Page 143 - CW E-Magazine (12-11-2024)

P. 143

Top Stories Manufacturer of

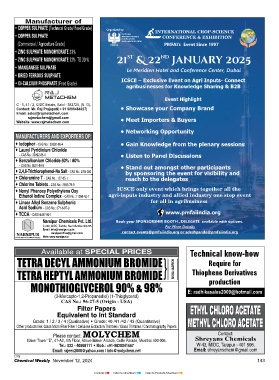

• COPPER SULPHATE (Technical Grade/ Feed Grade) Organized by INTERNATIONAL CROP-SCIENCE

• COPPER SULPHATE TM PESTICIDES CONFERENCE & EXHIBITION

MANUFACTURERS &

INDIAN PETROCHEM 2024 CONFERENCE FORMULATORS

ASSOCIATION OF INDIA

(Commercial / Agriculture Grade) PMFAI

Benzene and toluene markets in India set to grow • ZINC SULPHATE MONOHYDRATE 33%

• ZINC SULPHATE MONOHYDRATE 22% TO 30 %

The prospects and challenges in • MANGANESE SULPHATE

the benzene and toluene markets were Le Meridien Hotel and Conference Center, Dubai

discussed by Mr. Bhautik Mehta, Vice • DRIED FERROUS SULPHATE ICSCE – Exclusive Event on Agri Inputs- Connect

President – Energy, Partnerships & • DI-CALCIUM PHOSPHATE (Feed Grade) agribusinesses for Knowledge Sharing & B2B

Outsourcing, Aarti Industries.

Event Highlight

The global benzene production C - 1, 41 / 2, GIDC Estate, Kalol - 382725, (N. G).

was estimated at 53-mt with 2023 Contact: Mr. Raj Prajapati( + 91 9898464927) • Showcase your Company Brand

capacity utilisation at 67%. Benzene Email: sales@rajmetachem.com

rajmetachem@gmail.com

demand is expected to grow at 2.2% Website: www.rajmetachem.com • Meet Importers & Buyers

perannum in next ten years, driven

by cumene (due to increasing phenol • Networking Opportunity

and acetone demand), cyclohexane Global toluene end use markets Indian toluene end use markets ManufactuReRs and exPoRteRs of:

(due to rising demand for nylon), t Iodophor – CAS No.: 39392-86-4 • Gain Knowledge from the plenary sessions

ethylbenzene and nitrobenzene However, the Indian benzene demand expected to grow at around t Lauryl Pyridinium Chloride

(due growing demand from aniline demand is expected to grow at an 8.4% 5% perannum in next ten years. – CAS No.: 39392-86-4 • Listen to Panel Discussions

derivatives). CAGR in the 2024-2033 period. “The t Benzalkonium Chloride 50% / 80%

– CAS No. 8001-54-5

industries that use benzene deriva- The demand will be boosted by use t 2,4,6-Trichlorophenol-Na Salt – CAS No.: 3784-030 • Stand out amongst other participants

While globally half of benzene tives – cumene/phenol, aniline and of toluene diisocyanate (TDI) in light- by sponsoring the event for visibility and

is used for ethylbenzene, leading to styrene – are expected to experience weight materials applications, as well t Chloramine T – CAS No.: 127-65-1 reach to the delegates

styrene and polystyrene production, signifi cant growth, with projected as use of toluene derivatives in agro/ t Chlorine Tablets – CAS No.: 2893-78-9 ICSCE only event which brings together all the

India has minimal ethylbenzene output annual growth rates ranging from 5% pharma, solvent, dyes, electronics, and t Nonyl Phenoxy Polyethylene Oxy agri-inputs industry and allied industry one stop event

Ethanol Iodine Complex – CAS No.: 11096-42-7

due to no styrene capacity, informed to 15%. This growth highlights the construction materials. t Linear Alkyl Benzene Sulphonic for all in agribusiness

Mr. Mehta. opportunities for important benzene Acid Sodium – CAS No.: 271-6-87-0

derivatives,” said Mr. Mehta. Benzene India, which is a net importer

India’s benzene capacity in 2023 exports from India are expected to or toluene, has a small but steadily t TCCA – CAS No:87-90-1

was pegged at 2.8-mt, while demand touch 5-mt by 2050. increasing derivatives market. Increas- Narsipur Chemicals Pvt. Ltd. Book your SPONSORSHIP, BOOTH , DELEGATE available with options.

C-238, MIDC, Turbhe, Navi Mumbai 400705.

For More Details

lagged at 700-kt leading to the coun- ing opportunities in the booming fur- Email: info@narsipur.co.in contact events@pmfaiindia.org or adeshpande@pmfaiindia.org

try being a net benzene exporter. Most Toluene market niture and automotive markets is (An ISO 9001:2015 Certified Company) narsipuroffice@gmail.com

Web: www.narsipur.in

benzene derivatives are produced in Speaking about the toluene market, fuelling polyurethane demand and

the region, except for ethylbenzene/ Mr. Mehta estimated global toluene thus driving TDI use. Available from Ready Stock with MODVAT Benefitvailable from Ready Stock with MODVAT Benefitvailable from Ready Stock with MODVAT Benefitvailable from Ready Stock with MODVAT Benefitvailable from Ready Stock with MODVAT Benefit

A A A A

styrene. production in 2023 at 31-mt with Available at SPECIAL PRICES Technical know-how

The rising demand for high TETRA DECYL AMMONIUM BROMIDE

RON (Research Octane Number) is Require for

also driving toluene’s role in petrol TETRA HEPTYL AMMONIUM BROMIDE SIGMA -ALDRICH Thiophene Derivatives

blending. In pharma, agro and other production

speciality applications, demand is MONOTHIOGLYCEROL 90% & 98%

primarily driven by chlorotoluenes E: radhikasales2009@hotmail.com

and its downstream, benzoic acids, (3-Mercapto-1,2-Propanediol) (1-Thioglycerol)

plasticisers, preservatives, dyes & CAS No.: 96-27-5 (Origin - USA)

pigments and the likes. Filter Papers ETHYL CHLORO ACETATE

Equivalent to Int Standard

“The toluene demand in 2023 at Other products like: Glass Micro Fiber Filter / Cellulose Extraction Thimbles / Glass Thimbles / Chromatography Papers METHYL CHLORO ACETATE

Grade: 1 / 2 / 3 / 4 (Qualitative) w Grade: 40 /41 /42 / 43 (Quantitative)

about 0.7-0.8 mt can steadily increase

to 1.1-1.2 mt as the industrial sectors Please contact: MOLYCHEM Contact:

continue to demand and diversify,” Maker Tower “E”, 41-A2, 4th Floor, Above Maker Arcade, Cuffe Parade, Mumbai 400 005. Shreyans Chemicals

Global benzene end use market Indian benzene end use markets said Mr. Mehta. tel.: 022 - 40668111 w Mob.: +91-9820041557 W-43, MIDC, Tarapur - 401 506.

email: rajeev2808@yahoo.com / info@molychem.net email: shreyanschem@gmail.com

17/16

142 Chemical Weekly November 12, 2024 Chemical Weekly November 12, 2024 143

Contents Index to Advertisers Index to Products Advertised