Page 185 - CW E-Magazine (19-9-2023)

P. 185

Special Report

Preventing losses incurred due to cheap imports –

A case study of Chemplast Sanmar

hemplast Sanmar Ltd. recently project promoters to N.S. VENKATARAMAN

reported a consolidated net loss venture to set up ad- Director

Cof Rs. 64-crore in the fi rst quar- ditional capacity. Nandini Consultancy Centre

ter of 2023-24 (Q1FY24), as against a Chennai - 600090

consolidated net profi t of Rs. 4-crore in Competitiveness of Email: nsvenkatchennai@gmail.com

Q1FY23. Indian production

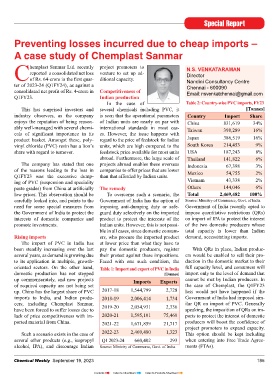

In the case of Table 2: Country-wise PVC imports, FY23

This has surprised investors and several chemicals including PVC, it [Tonnes]

industry observers, as the company is seen that the operational parameters Country Import Share

enjoys the reputation of being reason- of Indian units are nearly on par with China 831,619 34%

ably well-managed with several chemi- international standards in most cas- Taiwan 398,289 16%

cals of signifi cant importance in its es. However, the issue happens with

product basket. Amongst these, poly- regard to the price of feedstock for Indian Japan 386,519 16%

vinyl chloride (PVC) resin has a lion’s units, which are high compared to the South Korea 214,453 9%

share with regard to turnover. feedstock price available for most units USA 187,243 8%

abroad. Furthermore, the large scale of Thailand 141,822 6%

The company has stated that one projects abroad enables these overseas Indonesia 67,398 3%

of the reasons leading to the loss in companies to offer prices that are lower Mexico 54,755 2%

Q1FY23 was the excessive dump- than that afforded by Indian units.

ing of PVC (suspension and speciality Vietnam 43,338 2%

paste grades) from China at artifi cially The remedy Others 144,046 6%

low prices. This observation should be To overcome such a scenario, the Total 2,469,482 100%

carefully looked into, and points to the Government of India has the option of Source: Ministry of Commerce, Govt. of India

need for some special measures from imposing anti-dumping duty or safe- Government of India recently opted to

the Government of India to protect the guard duty selectively on the imported impose quantitative restrictions (QRs)

interests of domestic companies and product to protect the interests of the on import of IPA to protect the interest

promote investments. Indian units. However, this is not possi- of the two domestic producers whose

ble in all cases, since domestic consum- total capacity is lower than Indian

Rising imports ers, who procure the imported product demand, necessitating imports.

The import of PVC in India has at lower price than what they have to

been steadily increasing over the last pay the domestic producers, register With QRs in place, Indian produc-

several years, as demand is growing due their protest against these impositions. ers would be enabled to sell their pro-

to its application in multiple, growth- Faced with one such condition, the duction in the domestic market to their

oriented sectors. On the other hand, Table 1: Import and export of PVC in India full capacity level, and consumers will

domestic production has not stepped [Tonnes] import only to the level of demand that

up commensurately, and new projects Imports Exports cannot be met by Indian producers. In

of required capacity are not being set the case of Chemplast, the Q1FY23

up. China has the largest share of PVC 2017-18 1,544,799 2,728 loss would not have happened if the

imports to India, and Indian produ- 2018-19 2,006,414 1,734 Government of India had imposed sim-

cers, including Chemplast Sanmar, 2019-20 2,054,931 2,336 ilar QR on import of PVC. Generally

have been forced to suffer losses due to speaking, the imposition of QRs on im-

lack of price competitiveness with im- 2020-21 1,595,101 75,469 ports to protect the interest of domestic

ported material from China. 2021-22 1,671,859 21,717 producers will boost the confi dence of

project promoters to expand capacity.

Such a scenario exists in the case of 2022-23 2,469,480 1,323 This option should be kept including

several other products (e.g., isopropyl Q1 2023-24 660,402 293 when entering into Free Trade Agree-

alcohol, IPA), and discourage Indian Source: Ministry of Commerce, Govt. of India ments (FTAs).

Chemical Weekly September 19, 2023 185

Contents Index to Advertisers Index to Products Advertised