Page 179 - CW E-Magazine (1-7-2025)

P. 179

Special Report Special Report

second sources is expensive, so the sup-

ply chain risks of an uneven customer-

supplier relationship may be greater. But

as bio/pharma companies increasingly

rely on materials suppliers for more

sophisticated ingredients and delivery

device components, often on a sole-

source basis, they are likely to want to

make sure that they stand in good stead

with their materials suppliers.

The most interesting fi nding was

how little effort many bio/pharma com-

panies make to assess their own perfor-

mance as customers. Being respectful

of the supplier and reducing friction in

customer-supplier interactions is not

Fig. 3: Customer expectations that are diffi cult for materials suppliers only central to being a ‘Customer of

Fig. 1: CDMOs and Materials Suppliers – Most important factors defi ning a ‘Customer of Choice’ Source: DCAT Report Choice’, but also just good business,

Source: DCAT Report

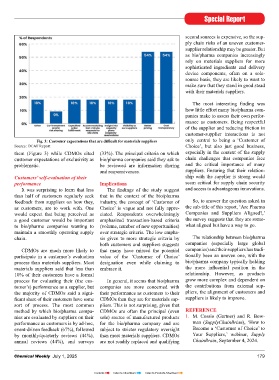

them (Figure 3) while CDMOs cited (33%). The principal criteria on which especially in the context of the supply

customer expectations of exclusivity as bio/pharma companies said they ask to chain challenges that companies face

problematic. be reviewed are information sharing and the critical importance of many

and responsiveness. suppliers. Ensuring that their relation-

Customers’ self-evaluation of their ship with the supplier is strong would

performance Implications seem critical for supply chain security

It was surprising to learn that less The fi ndings of the study suggest and access to advantageous innovations.

than half of customers regularly seek that in the context of the bio/pharma

feedback from suppliers on how they, industry, the concept of ‘Customer of So, to answer the question asked in

as customers, are to work with. One Choice’ is vague and not fully appre- the sub-title of this report, ‘Are Pharma

would expect that being perceived as ciated. Respondents overwhelmingly Companies and Suppliers Aligned?,’

a good customer would be important emphasized transaction-based criteria the survey suggests that they are some-

to bio/pharma companies wanting to (volume, number of new opportunities) what aligned but have a way to go.

maintain a smoothly operating supply over strategic criteria. The low empha-

chain. sis given to more strategic criteria by The relationship between bio/pharma

both customers and suppliers suggests companies (especially large global

CDMOs are much more likely to that many have missed the potential companies) and their suppliers has tradi-

participate in a customer’s evaluation value of the ‘Customer of Choice’ tionally been an uneven one, with the

process than materials suppliers. Most designation even while claiming to bio/pharma company typically holding

Fig. 2: Bio/Pharma companies, CDMOs & Material Suppliers: What benefi ts do customers expect? What are suppliers offering? materials suppliers said that less than embrace it. the more infl uential position in the

Source: DCAT Report 10% of their customers have a formal relationship. However, as products

have a more transactional perspective capacity plans, risk sharing and co-invest- Choice’, including the ones suppliers process for evaluating their (the cus- In general, it seems that bio/pharma grow more complex and dependent on

than CDMOs. ment, and more interaction with senior are quite willing to offer and a few that tomer’s) performance as a supplier, but companies are more concerned with the contributions from external sup-

leadership. Fewer than 50% of sup- they are not. In particular, both mate- the majority of CDMOs said a signi- their performance as customers to their pliers, the alignment of customers and

Benefi ts of being a ‘Customer of pliers named ‘better pricing’ as a benefi t rials suppliers and CDMOs are very fi cant share of their customers have some CDMOs than they are for materials sup- suppliers is likely to improve.

Choice’ of being a ‘Customer of Choice’, but reluctant to accede to bio/pharma com- sort of process. The most common pliers. This is not surprising, given that

Suppliers generally are willing to more materials suppliers than CDMOs panies’ expectations of access to their method by which bio/pharma compa- CDMOs are often the principal (even REFERENCE

offer a broad array of benefi ts to their appear to offer that (Figure 2). operating cost data. They are somewhat nies are evaluated by suppliers on their sole) source of manufactured products 1. M. Cossio (Gartner) and R. Bow-

‘Customers of Choice’. Most of those more willing to provide visibility to performance as customers is by ad-hoc, for the bio/pharma company and are man (SupplyChainBrian), ‘How to

benefi ts refl ect the opportunity to build As customers, bio/pharma com- their supply chains. Materials supp- event-driven feedback (67%), followed subject to stricter regulatory oversight Become a ‘Customer of Choice’ to

closer collaboration between supplier panies expect a full array of benefi ts liers said that customer expectations of by monthly/quarterly reviews (44%), than most materials suppliers. CDMOs Your Suppliers,’ webinar, Supply

and customer, including insight into from being designated a ‘Customer of better pricing are especially diffi cult for annual reviews (44%), and surveys are not readily replaced and qualifying ChainBrain, September 4, 2024.

178 Chemical Weekly July 1, 2025 Chemical Weekly July 1, 2025 179

Contents Index to Advertisers Index to Products Advertised