Page 191 - CW E-Magazine (19-11-2024)

P. 191

Special Report Special Report

BUSINESS OUTLOOK registered a degrowth of 8% valuewise

Dyes and pigments: 10% volume growth likely 100% in FY24, owing to moderation in prices.

However, in 4MFY25, there was

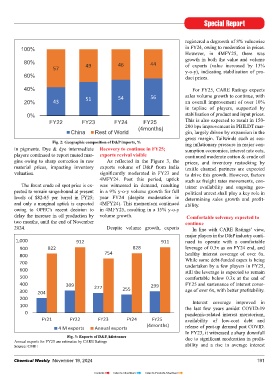

in FY25 with margin expansion of 150-200 bps 80% 49 46 44 growth in both the value and volume

of exports (value increased by 13%

57 y-o-y), indicating stabilisation of pro-

60%

Synopsis to remain comfortable in FY25, in line and Europe, experienced recessionary duct prices.

ollowing a slowdown in FY23, with FY24. trends that affected the demand for

the domestic dye, dye interme- D&P from textile and other industries. 40% For FY25, CARE Ratings expects

Fdiates, and pigment (D&P) indus- Signs of demand revival in FY24 Additionally, sharp volatility in com- 51 54 56 sales volume growth to continue, with

try showed signs of recovery in FY24, India is one of the leading global modity prices (including crude oil), 20% 43 an overall improvement of over 10%

aligning with CARE Ratings’ expecta- suppliers of D&P with ~10% share by supply chain disruptions, and infl ux of in topline of players, supported by

tions. The industry saw a revival in sales value in the global industry. Within the low-cost Chinese imports impacted the 0% stabilisation of product and input prices.

volume, ranging from 5-10%, and ~100 total D&P industry, dye and dye inter- domestic D&P producers. Major indus- FY22 FY23 FY24 FY25 This is also expected to result in 150-

bps increase in operating profi tability mediates constitute ~75-80%, with try players saw over 5% moderation in (4 months) 200 bps improvement in PBILDT mar-

in FY24 (against CARE Ratings’ ex- their major (over 70%) end-use applica- topline and contraction of ~500 bps in China Rest of World gin, largely driven by expansion in the

pectation of 5-7% volume growth and tion being in textiles. This is evidenced their operating profi tability. Fig. 2: Geographic composition of D&P imports, % gross margin. Tailwinds such as eas-

a 100-150 bps recovery in profi t before by India’s signifi cant export of D&P ing infl ationary pressure in major con-

interest, lease rentals, depreciation, and to countries such as Bangladesh (10% For FY24, CARE Ratings had envi- in pigments. Dye & dye intermediate Recovery to continue in FY25; sumption economies, interest rate cuts,

exports revival visible

taxation [PBILDT] margin). of total D&P export volume), China saged a 5-7% volume growth and a players continued to report muted mar- As refl ected in the Figure 3, the continued moderate cotton & crude oil

(7%), Turkey (7%) and the USA (5%) – 100-150 bps recovery in PBILDT gins owing to sharp correction in raw prices, and inventory restocking by

While volumes improved across majority of which, are textile producing margin, supported by restocking of material prices, impacting inventory exports volume of D&P from India textile channel partners are expected

D&P players due to improvement in nations. Also, the industry highly inventory by textile channel partners, valuation. signifi cantly moderated in FY23 and to drive this growth. However, factors

4MFY24. Post this period, uptick

demand from major consumption indus- depends on imports, from China, which softening cotton & crude oil prices and was witnessed in demand, resulting such as freight rates movements, con-

tries and softening input prices, margin has over 50% share in overall imports. onset of festive season. The Brent crude oil spot price is ex- tainer availability and ongoing geo-

improvements were primarily observed pected to remain range-bound at present in a 9% y-o-y volume growth for full political unrest shall play a key role in

by pigment players. The profi tability Thus, with signifi cant global link- As expected, the industry experi- levels of $82-85 per barrel in FY25; year FY24 (despite moderation in determining sales growth and profi t-

of dye & dye intermediate players re- ages, the industry’s performance re- enced a revival in sales volume, rang- and only a marginal uptick is expected 4MFY24). This momentum continued ability.

mained muted owing to a sharp correc- mained subdued in FY23 due to global ing from 5-10%, and expansion of ~100 owing to OPEC’s recent decision to in 4MFY25, resulting in a 15% y-o-y

tion in raw material prices, impacting infl ationary pressure, an uncertain geo- bps in operating profi tability. While delay the increase in oil production by volume growth. Comfortable solvency expected to

the inventory valuation. political scenario, and destocking by volume growth was across dyes & pig- two months, until the end of November Despite volume growth, exports continue

majority of the users. Major consump- ments (in the second half of the fi scal 2024. In line with CARE Ratings’ view,

In FY23, the D&P industry faced a tion economies, particularly the USA year), margin improvement was seen major players in the D&P industry conti-

demand slowdown from the end-user 1,000 912 911 nued to operate with a comfortable

industries such as textiles, plastic and 700 900 822 828 leverage of 0.3x as on FY24 end, and

coating. This was due to high infl ation 616 800 754 healthy interest coverage of over 6x.

across major consumption economies 600 554 549 700 While some debt-funded capex is being

and sharp fl uctuation in input costs. 600 undertaken by a few players in FY25,

Major industry players saw over 5% 500 398 still the leverage is expected to remain

moderation in topline and contraction 400 342 500 comfortable below 0.3x at the end of

of ~500 bps in their operating profi tability. 318 400 309 277 299 FY25 and sustenance of interest cover-

300 237 300 204 255 age of over 6x, with better profi tability.

For FY25, CARE Ratings expects 200

the growth momentum to continue 200 121 100 Interest coverage improved in

with volume backed recovery of over 100 0 the last few years amidst COVID-19

10% in topline for D&P players, and pandemic-related interest moratorium,

improvement of 150-200 bps in the 0 FY21 FY22 FY23 FY24 FY25 availability of low-cost debt and

operating profi tability largely led by FY22 FY23 FY24 FY25 4 M exports Annual exports (4 months) release of pent-up demand post COVID.

improvement in gross margin. (4 months) In FY23, it witnessed a sharp downfall

Production Imports Fig. 3: Exports of D&P, kilotonnes due to signifi cant moderation in profi t-

Annual exports for FY25 are estimates by CARE Ratings

The solvency position is expected Fig. 1: Production and imports of D&P, kilotonnes Source: CMIE ability and a rise in average interest

190 Chemical Weekly November 19, 2024 Chemical Weekly November 19, 2024 191

Contents Index to Advertisers Index to Products Advertised