Page 190 - CW E-Magazine (7-1-2025)

P. 190

Special Report Special Report

PHARMA PULSE Table: 1 Top 10 Therapy Performance in IPM Since December 2023 (yoy, %)

Indian pharma market sees recovery in volume Therapy wise growth (%) Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 June-24 July-24 Aug-24 Sep-24 Oct-24 Nov-24

Cardiac 11.5 11.7 14.0 15.0 13.5 6.2 9.7 7.9 9.7 9.5 11.5 11.7

growth in November 2024

Anti-Infectives 10.3 11.7 9.0 9.0 9.9 12.0 17.2 12.8 8.1 5.7 -0.7 8.4

ndia Ratings and Research (Ind-Ra) grew strongly at 1.8% y-o-y in November During January to November 2024, Gastrointestinal 10.0 10.3 10.0 9.0 9.0 4.7 10.7 9.6 8.7 3.5 7.5 11.0

highlights that the Indian pharma- 2024 as against the average negative the IPM reported average growth of

Iceutical market (IPM) delivered growth of 1.1% y-o-y over the past 12 7.7% y-o-y (monthly) with average Anti-diabetic 8.9 10.8 11.0 12.4 10.7 4.8 5.8 5.3 7.8 5.6 9.4 10.1

higher growth at 9.9% y-o-y in months. Key therapies such as cardiac volume growth at negative 0.7% y-o-y.

November 2024 (November 2023: up (11.7%), gastro (11.0%), anti-diabetic Vitamins 5.9 6.7 7.0 7.2 4.4 0.3 2.6 0.3 2.0 3.4 3.7 7.4

2.9% y-o-y) than the average growth (10.1%), and derma (15.8%) outper- “After four months of a subdued Respiratory 8.1 4.0 -4.0 -3.1 4.7 10.2 19.2 10.5 5.4 -1.7 -3.5 2.7

of 6.0% y-o-y during July to October formed the IPM growth, while respi- performance in volume growth, IPM

2024 (Source: Pharmatrac), on account ratory (2.7%), gynaecology (4.2%), anti- delivered volume growth at 1.8% y-o-y Analgesics 10.2 10.6 8.0 6.2 6.4 2.7 5.7 3.9 3.4 4.1 4.0 8.4

of price growth (5.4% y-o-y) and new infectives (8.4%), vitamins (7.4%), in November 2024, while price growth Derma 6.6 7.6 10.0 13.4 11.3 4.2 9.0 7.7 8.5 6.3 11.1 15.8

launches (2.7% y-o-y). analgesic (8.5%), and central nervous and new launches remained the key

system (CNS; 8.7%) recorded lower drivers for the overall growth of 9.9% CNS 12.0 11.6 12.0 11.9 10.2 2.4 8.4 4.4 5.3 9.7 8.6 8.7

On the positive side, sales volumes growth in November 2024. during the month. Both the acute and

Gynaecological 8.8 5.3 7.0 5.8 1.2 -2.7 0.1 -3.5 2.6 1.0 4.5 4.2

(%) IPM growth (yoy, %) IPM 9.2 9.5 9.0 9.5 9.2 5.2 8.8 6.1 6.3 5.3 6.1 9.9

25

Source: Pharmatrac, Ind-Ra

20 Table: 2 Segment-wise Growth Since December 2023 (yoy, %)

Segment Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 June-24 July-24 Aug-24 Sep-24 Oct-24 Nov-24

15

Acute 8.0 8.8 6.6 6.7 7.6 5.8 10.2 6.1 5.1 3.3 2.6 8.8

10

Sub-chronic 10.5 10.2 11.4 12.8 10.2 4.4 6.9 5.6 6.6 6.0 7.0 10.3

5 2.4 3.2

11.2 20.8 13.8 0.2 6.0 6.2 5.5 5.1 2.4 14.1 9.5 9.7 9.2 9.7 9.4 8.8 6.1 6.3 5.3 6.1 9.9 Chronic 11.1 10.8 11.8 12.3 11.5 4.7 8.2 6.3 7.9 7.3 9.7 10.4

0 5.1 Source: Pharmatrac, Ind-Ra

Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 June-23 July-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 June-24 July-24 Aug-24 Sep-24 Oct-24 Nov-24 chronic segments have seen increased The India business accounted for the acute segment grew at 8.8% y-o-y

demand across key therapies. Ind-Ra around 45% of the coverage companies (November 2023: 3.0% y-o-y) while

expects the IPM growth to be at 8%-9% over FY19-FY24. the chronic and sub-chronic therapy

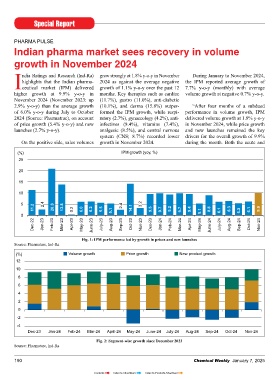

Fig. 1: IPM performance led by growth in prices and new launches y-o-y for FY25,” says Mr. Vivek Jain, segment rose 10.4% y-o-y (2.9%) and

Source: Pharmatarc, Ind-Ra

Director, Corporate Ratings, Ind-Ra. Growth basis MAT 10.3% y-o-y (4.1%), respectively.

(%) Volume growth Price growth New product growth In terms of MAT over November

12 IPM 2QFY25: Growth driven by 2021-November 2024, the acute seg- Cardiac (chronic; 13.3% of IPM),

price and new launches ment (46% of IPM) expanded at a anti-infectives (acute; 11.8%), gastro-

10

The domestic formulations busi- CAGR of 7.7% y-o-y, while the chronic intestinal (acute; 12.0%), anti-diabetic

8 ness under Ind-Ra’s coverage deli- segment (33%) and sub-chronic seg- (chronic; 9.1%) and vitamins (acute;

6 vered healthy growth at 9.6%in 2QFY25 ment (21%) increased at a CAGR of 8.9%) contributed 55% to the IPM in

against 10.5% y-o-y in 1QFY25 9.7% y-o-y and 10.4% y-o-y, respec- November 2024. All medicines in the

4

(2QFY24: 7.5% y-o-y), on account tively. In terms of MAT in November National List of Essential Medicines

2 of growth in the key therapies such as 2024, the price increased 5.5% and (NLEM) are under the price regula-

0 cardiac, gastro-intestinal, anti-infective the new launches rose 2.5%, offsetting tion. The NLEM has been a source of

and anti-diabetic. The IPM reported re- the slower growth in volume (fl attish), considerable agony to the IPM, which

-2

venue growth of 8.1% y-o-y in 2QFY25 leading to the IPM growth of 7.9% to determines the basis of drug pricing

-4 (2QFY24: 6.5% y-o-y,), driven by Rs. 2,185 bn (November 2023: 10.5% cap. As per the Drugs Prices Control

Dec-23 Jan-24 Feb-24 Mar-24 April-24 May-24 June-24 July-24 Aug-24 Sep-24 Oct-24 Nov-24 price (5.4% y-o-y) and new launches y-o-y; Rs. 2,025-bn). Order 2013, NLEM scheduled drugs

Fig. 2: Segment-wise growth since December 2023 (2.5% y-o-y), while the volume growth accounted for 13.5% of the total IPM in

Source: Pharmatarc, Ind-Ra remained weak at 0.2% y-o-y. In November 2024, the sales of November 2024.

190 Chemical Weekly January 7, 2025 Chemical Weekly January 7, 2025 191

Contents Index to Advertisers Index to Products Advertised