Page 191 - CW E-Magazine (23-7-2024)

P. 191

Special Report Special Report

FY25 profi tability to remain weak

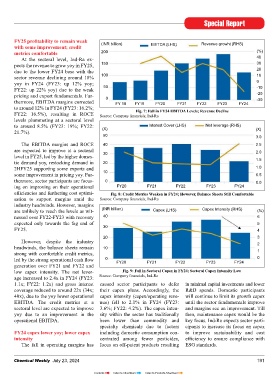

Others Herbicides Fungicide Insecticide Others Herbicides Fungicide Insecticide (INR billion) EBITDA (LHS) Revenue growht (RHS)

(USD million) tonnes with some improvement; credit

6,000 8,00,000 metrics comfortable 200 (%)

At the sectoral level, Ind-Ra ex- 40

5,000 pects the revenue to grow yoy in FY25, 150 30

6,00,000 20

4,000 due to the lower FY24 base with the 100 10

sector revenue declining around 18%

3,000 4,00,000 yoy in FY24 (FY23: up 12% yoy; 50 0

FY22: up 22% yoy) due to the weak -10

2,000 pricing and export fundamentals. Fur- -20

2,00,000 0 -30

1,000 thermore, EBITDA margins corrected FY 18 FY19 FY20 FY21 FY22 FY23 FY24

to around 12% in FY24 (FY23: 16.2%;

Fig. 7: Fall in FY24 EBITDA Levels; Revenue Decline

0 0 FY22: 16.5%), resulting in ROCE Source: Company fi nancials, Ind-Ra

FY19 FY20 FY21 FY22 FY23 FY24 FY19 FY20 FY21 FY22 FY23 FY24 levels plummeting at a sectoral level

to around 8.5% (FY23: 19%; FY22: Interest Cover (LHS) Net leverage (RHS)

Fig. 4: Fall in Export Prices Impact value of India’s Ag-chem Exports Fig. 5: Weak Export Deamand; India’s Agro-chem Exports Remain (X) (X)

Source: CMIE, Ind-Ra Stagnant in FY24 21.7%). 50

Source: CMIE, Ind-Ra 3.0

The EBITDA margins and ROCE 40 2.5

Spain Belgium Germany France India USA China are expected to improve at a sectoral 2.0

level in FY25, led by the higher domes- 30

2023 tic demand yoy, restocking demand in 20 1.5

2HFY25 supporting some exports and 1.0

2022 10

some improvement in pricing yoy. Fur- 0.5

thermore, sector participants are focus- 0

2021 0.0

ing on improving on their operational FY20 FY21 FY22 FY23 FY24

effi ciencies and furthering cost optimi- Fig. 8: Credit Metrics Weaken in FY24; However, Balance Sheets Still Comfortable

2020

sation to support margins amid the Source: Company fi nancials, Ind-Ra

2019 industry headwinds. However, margins (INR billion) Capex Intensity (RHS)

are unlikely to reach the levels as wit- Capex (LHS) (%)

0 5 10 15 20 25 nessed over FY22-FY23 with recovery 40 6

(%) expected only towards the fag end of 5

Fig. 6: Top 7 countries = 2/3 of Agro-chem Export Market; India Loses Share in 2023 FY25. 30 4

Source: UN Comtrade Database, Ind-Ra 20 3

export shares wherein EBITDA levels of $4.5-bn going off patent over export volumes being largely stagnant at However, despite the industry 2

signifi cantly moderate. Domestic play- 2024-2028, there lies a huge opportu- below 2% volume growth (around 9%). headwinds, the balance sheets remain 10 1

ers will look to diversify their sales mix nity for domestic players. This indicates the fall in the value of strong with comfortable credit metrics,

geographically while also increasing its exports is largely attributable to the fall led by the strong operational cash fl ow 0 FY20 FY21 FY22 FY23 FY24 0

herbicide exports as the domestic agro- 40% fall in absolute EBITDA in FY24; in export prices and minimal export vol- generation over FY21 and FY22 and

Fig. 9: Fall in Sectoral Capex in FY24; Sectoral Capex Intensity Low

chem consumption gradually mirrors some improvement in FY25 umes amid the larger channel inventory low capex intensity. The net lever- Source: Company fi nancials, Ind-Ra

global consumption. The sectoral revenue fell 18%-20% and increased Chinese dumping. While age increased to 2.4x in FY24 (FY23:

yoy in FY24, after recording aver- the revenue across each quarter in FY24 1.1x; FY22: 1.2x) and gross interest caused sector participants to defer in minimal capital investments and lower

Geopolitical events are also monito- age revenue growth of 15%-20% over was lower yoy, there was some qoq coverage reduced to around 22x (34x; their capex plans. Accordingly, the R&D spends. Domestic participants

rables that could further impact export FY19-FY23, largely led by limited recovery in 4Q with revenues and margins 40x), due to the yoy lower operational capex intensity (capex/operating reve- will continue to limit its growth capex

fundamentals like over FY23-FY24. export volumes and lower export prices. improving after nose diving in 3Q. EBITDA. The credit metrics at a nue) fell to 2.1% in FY24 (FY23: until the sector fundamentals improve

However, Ind-Ra expects India to re- This caused the absolute EBITDA to sectoral level are expected to improve 3.6%; FY22: 4.2%). The capex inten- and margins see an improvement. Till

main a net exporter, despite the head- reduce around 40% yoy during the While FY25 is likely to be another yoy due to an improvement in the sity within the sector has traditionally then, maintenance capex would be the

winds. Domestic producers will look year. weak year for the agrochemicals sector, operational EBITDA. been lower than commodity and key focus. Ind-Ra expects sector parti-

for custom-synthesis manufacturing the EBITDA is expected to improve specialty chemicals due to factors cipants to increase its focus on capex

opportunities that would provide more India’s total export value in FY24 yoy with a modest recovery in 2H, as FY24 capex lower yoy; lower capex including domestic consumption con- to improve sustainability and cost

operational stability. Furthermore, with fell 20%-22% yoy (after average growth channel inventories gradually reduce intensity centrated among fewer pesticides, effi ciency to ensure compliance with

16 molecules with an estimated market of around 15% over FY20-FY23) with resulting in restocking demand. The fall in operating margins has focus on off-patent products resulting ESG standards.

190 Chemical Weekly July 23, 2024 Chemical Weekly July 23, 2024 191

Contents Index to Advertisers Index to Products Advertised