Page 178 - CW E-Magazine (6-8-2024)

P. 178

Special Report

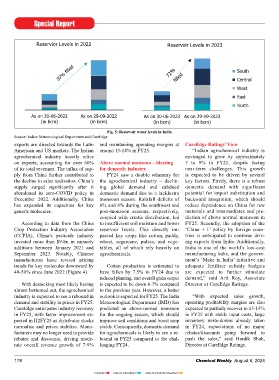

Reservior Levels in 2022 Reservoir Levels in 2023

South

Central

West

East

North

As on 30-06-2022 As on 29-09-2022 As on 30-06-2023 As on 29-09-2023

(in bcm) (in bcm) (in bcm) (in bcm)

Fig. 5: Reservoir water levels in India

Source: Indian Meteorological Department and CareEdge

exports are directed towards the Latin and maintaining operating margins at CareEdge Ratings’ View

American and US markets. The Indian around 13-14% in FY25. “Indian agrochemical industry is

agrochemical industry heavily relies envisaged to grow by approximately

on exports, accounting for over 60% Above normal monsoon – blessing 7 to 9% in FY25, despite facing

of its total revenues. The infl ux of sup- for domestic industry near-term challenges. This growth

ply from China further contributed to FY24 saw a double whammy for is expected to be driven by several

the decline in sales realisation. China’s the agrochemical industry – declin- key factors. Firstly, there is a robust

supply surged signifi cantly after it ing global demand and subdued domestic demand with significant

abandoned its zero-COVID policy in domestic demand due to a lacklustre potential for import substitution and

December 2022. Additionally, China monsoon season. Rainfall defi cits of backward integration, which should

has expanded its capacities for key 6% and 8% during the southwest and reduce dependence on China for raw

generic molecules. post-monsoon seasons, respectively, materials and intermediates and pre-

coupled with erratic distribution, led diction of above normal monsoon in

According to data from the China to insuffi cient soil moisture and lower FY25. Secondly, the adoption of the

Crop Protection Industry Association reservoir levels. This directly im- ‘China + 1’ policy by foreign coun-

(CCPIA), China’s pesticide industry pacted key crops like cotton, paddy, tries is anticipated to continue driv-

invested more than $9-bn in capacity wheat, sugarcane, pulses, and vege- ing exports from India. Additionally,

additions between January 2021 and tables, all of which rely heavily on India is one of the world’s low-cost

September 2023. Notably, Chinese agrochemicals. manufacturing hubs, and the govern-

manufacturers have revised pricing ment’s ‘Make in India’ initiative and

trends for key molecules downward by Cotton production is estimated to adequate fertiliser subsidy budgets

40-50% since June 2022 (Figure 4). have fallen by 7.5% in FY24 due to are expected to further stimulate

reduced planting, and overall grain output demand,” said Arti Roy, Associate

With destocking most likely having is expected to be down 6-7% compared Director at CareEdge Ratings.

almost bottomed out, the agrochemical to the previous year. However, a better

industry is expected to see a rebound in outlook is expected for FY25. The India “With expected sales growth,

demand and stability in prices in FY25. Meteorological Department (IMD) has operating profi tability margins are also

CareEdge anticipates industry recovery predicted an above-normal monsoon expected to partially recover to 13-14%

in FY25, with faster improvement ex- for the ongoing season, which should in FY25 with stable input costs, large

pected in H2FY25 as distributor stocks improve soil conditions and boost crop inventory write-downs already taken

normalise and prices stabilise. Manu- yields. Consequently, domestic demand in FY24, expectations of no major

facturers may no longer need to provide for agrochemicals is likely to see a re- rebates/discounts going forward to

rebates and discounts, driving mode- bound in FY25 compared to the chal- push the sales,” said Hardik Shah,

rate overall revenue growth of 7-9% lenging FY24. Director at CareEdge Ratings.

178 Chemical Weekly August 6, 2024

Contents Index to Advertisers Index to Products Advertised