Page 184 - CW E-Magazine (18-2-2025)

P. 184

Special Report Special Report

CAREEDGE RATINGS REPORT dealers, and higher burn on branding. total paint demand, mainly coming from players is pegged at around 4.3-bn litre

Amidst an intensifying competitive the automotive industry, as well as sec- per annum (LPA) as of end of FY24.

Paint sector: Operating profi tability to drop by another landscape, existing players have taken tors like oil & gas, aerospace, marine, The existing and new players have

price hikes in July-August 2024 (1.5- and electronics. planned a massive capex entailing capa-

200 bps by FY26 2.5%) to pass on the rise in input costs. city addition of about 70% over the

Recent price increases along with ex- Operating profi tability to moderate next 3-4 years, out of which the major-

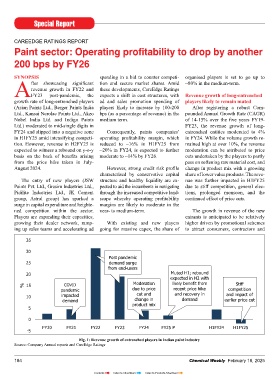

SYNOPSIS spending in a bid to counter competi- organised players is set to go up to pected demand pickup are likely to due to intensifying competition ity is expected to become operational

fter showcasing signifi cant tion and secure market shares. Amid ~80% in the medium-term. lead to a rebound in revenue growth, A recent price hike of 1.5-2.5% to in FY25 and FY26. Close to 1-bn LPA

revenue growth in FY22 and these developments, CareEdge Ratings albeit expected to remain muted. pass on the rise in cost of raw materials, capacity has been added in current

AFY23 post-pandemic, the expects a shift in cost structures, with Revenue growth of long-entrenched Future growth shall be driven by effective which are primarily crude oil deriva- fi scal, most of which is from a new entrant

growth rate of long-entrenched players ad and sales promotion spending of players likely to remain muted branding, growth in tinting machines tives, shall enable the players to main- belonging to a large conglomerate.

(Asian Paints Ltd., Berger Paints India players likely to increase by 100-200 After registering a robust Com- and dealer networks, product innova- tain gross margin at a fi ve-year average

Ltd., Kansai Nerolac Paints Ltd., Akzo bps (as a percentage of revenue) in the pounded Annual Growth Rate (CAGR) tion networks, and expansion into new (FY20-FY24) of around 40% in FY25. Prior to the GST application on

Nobel India Ltd. and Indigo Paints medium term. of 14-15% over the fi ve years FY19- categories. paints, organised players had an esti-

Ltd.) moderated to mid-single digits in FY23, the revenue growth of long- Operating margin, which remained mated market share of about 65% in the

FY24 and slipped into a negative zone Consequently, paints companies’ entrenched entities moderated to 4% Demand for decorative paints, ac- healthy at an average of around 18% in domestic paint sector, which has now

in H1FY25 amid intensifying competi- operating profi tability margin, which in FY24. While the volume growth re- counting for 70-75% of paint demand, the previous fi ve years period, is, how- increased to about 75%. With incre-

tion. However, revenue in H2FY25 is reduced to ~16% in H1FY25 from mained high at over 10%, the revenue is primarily driven by new construction ever, slated to take a hit in the medium mental capacity from larger companies,

expected to witness a rebound on y-o-y ~20% in FY24, is expected to further moderation can be attributed to price (20%) and repainting (80%). The re- term. H1FY25 witnessed a decline in the organised sector’s share is expected

basis on the back of benefi ts arising moderate to ~14% by FY26. cuts undertaken by the players to partly painting segment is further boosted by the margin of sample players to ~16%, to go up to 80% in the medium term.

from the price hike taken in July- pass on softening raw material cost, and population growth, a shorter repainting primarily attributed to the margin cor-

August 2024. However, strong credit risk profi le change in product mix with a growing cycle, increased rental homes, and rising rection of the market leader. CareEdge Robust credit risk profi le

characterised by conservative capital share of lower value products. The reve- incomes. The real estate sector is expec- Ratings expects operating margins of The credit risk profi le of established

The entry of new players (JSW structure and healthy liquidity are ex- nue was further impacted in H1FY25 ted to stay strong in FY25 & FY26 due incumbents to moderate to ~14% by industry players remains robust, with

Paints Pvt. Ltd., Grasim Industries Ltd., pected to aid the incumbents in navigating due to stiff competition, general elec- to project completions and government FY26 amidst pricing pressure due to an overall gearing ratio of around 0.1x

Pidilite Industries Ltd., JK Cement through the increased competitive land- tions, prolonged monsoon, and the spending on housing and infrastructure. increased competition. and ample surplus liquidity accumu-

group, Astral group) has sparked a scape whereby operating profi tability continued effect of price cuts. CareEdge Ratings expects the housing lated over the years through healthy

surge in capital expenditure and heighte- margins are likely to moderate in the demand to remain resilient over the next Organised players’ share expected to cashfl ows. The strong credit risk profi le

ned competition within the sector. near- to medium-term. The growth in revenue of the new two years, accompanied by an increase grow to ~80% in the medium term shall support the ambitious expansion

Players are expanding their capacities, entrants is anticipated to be relatively in launches and sales growth of 10-15%. with new capacities coming online plans of the players without signifi -

growing their dealer network, ramp- With existing and new players higher driven by promotional schemes Industrial paints represent 25-30% of The capacity of the long-entrenched cantly leveraging the balance sheets in

ing up sales teams and accelerating ad going for massive capex, the share of to attract consumers, contractors and

50%

35

45%

30

Post pandemic 40%

25 demand surge 35% Gross margin (%)

FY22, 31

from end-users

20 Muted H1; rebound 30% Operating Margin (%)

expected in H2 with 25%

% 15 COVID Moderation likely benefit from Stiff

pandemic due to price recent price hike competition 20% Employee cost (as a % of revenue)

10 impacted cut and and recovery in and impact of

demand change in demand earlier price cut 15% Ad and sales promotion expense

product mix

5 10% (as a % of revenue)

0 5%

FY20 FY21 FY22 FY23 FY24 FY25 P H1FY24 H1FY25 0%

-5 FY20 FY21 FY22 FY23 FY24 FY25 P FY26 P

Fig. 1: Revenue growth of entrenched players in Indian paint industry Fig. 2: Operational profi tability trends in Indian paint industry

Source: Company Annual reports and CareEdge Ratings Source: Company Annual reports and CareEdge Ratings

184 Chemical Weekly February 18, 2025 Chemical Weekly February 18, 2025 185

Contents Index to Advertisers Index to Products Advertised