Page 152 - CW E-Magazine (14-1-2025)

P. 152

News from Abroad

OUTLOOK

Global battery recycling market to grow at over 37%

annually between 2024 and 2029

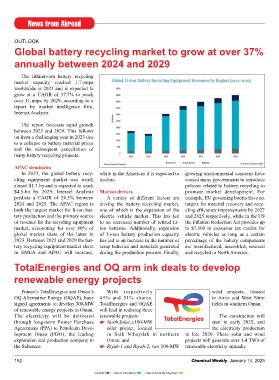

The lithium-ion battery recycling

market capacity reached 1.7-mtpa

worldwide in 2023 and is expected to

grow at a CAGR of 37.7% to reach

over 11-mtpa by 2029, according to a

report by market intelligence fi rm,

Interact Analysis.

The report forecasts rapid growth

between 2025 and 2029. This follows

on from a challenging year in 2023 due

to a collapse in battery material prices

and the subsequent cancellation of

many battery recycling projects.

APAC dominates

In 2023, the global battery recy- while in the Americas it is expected to growing environmental concerns have

cling equipment market was worth decline. caused many governments to introduce

almost $1.7-bn and is expected to reach policies related to battery recycling to

$4.5-bn by 2029. Interact Analysis Market drivers promote market development. For

predicts a CAGR of 24.5% between A variety of different factors are example, EU governing bodies have set

2024 and 2029. The APAC region is driving the battery recycling market, targets for material recovery and recy-

both the largest market for li-ion bat- one of which is the expansion of the cling effi ciency improvements by 2027

tery production and the primary source electric vehicle market. This has led and 2025 respectively, while in the US

of revenue for the recycling equipment to an increased number of retired Li- the Infl ation Reduction Act provides up

market, accounting for over 80% of ion batteries. Additionally, expansion to $7,500 in consumer tax credits for

global market share of the latter in of Li-ion battery production capacity electric vehicles as long as a certain

2023. Between 2025 and 2029 the bat- has led to an increase in the number of percentage of the battery components

tery recycling equipment market share scrap batteries and materials generated are manufactured, assembled, sourced

in EMEA and APAC will increase, during the production process. Finally, and recycled in North America.

TotalEnergies and OQ arm ink deals to develop

renewable energy projects

France’s TotalEnergies and Oman’s With respectively wind projects, located

OQ Alternative Energy (OQAE), have 49% and 51% shares, in Amin and West Nimr

signed agreements to develop 300-MW TotalEnergies and OQAE fi elds in southern Oman.

of renewable energy projects in Oman. will lead in realising three

The electricity will be delivered renewable projects: The construction will

through long-term Power Purchase North Solar, a 100-MW start in early 2025, and

Agreements (PPA) to Petroleum Deve- solar project, located the electricity production

lopment Oman (PDO), the leading in Saih Nihaydah in northern in late 2026. These solar and wind

exploration and production company in Oman; and projects will generate over 1.4 TWh of

the Sultanate. Riyah-1 and Riyah-2, two 100-MW renewable electricity annually.

152 Chemical Weekly January 14, 2025

Contents Index to Advertisers Index to Products Advertised