolidation players in the chemical sector need to tion and slower demand growth have

and more space for larger players with be prepared for some shocks as the big been impacting the industry’s recovery

the big pockets. There will be space for players are going to disrupt the market,” efforts.

smaller players with access to techno- said Mr. Sharma.

logy and capabilities to take their pro- Mr. Sharma identifi ed India as a

duct to the market, but larger player who Later, Mr. Sharma emphasised the bright spot post-pandemic, with a con- GOVERNMENT RECOGNISED

STAR EXPORT HOUSE

need technology and access to the mar- need for the industry to think about effec- sensus of 6+% growth, but noted the

ket, will be ready to grab those smaller tive carbon management to stay competi- lack of capacity addition in the last two

players,” he said. tive and meet regulatory requirements. decades. “India’s potential remains

138 Chemical Weekly November 12, 2024 Chemical Weekly November 12, 2024 139

Contents Index to Advertisers Index to Products Advertised