Page 189 - CW E-Magazine (23-7-2024)

P. 189

Special Report Special Report

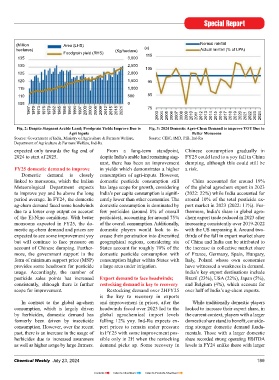

Agrochemicals sector to remain under pressure (Million Area (LHS) Normal rainfall

hectares) Foodgrain yield (RHS) (Kg/hectare) (x) Actual rainfall (% of LPA)

in FY25; some improvement gradually over 2H 135 3,000 115

130 2,500

ndia Ratings and Research (Ind-Ra) impacted FY24 monsoons. However, buters to defer procurements, resulting 125 2,000 105

expects the FY25 agrochemical the risk of Chinese dumping is likely in limited refurbishments of channel

Imargins to remain under pressure, to still linger in FY25, albeit at a little inventory. 120 1,500 95

but show some improvement yoy. lower intensity as the country’s domes- 115 1,000

tic demand gradually improves,” says Accordingly, large portions of in- 110 500 85

“FY25 is likely to be another weak Siddharth Rego, Associate Director, ventory had built up at global agro-

year for the agrochemicals sector with Corporate Ratings, Ind-Ra. chemical majors over 2023, resulting in 105 0 75

only a modest recovery likely in 2H, prices falling over the year, further caus- 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 2012 2015 2018 2021

as channel inventories gradually re- Inventory levels of global ag-chem ing customers to delay procurement in 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

duce resulting in restocking demand. players still elevated the hope of price corrections. Thus, ef-

However, the bottom-of-the-cycle The global ag-chem industry has an fectively at end-2023, agrochem players Fig. 2: Despite Stagnant Arable Land; Foodgrain Yields Improve Due to Fig. 3: 2024 Domestic Agro-Chem Demand to improve YOY Due to

Agri Inputs

Better Monsoons

conditions had already been witnessed oligopolistic structure with four to fi ve held higher inventory volumes which Source: Government of India, Ministry of Agriculture & Farmers Welfare, Source: CEIC, IMD, PIB, Ind-Ra

in FY24, and FY25 is expected to be players accounting for 55%-60% of the were at a lower price than those at end- Department of Agriculture & Farmers Welfare, Ind-Ra

better yoy. Players having a higher ex- global market share. Accordingly, the 2022 when they would have held lower expected only towards the fag end of From a long-term standpoint, Chinese consumption gradually in

port share are likely to take longer to results of these players indicate a busi- inventory volumes at a higher price. 2024 to start of 2025. despite India’s arable land remaining stag- FY25 could lead to a yoy fall in China

recover on account of their large supply ness recovery and are a precursor for nant, there has been an improvement dumping, although this could still be

chain inventories, although restocking what to expect from domestic players. Ind-Ra expects the channel inven- FY25 domestic demand to improve in yields which demonstrates a higher a risk.

demand could lend some support over 2023 was a weak year for global ag- tory levels to gradually reduce over Domestic demand is closely consumption of agri-inputs. However,

2HFY25. While the gradual moderation chem players who recorded a revenue 2024, resulting in restocking demand linked to monsoons, which the Indian domestic pesticide consumption still China accounted for around 19%

in interest rates over 2024-2025 would decline for the fi rst time since 2015, and thus, some recovery in prices. This Meteorological Department expects has large scope for growth, considering of the global agrochem export in 2023

support restocking demand, the rates are when the below-normal monsoons, will also be contributed by a slight to improve yoy and be above the long India’s per capita consumption is signifi - (2022: 22%) while India accounted for

still expected to be elevated, resulting high channel inventory and pressure on softening of interest rates yoy in 2024- period average. In FY24, the domestic cantly lower than other economies. The around 10% of the total pesticide ex-

in new normalised, lower channel farmer incomes impacted sales volumes 2025, although they would remain ele- ag-chem demand faced some headwinds domestic consumption is dominated by port market in 2023 (2022: 11%). Fur-

inventory levels. Domestic demand in and compressed margin on account of vated. The recovery is expected to be due to a lower crop output on account few pesticides (around 8% of overall thermore, India’s share in global agro-

FY25 is expected to be better yoy led inventory losses. The higher interest prolonged considering the substantially of the El-Nino conditions. With better pesticides), accounting for around 75% chem export trade reduced in 2023 after

by better monsoons after the El-Nino rates over 2023 caused ag-chem distri- high inventory days with recovery monsoons expected in FY25, the do- of the overall consumption. Additionally, increasing consistently over 2019-2022

mestic ag-chem demand and prices are domestic players would look to in- with the US surpassing it. Around two-

Adama BASF Bayer Chemours expected to see some improvement yoy crease their penetration into diversifi ed thirds of the fall in export market share

but will continue to face pressure on geographical regions, considering six of China and India can be attributed to

FMC Honeywell Sumitomo Syngenta account of Chinese dumping. Further- States account for roughly 70% of the the increase in collective market share

(days) more, the government support in the domestic pesticide consumption with of France, Germany, Spain, Hungary,

form of minimum support price (MSP) consumption higher within States with Italy, Poland whose own economies

275

provides some headroom for pesticide a large area under irrigation. have witnessed a weakness in demand.

225 usage. Accordingly, the number of India’s key export destinations include

pesticide sales points has increased Export demand to face headwinds; Brazil (23%), USA (22%), Japan (5%),

175 consistently, although there is further restocking demand is key to recovery and Belgium (4%), which account for

scope for improvement. Restocking demand over 2HFY25 over half of India’s ag-chem exports.

125 is the key to recovery in exports

In contrast to the global ag-chem and improvement in prices, after the While traditionally domestic players

75 consumption, which is largely driven headwinds faced over 2023 led to the looked to increase their export share, in

by herbicides, domestic demand has global agrochemical import levels the current context, players with a larger

25 formerly been driven by insecticide falling 12% yoy. Ind-Ra expects ex- domestic share stand to benefi t, conside-

consumption. However, over the recent port prices to remain under pressure ring stronger domestic demand funda-

2017 2018 2019 2020 2021 2022 2023

past, there is an increase in the usage of in FY25 with some improvement pos- mentals. Those with a larger domestic

Fig. 1: Elevated inventory Levels of Global Majors at end-2023 herbicides due to increased awareness sible only in 2H when the restocking share recorded strong operating EBITDA

Source: Company data, Ind-Ra; Inventory days = (Average Inventory/COGS)*365 as well as higher usage by large farmers. demand picks up. Some recovery in levels in FY24 unlike those with larger

188 Chemical Weekly July 23, 2024 Chemical Weekly July 23, 2024 189

Contents Index to Advertisers Index to Products Advertised