Page 176 - CW E-Magazine (27-8-2024)

P. 176

Special Report Special Report

Brazil, where the impacts of price declines now reached an all-time high of 93%in Pyrifl uquinazon, Bacillus fi rmus, Vali-

were not fully felt during crop protec- the world market while the share of pat- Patented, 7% fenalate, Dimethyl Disulfi de, Coumoxy- 6.0

tion product purchasing times; im- ented pesticides is just 7%. The main strobin and Lepimectin. 5.38

proved weather in the Western US; and reason for the poor share of patented 5.0 4.90

high pest pressure in key country mar- pesticides is that many new chemistries Among the Top-20 generic active 4.19

kets, notably Brazil and China. Howev- that are launched fail to fi t the cost of ingredients, generic herbicides consti- 4.0

er, the market in 2024 can be expected cultivation or give desired results on tute 55% in terms of sales value fol-

to decline as the full impacts of falling the fi eld, according to the Crop Care lowed by generic fungicides with a 3.0

agrochemical prices are felt in Central Federation of India (CCFI). share of 24%, and insecticides at 21%.

& South America and the continuing Generics, 93% 2.0

impacts of the El Niño weather event According to Agribusiness by S&P Agrochemical exports from India

are felt in much of Asia Pacifi c(3). Global, the total agrochemical market is The Indian agrochemical industry has 1.0

valued at $75.5-bn as of 2022 of which established advanced world-class manu-

Regional trends the sale of generics is at $70.2-bn and facturing facilities to cater to the domes- 0.0

In the past fi ve years, the growth the sale of patented agrochemicals is Fig. 3: Total agrochemical market 2022 tic and global demands, thus ensuring

rate of the crop protection products at $5.3-bn. S&P Global further reduction in the import of agro- FY22 FY23 FY24

market in different regions of the world cially launched. In 2022, their total chemicals in the long term. The industry

has been different, and the growth rate According to Mr. Deepak Shah, sales was only $486-mn, out of the total has acquired world-wide renown for its Fig. 4: Exports of agrochemicals from India [$ bn]

in emerging markets is faster(4). Chairman, CCFI, in 2010, there were market of $75 bn. These were Bixafen, production effi ciencies, product effi cacy, Source: Chemexcil

Latin America has become an in- 10 new active ingredients commer- Isopyrazam, Ametoctradin, Isotianil, quality and competitive pricing. Table 5: Export of agrochemicals (Chapter 38) – Top-15 countries

creasingly important source of agri- [$ million]

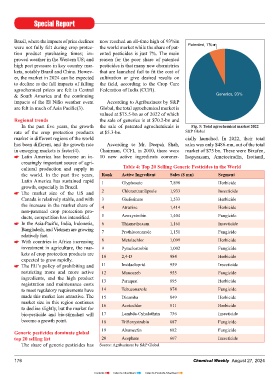

cultural production and supply in Table 4: Top 20 Selling Generic Pesticides in the World The pesticide market size in India Country 2021-22 2022-23 2023-24 Share

the world. In the past fi ve years, Rank Active Ingredient Sales ($ mn) Segment is estimated to be Rs. 229.4-bn in 2022,

Latin America has sustained rapid 1 Glyphosate 7,898 Herbicide and it is expected to reach Rs. 342.3-bn Brazil 1,243 1,341 975 23.25%

growth, especially in Brazil. by 2028, with a projected Compounded

The market size of the US and 2 Chlorantraniliprole 1,933 Insecticide Annual Growth Rate (CAGR) of 4.6%. USA 1,099 1,456 912 21.75%

Canada is relatively stable, and with 3 Glufosinate 1,533 Herbicide Recognizing the pivotal role of the Japan 181 177 219 5.22%

the increase in the market share of 4 Atrazine 1,414 Herbicide agrochemical industry, the Indian govern-

non-patented crop protection pro- ment has identifi ed it as one of the top Belgium 115 156 171 4.08%

ducts, competition has intensifi ed. 5 Azoxystrobin 1,404 Fungicide 12 sectors to attain global leadership.

In the Asia-Pacifi c, India, Indonesia, 6 Thiamethoxam 1,161 Insecticide China 107 110 128 3.05%

Bangladesh, and Vietnam are growing 7 Prothioconazole 1,151 Fungicide India emerged as the second-largest Vietnam 138 112 118 2.81%

relatively fast. exporter of agrochemicals globally in

With countries in Africa increasing 8 Metolachlor 1,099 Herbicide 2022, according to the World Trade France 104 112 104 2.48%

investment in agriculture, the mar- 9 Pyraclostrobin 1,002 Fungicide Organisation (WTO) data. The growth

kets of crop protection products are 10 2,4-D 984 Herbicide in India’s agrochemical industry has Argentina 124 137 93 2.22%

expected to grow rapidly. resulted in a worthwhile trade surplus Indonesia 91 108 79 1.88%

The EU’s policy of prohibiting and 11 Imidacloprid 959 Insecticide of Rs. 28,908-crore in FY23.

restricting more and more active 12 Mancozeb 955 Fungicide Netherland 75 62 75 1.79%

ingredients, and the high product 13 Paraquat 895 Herbicide Agrochemical products from India

registration and maintenance costs are widely exported to the developed Bangladesh 88 83 71 1.69%

to meet regulatory requirements have 14 Tebuconazole 874 Fungicide countries with the USA and Brazil occu- Colombia 71 80 69 1.65%

made this market less attractive. The 15 Dicamba 849 Herbicide pying close to 45% share of the $4.19-bn

market size in this region continues 16 Acetochlor 811 Herbicide billion agrochemical basket in FY24. UK 77 63 59 1.41%

to decline slightly, but the market for

bio-pesticide and bio-stimulant will 17 Lambda-Cyhalothrin 736 Insecticide One of the primary drivers behind Thailand 83 77 58 1.38%

become a growth point. 18 Trifl oxystrobin 687 Fungicide India’s growth in the agrochemical Australia 122 117 52 1.24%

sector is the backward integration of

19 Abamectin 682 Fungicide

Generic pesticides dominate global production processes. Sum of above 3,718 4,191 3,183 75.89%

top 20 selling list 20 Acephate 667 Insecticide

The share of generic pesticides has Source: Agribusiness by S&P Global However, the industry faces chal- Total [all countries] 4,897 5,379 4,194 100.00%

176 Chemical Weekly August 27, 2024 Chemical Weekly August 27, 2024 177

Contents Index to Advertisers Index to Products Advertised