Page 134 - CW E-Magazine (18-2-2025)

P. 134

Point of View

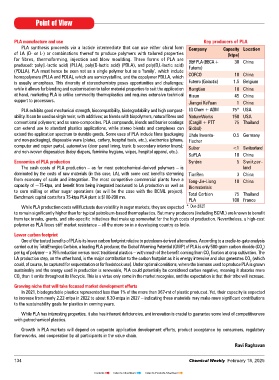

PLA manufacture and use Key producers of PLA

PLA synthesis proceeds via a lactide intermediate that can use either chiral form Company Capacity Location

of LA (D- or L-) or combinations thereof to produce polymers with tailored properties (ktpa)

for fibres, thermoforming, injection and blow moulding. Three forms of PLA are B&F PLA (BBCA + 30 China

produced: poly(L-lactic acid) (PLLA), poly(D-lactic acid) (PDLA), and poly(D,L-lactic acid) Futerro)

(PDLLA). PLA must hence be seen not as a single polymer but as a ‘family’, which include

homopolymers (PLLA and PDLA), which are semicrystalline, and the copolymer PDLLA, which COFCO 10 China

is usually amorphous. This diversity of stereochemistry poses opportunities and challenges; Futerro (Galactic) 1.5 Belgium

while it allows for blending and customisation to tailor material properties to suit the application Hengtian 10 China

at hand, marketing PLA is unlike commodity thermoplastics and requires extensive technical Hisun 45 China

support to processors. Jiangxi KeYuan 1 China

PLA exhibits good mechanical strength, biocompatibility, biodegradability and high compost- LG Chem + ADM 75* USA

ability. It can be used as virgin resin; with additives; as blends with biopolymers, natural fibres and NatureWorks 150 USA

conventional polymers; and as nano-composites. PLA compounds, blends and barrier coatings (Cargill + PTT 75 Thailand

can extend use to standard plastics applications, while stereo blends and complexes can Global)

extend the application spectrum to durable goods. Some uses of PLA include films (packaging Uhde Inventa- 0.5 Germany

and non-packaging), disposable ware (plates, cutlery, hospital tools, etc.), electronics (phone, Fischer

computer and copier parts), automotive (door panel lining, trunk & secondary interior liners); Sulzer <1 Switzerland

and non-woven disposables (baby diapers, feminine hygiene, wipes, hospital apparel, etc.).

SuPLA 10 China

Economics of PLA production Synbra 5 Switzer-

The cash costs of PLA production – as for most petrochemical-derived polymers – is land

dominated by the costs of raw materials (in this case, LA), with some cost benefits stemming TianRen 3 China

from economy of scale and integration. The most competitive commercial plants have a Tong-Jie-Liang 10 China

capacity of ~75-ktpa, and benefit from being integrated backward to LA production as well as Biomaterials

to corn milling or other sugar operations (as will be the case with the BCML project). Total Corbion 75 Thailand

Benchmark capital costs for a 75-ktpa PLA plant is $180-200 mn.

PLA 100 France

While PLA production costs will fluctuate due volatility in sugar markets, they are expected *: Due 2025

to remain significantly higher than for typical petroleum-based thermoplastics. But many producers (including BCML) are known to benefit

from tax breaks, grants, and site-specific initiatives that make up somewhat for the high costs of production. Nevertheless, a high-cost

polymer as PLA faces stiff market resistance – all the more so in a developing country as India.

Lower carbon footprint

One of the touted benefits of PLA is its lower carbon footprint relative to petroleum-derived alternatives. According to a cradle-to-gate analysis

carried out by TotalEnergies Corbion, a leading PLA producer, the Global Warming Potential (GWP) of PLA is only 500-gram carbon dioxide (CO )

2

per kg of polymer – a 75% reduction versus most traditional plastics – with much of the benefit coming from CO fixation at crop cultivation. The

2

LA production step, on the other hand, is the major contribution to the carbon footprint as it is energy intensive and also generates CO (which

2

could, of course, be captured for sequestration or for feedstock use). Under optimal conditions, where the biomass used to produce PLA is grown

sustainably and the energy used in production is renewable, PLA could potentially be considered carbon negative, meaning it absorbs more

CO than it emits throughout its lifecycle. This is a virtue only some in the market recognise, and the expectation is that their tribe will increase.

2

Growing niche that will take focused market development efforts

In 2021, biodegradable plastics represented less than 1% of the more than 367-mt of plastic produced. Yet, their capacity is expected

to increase from nearly 2.22-mtpa in 2022 to about 6.30-mtpa in 2027 – indicating these materials may make more significant contributions

to the sustainability goals for plastics in coming years.

While PLA has interesting properties, it also has inherent deficiencies, and innovation is crucial to guarantee some level of competitiveness

with petrochemical plastics.

Growth in PLA markets will depend on corporate application development efforts, product acceptance by consumers, regulatory

frameworks, and cooperation by all participants in the value chain.

Ravi Raghavan

134 Chemical Weekly February 18, 2025

Contents Index to Advertisers Index to Products Advertised