Page 195 - CW E-Magazine (9-7-2024)

P. 195

Special Report Special Report

FY25 chemicals outlook: Muted performance with tiveness and increased backward inte- cost structures due to higher logistics in FY25 to increase yoy, on account

gration. Specialty chemical players will costs. However, there could be some of incremental working capital fi nance

some improvement over 2H look to increase capacities, to move recovery over 2HFY25, led by a gra- to fund incremental revenue growth

up the value chain, increase backward dual reduction in channel inventories in FY25 on the back of a low revenue

ndia Ratings and Research (Ind-Ra) resulting in a fi ve-year CAGR of 17%. the weak domestic consumption. The integration, and diversify sales mix. resulting in restocking demand and base in FY24. The net debt levels have

has maintained a neutral outlook on While revenue growth in FY25 is likely to country has been exporting the excess The focus of sector participants would some reduction in low-priced imports been on the rise since FY22 due to a

Ithe chemicals sector and a Stable Out- remain well below the average of around at low prices across geographies. While be towards increasing the value-added from China over 2HFY25 as its domestic contraction in EBITDA margins and

look for its rated sector entities for FY25. 15% clocked by Ind-Ra rated sector China is taking measures to revive do- mix and high margin products. demand gradually improves. sustained capex intensity. The net debt

entities since FY19, the fundamental mestic consumption, the focus would bottomed out in FY22 due to the strong

“FY25 is likely to be another weak growth drivers of the sector, which con- be on its property sector which has been Elevated supply chain inventories, However, the margins are likely to operational EBITDA generated over

year for the chemicals sector due to a tribute around 7% to India’s GDP, re- a drag on its economic growth. but gradual reduction to create differ at a sub-segment level with mar- FY21 and FY22 when margins were at

continued global demand weakness main intact. Domestic demand is likely restocking demand in 2HFY25 gins within dyes & intermediates (due to its peak and this balance sheet strength

resulting in a global supply surplus for to remain robust in FY25, led by growth Indian producers are thus likely to With the inventories of global weak export demand), polyvinyl chloride enabled sector participants to absorb

most segments and consequently weak in end-use industries such as pharma- still face the risk of Chinese dumping chemicals majors at elevated levels, (due to low-priced imports) and agro- the headwinds witnessed over FY23-

prices. While the ‘bottom of the cycle’ ceuticals, paints, real estate, diversifi ed over FY25, although conditions could global market conditions are likely to chemicals (due to elevated inventory FY24.

conditions has already been witnessed manufacturing, personal & home care, be better yoy with a gradual recovery in remain challenging in 1HFY25. How- levels of customers) coming under

in FY24, only a modest recovery is likely food processing and automobiles. China. In FY24, while the import value ever, the prolonged destocking result- pressure. On the other hand, segments The high net debt levels are expec-

in FY25 with 1H remaining weak. reduced yoy due to a fall in commodity ing in inventory reduction would gradu- such as soda ash, caustic soda, fl uorine, ted to keep balance sheets moderately

The weaker-than-expected demand Export demand, however, is likely prices, the volumes increased. Down- ally spur demand to replenish inventory phthalic anhydride, pigments, and ben- leveraged in FY25, but slightly better

recovery in China post lifting of the to remain tepid amid a soft demand side risks could emanate from a weaker- in 2HFY25, thereby supporting prices. zene are likely to record a moderate per- yoy due to some improvement in profi t-

COVID lockdown has been at the core of environment particularly in Europe, than-expected recovery in China’s do- formance with some improvement yoy. ability towards the year end. However,

the chemical sector woes and the risk owing to the high infl ation. Producers mestic demand, which could lead to Sector EBITDA to remain muted in The margin profi le of specialty chemi- there appears to be adequate liquidity

of low-priced imports could continue who have a more geographically continued export of low-cost materials FY25, recovery likely in 2H cal players is typically less volatile than headroom available with significant

in FY25 albeit at a little lower inten- diversifi ed export mix towards Latin from the country, leading to prolonged The sectoral EBITDA margins are commodity chemical players. cash balances and positive operational

sity as the country’s domestic demand America, Middle East and the US are oversupply conditions. likely to slightly improve to around 16% cash flows, supported by a modest

gradually improves. With a gradual likely to be better placed. Players with in FY25 (FY24P: 14%; FY23: 17%; Moderately leveraged balance sheets and recovery in EBITDA. Free cash fl ows

reduction in supply chain inventories, contract manufacturing agreements Capex to continue though some defer- FY22: 19%; FY21: 21%) but will be adequate liquidity provide headroom are likely to remain negative in FY25,

restocking demand could lend some sup- are also expected to play well in terms ment over few quarters expected well below the high-levels witnessed over Ind-Ra expects the net debt levels given the continued capex.

