Page 163 - CW E-Magazine (27-5-2025)

P. 163

Special Report Special Report

Orphan drugs: Still showing market strength or not? to continue to lead among the large

Looking forward, J&J is projected

bio/pharma companies in orphan drug

rphan drugs have accounted within FDA, the Center for Biologics PATRICIA VAN ARNUM sales as a percentage of the company’s

for more than 50% of new drug Evaluation and Research (CBER) and Editorial Director, (DCAT) overall pharmaceutical sales, according

Oapprovals over the past fi ve are not included in this analysis. to the Evaluate report. Orphan drugs

years and are projected to account for more than fi ve in 10,000 people among will account for close to half of J&J’s

20% of the global Rx drug market by In 2024, 26 of CDER’s 50 novel other criteria. prescription drug sales by 2030, con-

2030, but are market prospects slowing? drug approvals (52%), were approved siderably higher than the 25% or so at

to treat rare or orphan diseases (de- Orphan versus non-orphan drugs AstraZeneca, Roche, Novartis, Bristol-

New drug approvals and orphan fi ned as diseases that affect fewer than Although a niche area in terms Myers Squibb, and Amgen. J&J, Merck &

drugs 200,000 people in the US). which con- of the patient populations served, Co., and Roche each are projected to

The question before the industry is tinues a recent trend in which more than orphan drugs are an important part of the Source: Evaluate Ltd., 2025 Orphan Drug Report: Are Orphans That Different? (2025) see 10% CAGR in their orphan drugs

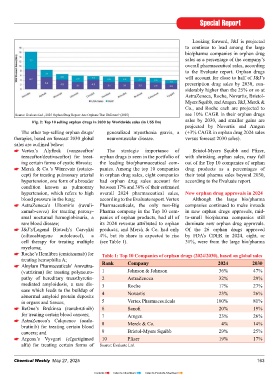

has the growth of orphan drugs reached half of new drug approvals were for growth strategy of both large bio/pharma- Fig. 2: Top 10 selling orphan drugs in 2030 by Worldwide sales (in US$ Bn) sales by 2030, and smaller gains are

an infl ection point? Attracted by regula- orphan drugs. In 2023, 28 of CDER’s 55 ceutical companies as well as smaller projected by Novartis and Amgen

tory advantages and market exclusivity, novel drug approvals (51%) received companies. The orphan drug market has The other top-selling orphan drugs/ generalized myasthenia gravis, a (+3% CAGR in orphan drug 2024 sales

orphan drugs have been an important orphan drug designation. In 2022, 20 been outpacing growth comparative to therapies, based on forecast 2030 global neuromuscular disease. versus forecast 2030 sales).

piece of bio/pharma companies’ deve- of 37, or 54% of novel drug approvals non-orphan drugs, but the differential in sales are outlined below:

lopment and commercialization strate- by FDA’s CDER were for rare diseases. growth rates is narrowing. Vertex’s Alyftrek (vanzacaftor/ The strategic importance of Bristol-Myers Squibb and Pfi zer,

gies. Market growth for orphan drugs In 2021, 26 of CDER’s 50 new drug tezacaftor/deutivacaftor) for treat- orphan drugs is seen in the portfolio of with shrinking orphan sales, may fall

has outperformed that of non-orphan approvals (52%) were approved to A recent analysis, ‘2025 Orphan ing certain forms of cystic fi brosis; the leading bio/pharmaceutical com- out of the Top 10 companies of orphan

drugs, but will that continue. treat rare or orphan diseases, and in Drug Report: Are Orphans That Diffe- Merck & Co.’s Winrevair (sotater- panies. Among the top 10 companies drug products as a percentages of

2020, 58%, or 31, of the 53 novel drug rent?’, by Evaluate Ltd., a business cept) for treating pulmonary arterial in orphan drug sales, eight companies their total pharma sales beyond 2030,

Orphan drugs continue to account approvals were orphan drugs. intelligence fi rm serving the bio/pharma- hypertension, one form of a broader had orphan drug sales account for according to the Evaluate report.

