Page 188 - CW E-Magazine (25-6-2024)

P. 188

Special Report Special Report

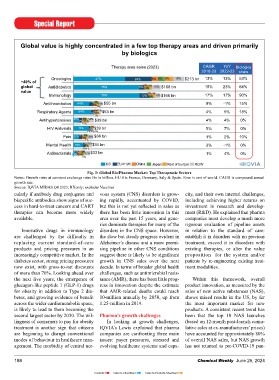

Global value is highly concentrated in a few top therapy areas and driven primarily

by biologics 25% launches continue to drive ~80% sales, but still not exceeded

Pre-COVID levels

Therapy area sales (2023) CAGR YoY Biologics

2018-23 2022-23 share

Oncologics 47% 24% 6% 6% 8% 10% $213 bn 13% 13% 53%

~40% of

global Antidiabetics 75% 6% 3% 3% 10% $168 bn 15% 23% 64%

2%

value 1% 4% 5.2

Immunology 76% 12% 2% 5% $166 bn 17% 17% 90% 16% 4.6

Antithrombotics 64% 17% 4% 10% $55 bn 9% -1% 15% 4.3 -56% -57% -41%

6%

9% 23%

4% 11%

Respiratory Agents 64% 13% 5% $53 bn 4% 5% 18% 26%

3%

6% 32%

Antihypertensives 25% 17% 11% $39 bn 4% 4% 0% 2.7

10%

3%

HIV Antivirals 76% 13% $39 bn 5% 7% 0% 84% 2.0 2.0 21%

1%1%6% 77% 20%

Pain 27% 17% 5% 29% $38 bn 1% 2% 10% 74% 35%

15%

7% 79%

20%

Mental Health 54% 13% 6% $34 bn 3% -1% 0% 80% 65%

4%4%

13%

Antibacterials 13% 29% 3% 37%$32 bn 1% 4% 0%

5%

US EU4+UK China Japan Rest of Europe ROW

Fig. 3: Global Bio/Pharma Market: Top Therapeutic Sectors

Notes: Growth rates at constant exchange rates Bn in billion. EU 4 is France, Germany, Italy & Spain. Row is rest of world. CAGR is compound annual

growth rate.

Fig. 4: Trend Analysis: New Activa Substances (NAS)

Source: IQVIA MIDAS Q4 2023; RXonly; excludes Vaccines *Top 10 NAS launches ranked by 12 months post-launch cumlative sales

cularly if antibody drug conjugates and vous system (CNS) disorders is grow- city, and their own internal challenges, Source: IQVIA MIDAS Q4 2023, Rx only

bispecifi c antibodies show signs of suc- ing rapidly, accentuated by COVID, including achieving higher returns on

cess in hard-to-treat cancers and CART but this is not yet refl ected in sales as investment in research and develop-

therapies can become more widely there has been little innovation in this ment (R&D). He explained that pharma

available. area over the past 15 years, and gene- companies must develop a much more

rics dominate therapies for many of the rigorous evaluation of pipeline assets

Innovative drugs in immunology disorders in the CNS space. However, in relation to the standard of care:

are challenged by the diffi culty in the slow but steady progress evident in establish it in disorders with no previous

replacing current standard-of-care Alzheimer’s disease and a more promi- treatment, exceed it in disorders with 289 307 100

products and pricing pressures in an sing pipeline in other CNS conditions existing therapies, or alter the value 262 266 281 26% 29%

increasingly competitive market. In the suggest there is likely to be signifi cant proposition for the system and/or 247 23% 23% 24% 25%

diabetes sector, strong pricing pressures growth in CNS sales over the next patients by re-engineering existing treat- 22% 8% 8% 9% 9% 10%

4%

7%

now exist, with gross-to-net discounts decade. In terms of broader global health ment modalities. 7% 19% 18% 18% 17% 16% 12%

of more than 70%. Looking ahead over challenges, such as antimicrobial resis- 17%

the next fi ve years, the emergence of tance (AMR), there has been little prog- Within this framework, overall 20% 20% 20% 20% 21% 22% 17%

glucagon-like peptide 1 (GLP-1) drugs ress in innovation despite the estimate product innovation, as measured by the

for obesity in addition to Type 2 dia- that AMR-related deaths could reach sales of new active substances (NAS), 33% 31% 31% 30% 28% 27% 28%

betes, and growing evidence of benefi t 10-million annually by 2050, up from shows mixed results in the US, by far

across the wider cardiometabolic space, 1.25-million in 2019. the most important market for new

is likely to lead to them becoming the products. A consistent recent trend has

second largest sector by 2030. The wil- Pharma’s growth challenges been that the top 10 NAS launches

lingness of consumers to pay for obesity In looking at growth challenges, (based on 12-month post-launch cumu-

treatment is another sign that citizens IQVIA’s Lewis explained that pharma lative sales at ex-manufacturers’ prices) Fig. 5: Small-Molecule Generics Market

are beginning to disrupt conventional companies are confronting three main have accounted for approximately 80% Notes: Generics include unbanded and branded generics, Rx only, biosimilars are excluded;

Argentina and Turkey excluded due to Fx fl uctuations Bn is billion. LATAM in Latin America. Row is rest of world. EU4 in France, Germany, Italy & Spain.

modes of behaviour in healthcare man- issues: payer pressures, stressed and of overall NAS sales, but NAS growth CAGR is compound annual growth rate.

agement. The morbidity of central ner- evolving healthcare systems and capa- has not returned to pre-COVID-19 pan- Source: IQVIA MIDAS Q4 2023

188 Chemical Weekly June 25, 2024 Chemical Weekly June 25, 2024 189

Contents Index to Advertisers Index to Products Advertised