Page 171 - CW E-Magazine (27-5-2025)

P. 171

Special Report Special Report

Rs. 102-crore or $12-mn) in FY24 to energy exchanges. The commissioning serve as key inputs for UPL in manu- resource use and waste generation per Green H adoption in the fertilizer augmentation of biomass consumption

2

technologies like RE, zero liquid dis- of the 62-MW wind-solar hybrid power facturing nitrogen-based fertilizers unit of physical output. industry by 2030. However, biomass usage in

charge, and scale-ban technology (re- plant in 2023 signifi cantly enhanced and green specialty chemicals. Nota- In 2030, most of the green H pro- the agrochemical industry will be both

2

ducing mineral deposits to improve UPL’s RE portfolio. Due to its com- bly, UPL exports 90% of its specialty Way forward for the agrochemical duced in India will be consumed in as a fuel and as a part of feedstock,

system effi ciency) and waste recycling missioning, the share of RE in UPL’s chemicals, refl ecting its export-oriented sector petroleum and fertilizer industry. Mar- substituting natural gas in the form of

technology. electricity consumption rose >2x in business model. The agrochemical sector is a hard- ket stakeholders estimate that approxi- bio-methane, bio-gas, etc.

just one year between FY23 and FY24. to-abate industrial sector, with the mately 10% of the H used in the ferti-

2

UPL has made a long-term com- Between FY20 and FY24, the annual To achieve an annual output of majority of emissions emanating from liser industry will be produced from With increased consumer demand

mitment to achieving carbon neutra- consumption from RE sources increased 10,000-tonnes of green H , UPL will natural gas and raw materials used in RE. Assuming that the agrochemical and awareness of lower-carbon pro

2

lity by 2040. As part of this eff ort, the at a compound annual growth rate require approximately 232-MW of manufacturing processes. Regardless, industry has substituted approximately ducts, the importance of a push towards

company made an interim target of a (CAGR) of 27.7%. RE, including 143-MW from solar in the near term, by 2030, two key 10% of its overall H usage with green sustainability has never been higher.

2

25% reduction in CO emissions inten- power and 89-MW from wind power. viable opportunities have emerged that H by 2030, it will indirectly lead to As one of the world’s largest and most

2

2

sity by FY25 (FY20 baseline), which it Other decarbonization and sustain- The company has already commenced will lead to a signifi cant quantum of RE installations of 8.7-GW in the carbon-intensive industries, agrochemi-

already surpassed by achieving a 34% ability measures partial green H production and plans RE installations in the sector. sector, necessitating an investment of cal sector decarbonization will require

2

reduction a year ahead of schedule. to reach full capacity by June 2026. approximately US$4.8-bn. collaborative action from all market

Green hydrogen The rising share of RE in electricity stakeholders.

UPL commissioned its fi rst wind- In addition to utilizing RE for Biomass Incorporating RE into overall elec- Considering the various penetration

solar hybrid power plant in Gujarat, decarbonization, UPL has made progress Apart from green H , UPL has tricity usage currently represents the levels for the aforementioned RE op- The Central Government must de-

2

in 2023. The project was developed towards producing green H . In July begun integrating biomass into its energy low-hanging fruit decarbonization op- portunities, the agrochemical industrial vise a dedicated emission reduction

2

in partnership with CleanMax Enviro 2023, the company secured a produc- mix to minimize its environmental portunity. The current penetration of sector is likely to integrate 9-11 GW of framework to set clear green adoption

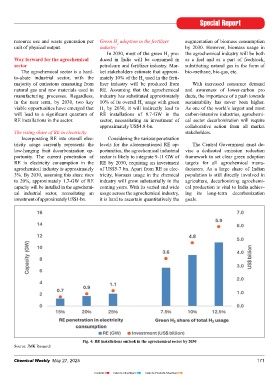

Energy Solutions Pvt. Ltd., comprising tion capacity of 10,000-tpa through impact further. In FY24, biomass repre- RE in electricity consumption in the RE by 2030, requiring an investment targets for all agrochemical manu-

29-MW solar and 33-MW wind power. SECI’s tender for green H producers. sented just 0.9% of the company’s total agrochemical industry is approximately of US$5-7 bn. Apart from RE as elec- facturers. As a large share of Indian

2

Designed to meet 30% of UPL’s power This allocation is part of India’s Stra- fuel consumption. By replacing coal 3%. By 2030, assuming this share rises tricity, biomass usage in the chemical population is still directly involved in

consumption through RE, the project tegic Interventions for Green Hydrogen with biomass, the company aims to to 20%, approximately 1.7-GW of RE industry will grow substantially in the agriculture, decarbonizing agrochemi-

is expected to reduce carbon emissions Transition (SIGHT) Scheme, mode-1, reduce coal usage by 15%, contributing capacity will be installed in the agrochemi- coming years. With its varied and wide cal production is vital to India achiev-

by 1.25-lakh tonnes of CO equivalent tranche-I, to establish green H pro- to lower emissions. cal industrial sector, necessitating an usage across the agrochemical industry, ing its long-term decarbonization

2

2

annually. duction facilities nationwide. Green H investment of approximately US$1-bn. it is hard to ascertain quantitatively the goals.

2

in the chemical sector is primarily uti- Other initiatives

Before 2023, UPL purchased green lized for producing green ammonia and In addition to the decarbonization

power from third-party sources and green methanol. These compounds can measures mentioned above, UPL is

developing solutions to enhance it’s envi-

ronmental, social, and economic sus-

tainability. Measured against the FY20

baseline, the company has achieved

36% revenue generation from such

solutions in FY24 and aims to reach

50% by CY25. In addition, UPL is

aiming for sustainable sourcing of raw

materials. With 35% sustainable sourcing

achieved in FY24, it targets 60% by

CY27, using FY20 as the baseline.

UPL has reported a 47% reduction

in specifi c water consumption in FY24,

measured against the FY20 baseline,

compared to its target of a 20% reduc-

tion by FY25. Similarly, the company

has achieved a 52% reduction in specifi c

waste disposal, exceeding its FY25

target of 25%. These reductions are Fig. 4: RE installations outlook in the agrochemical sector by 2030

Fig. 3: RE consumption annual trend at UPL tracked as part of its eff orts to decrease Source: JMK Research

170 Chemical Weekly May 27, 2025 Chemical Weekly May 27, 2025 171

Contents Index to Advertisers Index to Products Advertised