for a large percentage of new drug ceutical industry, estimates that by condition known as pulmonary between 17% and 36% of their estimated

approvals. Over the past fi ve years (2020- The large share of orphan drug 2030, orphan drugs will make up hypertension, which refers to high overall 2024 pharmaceutical sales, New orphan drug approvals in 2024

2024), orphan drugs have accounted for approvals is in part due to the regulatory one-fi fth of the forecast $1.6-trillion in blood pressure in the lung; according to the Evaluate report. Vertex Although the large bio/pharma

more than half of new drug approvals and market exclusivity advantages pro- worldwide prescription drug sales, a AstraZeneca’s Ultomiris (ravuli- Pharmaceuticals, the only non-Big companies continued to make inroads

(new molecular entities and biological vided by regulatory authorities to in- share that has doubled over the last decade. zumab-cwvz) for treating paroxy- Pharma company in the Top 10 com- in new orphan drugs approvals, mid-

therapeutics) from the US Food and centivize development of drugs to treat smal nocturnal hemoglobinuria, a panies of orphan products, had all of to-small bio/pharma companies still

Drug Administration’s (FDA) Center rare diseases. In the US, that is seven The Evaluate report points out that rare blood disease; its 2024 revenue attributed to orphan dominate new orphan drug approvals.

for Drug Evaluation and Research years of market exclusivity for the although the compound annual growth J&J’s/Legend Biotech’s Carvykti products, and Merck & Co. had only Of the 26 orphan drugs approved

(CDER) (see Figure-1). Other biologic- fi rst company to have a drug approved rate (CAGR) of orphan drug will con- (ciltacabtagene autoleucel), a 4%, but its share is expected to rise by FDA’s CDER in 2024, eight, or

based products, including blood pro- for the orphan indication, and in the tinue to outperform the CAGR of non- cell therapy for treating multiple (see Table 1). 31%, were from the large bio/pharma

ducts, vaccines, allergenics, tissues, and European Union (EU), it is 10 years of orphan drugs through 2030, the growth myeloma;

cellular & gene therapies, are reviewed market exclusivity, with the EU defi n- gap between them is lessening: a CAGR Roche’s Hemlibra (emicizumab) for Table 1: Top 10 Companies of orphan drugs (2024/2030), based on global sales

and approved by a separate center ing orphan drugs as those affecting not of 10% for the 2025-2030 forecast treating hemophilia A;

period for orphan drugs versus 7.5% for Alnylam Pharmaceuticals’ Amvuttra- Rank Company 2024 2030

non-orphan prescription drugs, with (vutrisiran) for treating polyneuro- 1 Johnson & Johnson 36% 47%

orphan drugs’ growth advantage closing pathy of hereditary transthyretin- 2 AstraZeneca 32% 29%

to just 1% by the end of the decade. mediated amyloidosis, a rare dis- 3 Roche 17% 27%

ease which leads to the buildup of

Among companies and products, abnormal amyloid protein deposits 4 Novartis 23% 26%

the top-selling orphan drug, Johnson & in organs and tissues; 5 Vertex Pharmaceuticals 100% 81%

Johnson’s (J&J) Darzalex (daratu- BeOne’s Brukinsa (zanubrutinib) 6 Sanofi 20% 19%

mumab), indicated to treat multiple for treating certain blood cancers; 7 Amgen 23% 26%

myeloma and AL amyloidosis, is pro- AstraZeneca’s Calquence (acala-

jected to keep its number one position brutinib) for treating certain blood 8 Merck & Co. 4% 14%

among orphan drugs by 2030, reaching cancers; and 9 Bristol-Myers Squibb 29% 25%

Fig. 1: Percentage of new drug approvals by the US Food and Drug Adminstation’s Center

for drug Evaluation and Research sales of more than $16-bn, according to Argenx’s Vyvgart (efgartigimod 10 Pfi zer 19% 17%

That Were Orphan Drug, 2020-2024 the Evaluate report (see Figure-2). alfa) for treating certain forms of Source: Evaluate Ltd.

162 Chemical Weekly May 27, 2025 Chemical Weekly May 27, 2025 163

Contents Index to Advertisers Index to Products Advertised