Page 133 - CW E-Magazine (21-1-2025)

P. 133

Point of View

Feedstock options for olefi ns production

The importance of the type of feedstock chosen for the

production of olefins – which underpin the manufacturing of

several chemicals and polymers – cannot be overstressed.

More than anything else – technology choice, scale or

location – it determines the competitiveness of production,

and is vital in today’s hyper-competitive business environ-

ment. At times, the choice is determined by the luck of

geography, as with access to cheap hydrocarbons – coal,

crude oil or natural gas. But companies can and do get

around feedstock limitations by innovative approaches,

which, increasingly, includes importing it from regions

where they are abundant and cheap.

India is deficit in crude oil and natural gas and has to

make this up through imports which have been rising year-

on-year to meet the energy needs of a growing economy

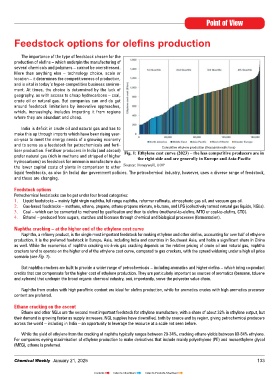

and to serve as a feedstock for petrochemicals and ferti- Cumulative ethylene production (thousand metric tons)

liser production. Fertiliser producers in India (and abroad) Fig. 1: Ethylene cost curve (2023) – the less competitive producers are in

prefer natural gas (rich in methane and stripped of higher the right side and are generally in Europe and Asia-Pacifi c

hydrocarbons) as feedstock for ammonia manufacture due

the lower capital costs of plants in comparison to other Source: Honeywell, UOP

liquid feedstocks, as also (in India) due government policies. The petrochemical industry, however, uses a diverse range of feedstock,

and these are changing.

Feedstock options

Petrochemical feedstocks can be put under four broad categories:

1. Liquid feedstocks – mainly light virgin naphtha, full range naphtha, reformer raffinate, atmospheric gas oil, and vacuum gas oil.

2. Gas-based feedstocks – methane, ethane, propane, ethane-propane mixture, n-butane, and LPG (collectively termed natural gas liquids, NGLs).

3. Coal – which can be converted to methanol by gasification and then to olefins (methanol-to-olefins, MTO or coal-to-olefins, CTO).

4. Ethanol – produced from sugars, starches and biomass through chemical and biological processes (fermentation).

Naphtha cracking – at the higher end of the ethylene cost curve

Naphtha, a refinery product, is the single most important feedstock for making ethylene and other olefins, accounting for over half of ethylene

production. It is the preferred feedstock in Europe, Asia, including India and countries in Southeast Asia, and holds a significant share in China

as well. While the economics of naphtha cracking vis-à-vis gas cracking depends on the relative pricing of crude oil and natural gas, naphtha

crackers tend to operate on the higher end of the ethylene cost curve, compared to gas crackers, with the spread widening under a high oil price

scenario (see Fig. 1).

But naphtha crackers are built to provide a wider range of petrochemicals – including aromatics and higher olefins – which bring co-product

credits that can compensate for the higher cost of ethylene production. They are particularly important as sources of aromatics (benzene, toluene

and xylenes) that underpin the broad organic chemical industry, and, importantly, serve the polyester value chain.

Naphtha from crudes with high paraffinic content are ideal for olefins production, while for aromatics crudes with high aromatics precursor

content are preferred.

Ethane cracking on the ascent

Ethane and other NGLs are the second most important feedstock for ethylene manufacture, with a share of about 32% in ethylene output, but

their demand is growing faster as supply increases. NGL supplies have diversified, both by source and by region, giving petrochemical producers

across the world – including in India – an opportunity to leverage the resource at a scale not seen before.

While the yield of ethylene from the cracking of naphtha typically ranges between 29-34%, cracking ethane yields between 80-84% ethylene.

For companies eyeing maximisation of ethylene production to make derivatives that include mainly polyethylene (PE) and monoethylene glycol

(MEG), ethane is preferred.

Chemical Weekly January 21, 2025 133

Contents Index to Advertisers Index to Products Advertised