Page 199 - CW E-Magazine (8-4-2025)

P. 199

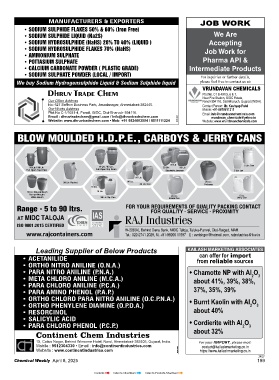

Special Report MANUFACTURERS & EXPORTERS JOB WORK

• SODIUM SULPHIDE FLAKES 50% & 60% (Iron Free)

• SODIUM SULPHIDE LIQUID (Na2S) We Are

• SODIUM HYDROSULPHIDE (NaHS) 28% TO 40% (LIQUID ) Accepting

• SODIUM HYDROSULPHIDE FLAKES 70% (NaHS) Job Work for

• AMMONIUM SULPHATE

• POTTASIUM SULPHATE Pharma API &

• CALCIUM CARBONATE POWDER ( PLASTIC GRADE) Intermediate Products

• SODIUM SULPHATE POWDER (LOCAL / IMPORT) For inquiries or further details,

We buy Sodium Hydrogensulphide Liquid & Sodium Sulphide liquid please feel free to contact us at:

VRUNDAVAN CHEMICALS

Plot No. C1 B 407/3, 6 & 7,

Near Fire Station, GIDC Estate,

Our Office Address Panoli-394116, Dist-Bharuch, Gujarat (INDIA).

No: 527 Saffron Business Park, Jasodanagar, Ahmedabad-382445. Contact Person: Mr. Kashyap Patel

Our Works Address Mobile: +91-9879511311

Plot No C-1/1031-4, Panoli, GIDC, Dist-Bharuch-394116. Email: info@vrundavanchemicals.com

Email : dhruvtradechem@gmail.com / Info@dhruvtradechem.com KNS ADI vrundavan_chemicals@yahoo.in

Website: www.dhruvtradechem.com • Mob: +91 9824003584 / 8511111224 Website: www.vrundavanchemicals.com

Fig. 8: Evolution of worldwide production capacities for bio-based polymers, 2018-2029.

tions per polymer can be very different. for 4% (mainly epoxy resins and PA). growth rates for PHA, PLA and casein

Figure 9 shows a summary of the The market segments agri- and horti- polymers.

applications for all bio-based polymers culture and others had a market share

covered in the report. In 2024 fi bres of 3% and 2%, respectively. The biodegradability of polymers is

including woven, non-woven (mainly completely independent of the resource

CA and PTT) had the highest share with Bio-based and non-biodegradable from which the polymer is made, so

27%. Packaging, fl exible and rigid, had polymers and biodegradable being bio-based does not necessarily

a total share of 23%, followed by func- polymers mean that certain polymers are bio-

tional applications with 16% (mainly Bio-based non-biodegradable poly- degradable. PBS and copolymers such

epoxy resins and PUR), consumer mers show a CAGR of 10% to 2029. as poly (butylene succinate-co-butylene

goods with 10% (mainly epoxy resins, The highest growth is expected for PP adipate) (PBSA) are both industrial

PLA and PA) and automotive and trans- and PEF, followed by PE. Despite a compostable, but only PBSA bio-

port with 9% (mainly PUR, PA and current moderate average utilisation degrades also under home composting

epoxy resins). Building and construction rate of 65%, bio-based biodegradable conditions and in soil, according to the

accounted for 5% (mainly epoxy resins polymers show a high growth of 16% conditions defi ned in the established

and PUR) and electrics and electronics to 2029. This is mainly due to high standards and certifi cation schemes.

The same applies to PBAT, which is

industrial compostable and, for certain Leading Supplier of Below Products KAILASH MARKETING ASSOCIATES

grades, also home compostable and can offer for import

biodegradable in soil. This biodegrad- • ACETANILIDE from reliable sources

ability applies to both bio-based and • ORTHO NITRO ANILINE (O.N.A.)

fossil-based PBS and PBAT. As this • PARA NITRO ANILINE (P.N.A.) Chamotte NP with Al O

3

2

report focuses on bio-based polymers, • META CHLORO ANILINE (M.C.A.) about 41%, 39%, 38%,

the development of fossil-based PBS • PARA CHLORO ANILINE (P.C.A.)

and PBAT, although biodegradable, • PARA AMINO PHENOL (P.A.P.) 37%, 35%, 39%

is not shown in detail here. However, • ORTHO CHLORO PARA NITRO ANILINE (O.C.P.N.A.)

fossil-based PBS and PBAT produc- • ORTHO PHENYLENE DIAMINE (O.P.D.A.) Burnt Kaolin with Al O

3

2

tion capacities, mainly in Asia, were at • RESORCINOL about 40%

3-mt in 2024, with an assumed actual • SALICYLIC ACID

production of around 600,000 tonnes. Cordierite with Al O

Until 2029 fossil-based PBS and PBAT • PARA CHLORO PHENOL (P.C.P.) about 32% 2 3

production capacities are not expected Continent Chem Industries

to increase signifi cantly, with a CAGR 15, Calico Nagar, Behind Winsome Hotel, Narol, Ahmedabad-382405, Gujarat, India. For your IMPORT, please mail:

Fig. 9: Shares of the produced bio-based polymers in different market segments, 2024. of 1%. Mobile : 9512304330 • Email : info@continentindustries.com contact@kailashmarketing.co.in

Website : www.continentindustries.com KNS ADI https://www.kailashmarketing.co.in

24/37

198 Chemical Weekly April 8, 2025 Chemical Weekly April 8, 2025 199

Contents Index to Advertisers Index to Products Advertised