Page 162 - CW E-Magazine (6-2-2024)

P. 162

Special Report

Global petrochemicals market in a decade of

unprecedented oversupply

he global petrochemicals mar- will be more than 6% lower than pre- JAMES WILSON

ket is currently in a diffi cult pandemic projections. This has caused Senior Petrochemical Analyst

Tmoment with oversupply driving reduced operating rates and margins in ICIS

utilisation rates and margins for chemi- all regions, even for those feedstock-

cals producers hitting record lows. advantaged producers in the US and declines since 2021, dropping by

Middle East who have seen their cost almost 30%.

The fact that the industry is in a of production advantages increase.

downcycle is no surprise: the scale of Iranian export volumes have almost

the current capacity build out has been Impact of China slowdown halved in 2023 compared to 2020.

clear for years. China – the world’s largest importer Perhaps more surprisingly, total exports

of chemicals – has been responsible for from Saudi Arabia are also down by

What is unique about the situa- around 75% of olefi n and aromatics more than 20%.

tion today is that impacts of capacity capacity additions between 2020-2024.

expansions have been compounded by Combined with a weak economy, this Polyethylene (PE) exports have

weaker than expected demand growth, has resulted in imports of ethylene decreased by a little over 30% and

and there is another wave of capacity derivatives to China decreasing by around ethylene glycol exports are down by

additions due online within the next 20% in the fi rst nine months of 2023, nearly 15%. Overall, Saudi ethylene

fi ve years. compared to the same period in 2020. derivative exports into China are down

by around one-quarter. In marked con-

Chemicals demand proved to be The biggest impact, in both rela- trast, US exports have signifi cantly

surprisingly robust in the immediate tive and absolute terms, has fallen on increased over this period. North

wake of the coronavirus pandemic, other Asian producers. Asia cracking American export volumes to China

however since then demand growth margins have been negative since late have more than doubled in the fi rst

has fallen signifi cantly short of pre- 2021, with a record number of plants nine months of 2023, compared to the

pandemic expectations. Soaring energy being idled for extended periods. Asia same period in 2020.

prices and infl ation, caused by the exports into China have dropped by

Russia-Ukraine war, have acted to more than one-third. While the Middle East has seen

further hamper demand. exports of crude, naphtha and lique-

Notably, Middle Eastern exports fi ed petroleum gas (LPG) increase,

Global ethylene demand in 2024 into China have also shown steady this has not offset the loss of market

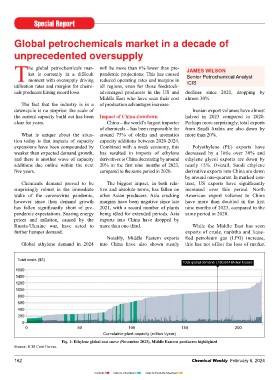

Total costs ($/t)

Total global demand (180,634 Million t/year)

1600

1400

1200

1000

800

600

400

200

0

0 50 100 150 200

Cumulative plant capacity (million t/year)

Fig. 1: Ethylene global cost curve (November 2023), Middle Eastern producers highlighted

Source: ICIS Cost Curves.

162 Chemical Weekly February 6, 2024

Contents Index to Advertisers Index to Products Advertised