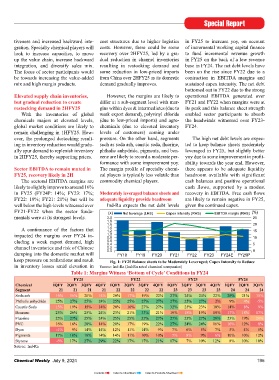

port to chemical prices over 2HFY25. of export order books. The weakness Ind-Ra expects the sectoral capex FY21-FY22 when the sector funda- (x) Net leverage (LHS) Capex intensity (RHS) EBITDA margin (RHS) (%)

High interest rates and weak end-use in global demand and multiple geo- spends at an absolute level in FY25 to mentals were at its strongest levels. 2.0 25

1.8

consumption are likely to constrain political issues will benefi t domestic- remain on par, despite revenue growth 1.6 20

1.4

export demand in FY25, especially from focused companies in FY25, although yoy, with chemical players going slow A continuance of the factors that 1.2 15

Europe in addition to elevated freight they too remain exposed to pricing on capex and deferring capex for a few impacted the margins over FY24 in- 1.0 10

0.8

rates owing to the Red Sea crisis. The pressure from inexpensive Chinese quarters till sector fundamentals and cluding a weak export demand, high 0.6 5

0.4

US and Latin America demand is likely imports. However, from a long-term margins improve. The capex/net re- channel inventories and risk of Chinese 0.2 0

0.0

to remain weak although better year- perspective, there remains a large ex- venue in FY25 is expected to be lower dumping into the domestic market will FY18 FY19 FY20 FY21 FY22 FY23 FY24E FY25P

on-year (yoy). India’s domestic de- port opportunity for Indian companies yoy at around 10.9% (FY24P: 12.2%; keep pressure on realisations and result Fig. 1: FY25 Balance sheets to be Moderately Leveraged; Capex Intensity to Reduce

mand on the other hand is expected to in speciality chemicals as supply chain FY23: 10.5%: FY22: 9%) but on par in inventory losses amid elevation in Source: Ind-Ra (Ind-Ra rated chemical companies)

remain strong in FY25, benefi tting do- diversifi cation and China+1 play out. with the average over FY19-FY24. Table 1: Margins Witness ‘Bottom of Cycle’ Conditions in FY24

mestic producers having a lower export This is because China accounts for 15- FY21 FY22 FY23 FY24

share,” says Siddharth Rego, Associate 17% of the global specialty chemical Capex pertaining to CDMO (con- Chemical IQFY 2QFY 3QFY 4QFY 1QFY 2QFY 3QFY 4QFY 1QFY 2QFY 3QFY 4QFY 1QFY 2QFY 3QFY

Director, Corporate Ratings, Ind-Ra. exports, while India accounts for only tract development and manufacturing Segment 21 21 21 21 22 22 22 22 23 23 23 23 24 24 24

a miniscule share. organisations) opportunities would Soda ash 16% 16% 20% 14% 20% 17% 19% 22% 27% 24% 24% 22% 29% 21% 15%

9%

2%

Modest revenue recovery in FY25; continue as planned, considering the Phthalic anhydride 25% 27% 25% 24% 25% 25% 27% 27% 27% 25% 27% 18% 14% 4% -5%

14%

27%

20%

16%

15%

25%

23%

32%

27%

8%

13%

19%

9%

Caustic Soda

domestic demand steady but export Improvement in China demand key output is covered by contractual agree- Benzene 25% 26% 25% 24% 23% 21% 33% 21% 19% 18% 19% 19% 17% 18% 17%

demand remains weak to chemical sector recovery ments. However, the overall large Fluorine 25% 27% 25% 24% 25% 25% 27% 27% 27% 25% 27% 28% 23% 19% 20%

After a yoy decline in FY24 led While the global economy has been capex theme is expected to sustain, given PVC 16% 16% 20% 14% 20% 17% 19% 22% 27% 24% 24% 16% 10% 12% 8%

predominantly by a sharp fall in reali- battling a weak demand environment, the growth opportunities. Commodity Dyes -1% 9% 14% 14% 12% 11% 14% 9% 7% 6% 5% 7% 5% 4% 5%

sations, Ind-Ra believes the revenue of China, which accounts for around 40% chemical players will look to increase Pigments 17% 18% 18% 14% 14% 11% 10% 10% 7% 8% 9% 6% 10% 10% 12%

chemical companies could witness of the global chemical market, has en- capacities, resulting in higher import Styrene -6% 17% 27% 29% 22% 17% 17% 21% 17% 7% 10% 12% 8% 10% 10%

modest growth in FY25 on a low base, sured strong production levels despite substitution, improved cost competi- Source: Ind-Ra

194 Chemical Weekly July 9, 2024 Chemical Weekly July 9, 2024 195

Contents Index to Advertisers Index to Products Advertised