Page 123 - CW E-Magazine (14-1-2025)

P. 123

Point of View

Considerable new capacity for PTA is in the offi ng;

but margins will come under pressure in near-term

The Adani group has waded further into the petro-

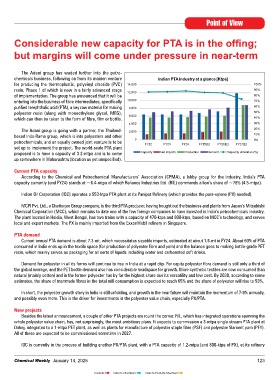

chemicals business, following on from its maiden venture Indian PTA industry at a glance [Ktpa]

for producing the thermoplastic, polyvinyl chloride (PVC) 14,000 100%

resin, Phase 1 of which is now in a fairly advanced stage 12,000 90%

of implementation. The group has announced that it will be 80%

entering into the business of fibre intermediates, specifically 10,000 70%

purified terephthalic acid (PTA), a key raw material for making 8,000 60%

polyester resin (along with monoethylene glycol, MEG), 50%

which can then be taken to the form of fibre, film or bottle. 6,000 40%

4,000 30%

The Adani group is going with a partner, the Thailand- 2,000 20%

based Indo-Rama group, which is into polyesters and other 10%

petrochemicals, and an equally owned joint venture is to be 0 0%

set up to implement the project. The world-scale PTA plant FY22 FY23 FY24 FY25[E] FY26[E] FY27[E]

proposed is to have a capacity of 3.2-mtpa and is to come Capacity Net imports Production Demand Capacity utilisation (%)

up somewhere in Maharashtra (location as yet unspecified).

Current PTA capacity

According to the Chemical and Petrochemical Manufacturers’ Association (CPMA), a lobby group for the industry, India’s PTA

capacity currently (end FY24) stands at ~6.4-mtpa of which Reliance Industries Ltd. (RIL) commands a lion’s share of ~78% (4.5-mtpa).

Indian Oil Corporation (IOC) operates a 553-ktpa PTA plant at its Panipat Refinery (which provides the para-xylene (PX) needed).

MCPI Pvt. Ltd., a Chatterjee Group company, is the third PTA producer, having bought out the business and plants from Japan’s Mitsubishi

Chemical Corporation (MCC), which remains to date one of the few foreign companies to have invested in India’s petrochemicals industry.

The plant located in Haldia, West Bengal, has two trains with a capacity of 470-ktpa and 800-ktpa, based on MCC’s technology, and serves

local and export markets. The PX is mainly imported from the ExxonMobil refinery in Singapore.

PTA demand

Current annual PTA demand is about 7.3-mt, which necessitates sizeable imports, estimated at about 1.6-mt in FY24. About 60% of PTA

consumed in India ends up in the textile space (for production of polyester fibre and yarn) and the balance goes to making bottle-grade PET

resin, which mainly serves as packaging for all sorts of liquids including water and carbonated soft drinks.

Demand for polyester in all its forms will continue to rise in India at a rapid clip. Per capita polyester fibre demand is still only a third of

the global average, and the PET bottle demand also has considerable headspace for growth. More synthetic textiles are now consumed than

natural (mainly cotton) and in the former polyester has by far the highest share due its versatility and low cost. By 2030, according to some

estimates, the share of manmade fibres in the total mill consumption is expected to reach 65% and the share of polyester will rise to 53%.

In short, the polyester growth story in India is still unfolding, and growth in the near future will maintain the momentum of 7-9% annually,

and possibly even more. This is the driver for investments in the polyester value chain, especially PX/PTA.

New projects

Besides the latest announcement, a couple of other PTA projects are round the corner. RIL, which has integrated operations spanning the

whole polyester value chain, has, not surprisingly, the most ambitious plans. It expects to commission a 3-mtpa single stream PTA plant at

Dahej, integrated to a 1-mtpa PET plant, as well as plants for manufacture of polyester staple fibre (PSF) and polyester filament yarn (PFY).

All of these are expected to be commissioned sometime in 2027.

IOC is currently in the process of building another PX/PTA plant, with a PTA capacity of 1.2-mtpa (and 800-ktpa of PX), at its refinery

Chemical Weekly January 14, 2025 123

Contents Index to Advertisers Index to Products Advertised