Page 156 - CW E-Magazine (19-8-2025)

P. 156

News from Abroad

OUTLOOK

US EIA’s long term forecasts project natural gas

remaining the largest source of hydrogen

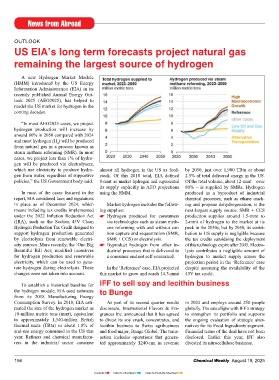

A new Hydrogen Market Module

(HMM) introduced by the US Energy

Information Administration (EIA) in its

recently published Annual Energy Out-

look 2025 (AEO2025), has helped to

model the US market for hydrogen in the

coming decades.

“In most AEO2025 cases, we project

hydrogen production will increase by

around 80% in 2050 compared with 2024

and most hydrogen (H ) will be produced

2

from natural gas in a process known as

steam methane reforming (SMR). In most

cases, we project less than 1% of hydro-

gen will be produced via electrolysers,

which use electricity to produce hydro- almost all hydrogen in the US as feed- by 2050, just over 1,900 TBtu or about

gen from water, regardless of supportive stock. Of this 2018 total, EIA defined 2.5% of total delivered energy in the US.

policies,” the US Government body said. 8-mmt as market hydrogen and represented Of the total volume, about 12-mmt – over

its supply explicitly in AEO projections 80% – is supplied by SMRs. Hydrogen

In most of the cases featured in the using the HMM. produced as a byproduct of industrial

report, EIA considered laws and regulations chemical processes, such as ethane crack-

in place as of December 2024, which Market hydrogen includes the follow- ing and propane dehydrogenation, is the

meant including tax credits implemented ing supplies: next-largest supply source. SMR + CCS

under the 2022 Inflation Reduction Act * Hydrogen produced for consumers production supplies around 1.5-mmt to

(IRA), such as the Section 45V Clean via technologies such as steam meth- 2-mmt of hydrogen to the market at its

Hydrogen Production Tax Credit designed to ane reforming with and without car- peak in the 2030s, but by 2050, its contri-

support hydrogen production generated bon capture and sequestration (SMR, bution to US supply is negligible because

by electrolysis from renewable electri- SMR + CCS) or electrolysis. the tax credits subsidising the deployment

city sources. More recently, the ‘One Big * Byproduct hydrogen from other in- of this technology expire after 2045. Electro-

Beautiful Bill Act; modified incentives dustrial processes that is delivered to lysis contributes a negligible amount of

for hydrogen production and renewable a consumer and not self-consumed. hydrogen to market supply across the

electricity, which can be used to gene- projection period in the ‘Reference’ case

rate hydrogen during electrolysis. These In the ‘Reference’ case, EIA projected despite assuming the availability of the

changes were not taken into account. this market to grow and reach 14.3-mmt 45V tax credit.

To establish a historical baseline for IFF to sell soy and lecithin business

the hydrogen module, EIA used estimates to Bunge

from its 2018 Manufacturing Energy

Consumption Survey. In 2018, EIA esti- As part of its second quarter results in 2024 and employs around 250 people

mated the size of the hydrogen market as disclosure, International Flavors & Fra- globally. The sale aligns with IFF’s strategy

10-million metric tons (mmt), equivalent grances Inc. announced that it has agreed to strengthen its portfolio and supports

to approximately 1,340-trillion British to divest its soy crush, concentrates, and the ongoing evaluation of strategic alter-

thermal units (TBtu) or about 1.8% of lecithin business to Swiss agribusiness natives for its Food Ingredients segment.

end-use energy consumed in the US that and food major, Bunge Global. The trans- Financial terms of the deal have not been

year. Refiners and chemical manufactu- action includes operations that genera- disclosed. Earlier this year, IFF also

rers in the industrial sector consume ted approximately $240-mn in revenue divested its nitrocellulose business.

156 Chemical Weekly August 19, 2025

Contents Index to Advertisers Index to Products Advertised