Page 133 - CW E-Magazine (18-2-2025)

P. 133

Point of View

India to get fi rst PLA plant, but application development

efforts will hold key to market growth

The global market for biodegradable

plastics, which are not always bio-based,

is still a small fraction of the overall market

for all plastics. The latter is dominated

by polyolefins – polyethylene (PE) and

polypropylene (PP) – which are available

in a wide range of molecular weights &

architectures and tailored (including by

use of additives) to the application at hand.

But the growing concern over single-

use plastics, particularly for packaging and

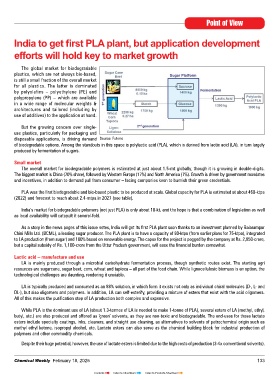

disposable applications, is driving demand Source: Futerro

of biodegradable options. Among the standouts in this space is polylactic acid (PLA), which is derived from lactic acid (LA), in turn largely

produced by fermentation of sugars.

Small market

The overall market for biodegradable polymers is estimated at just about 1.5-mt globally, though it is growing in double-digits.

The biggest market is China (70% share), followed by Western Europe (17%) and North America (7%). Growth is driven by government mandates

and incentives, in addition to demand pull from consumer – facing companies keen to burnish their green credentials.

PLA was the first biodegradable and bio-based plastic to be produced at scale. Global capacity for PLA is estimated at about 460-ktpa

(2022) and forecast to reach about 2.4-mtpa in 2027 (see table).

India’s market for biodegradable polymers (not just PLA) is only about 10-kt, and the hope is that a combination of legislation as well

as local availability will catapult it several-fold.

As a story in the news pages of this issue notes, India will get its first PLA plant soon thanks to an investment planned by Balarampur

Chini Mills Ltd. (BCML), a leading sugar producer. The PLA plant is to have a capacity of 80-ktpa (from earlier plans for 75-ktpa), integrated

to LA production (from sugar) and 100% based on renewable energy. The capex for the project is pegged by the company at Rs. 2,850-crore,

but a capital subsidy of Rs. 1,100-crore from the Uttar Pradesh government, will ease the financial burden somewhat.

Lactic acid – manufacture and use

LA is mainly produced through a microbial carbohydrate fermentation process, though synthetic routes exist. The starting agri

resources are sugarcane, sugar beet, corn, wheat and tapioca – all part of the food chain. While lignocellulosic biomass is an option, the

technological challenges are daunting, rendering it unviable.

LA is typically produced and consumed as an 88% solution, in which form it exists not only as individual chiral molecules (D-, L- and

DL-), but also oligomers and polymers. In addition, LA can self-esterify, providing a mixture of esters that exist with the acid oligomers.

All of this makes the purification step of LA production both complex and expensive.

While PLA is the dominant use of LA (about 1.3-tonnes of LA is needed to make 1-tonne of PLA), several esters of LA (methyl, ethyl,

butyl, etc.) are also produced and offered as ‘green’ solvents, as they are non-toxic and biodegradable. The end-uses for these lactate

esters include specialty coatings, inks, cleaners, and straight use cleaning, as alternatives to solvents of petrochemical origin such as

methyl ethyl ketone, isopropyl alcohol, etc. Lactate esters can also serve as the chemical building block for industrial production of

polymers and other commodity chemicals.

Despite their huge potential, however, the use of lactate esters is limited due to the high costs of production (3-4x conventional solvents).

Chemical Weekly February 18, 2025 133

Contents Index to Advertisers Index to Products Advertised