Page 126 - CW E-Magazine (29-10-2024)

P. 126

Top Stories

MARKET OUTLOOK

India’s PVC demand set to cross 5-mt in FY27;

pipes & fi ttings set to continue to dominate usage

India’s annual consumption of poly- the Indian pipe market, with polyethy- ment which is fast developing. “There

vinyl chloride (PVC) resin, currently lene (PE) and chlorinated PVC having is growing public awareness against

growing at a CAGR of about 7%, is set 26% and 5% share. “O-PVC and foam animal abuse, which is driving the

to cross the 5-mt mark in FY27, thanks core PVC pipes are gaining popularity synthetic leather market. Blister fi lm

to several drivers including the govern- in the Indian market and are being used for pharmaceutical packaging is also

ment’s emphasis on housing, Smart for drainage and sewerage pipes, venti- showing strong growth”.

Cities, and initiatives such as Digital lation, as cable conduit, etc.,” he noted.

India and Swachh Bharat. Emerging applications

PVC still has a small 8% share of Among emerging applications,

This was stated by Mr. Anand Tibre- the overall Window Profi les market, Mr. Tibrewal pointed to O-PVC pipes

wal, Head, PVC Operations, Reliance which is dominated by aluminium (55% for high pressure water supply, and

Industries Ltd. (RIL), while speaking share), timber (35%) and steel (12%). mining applications, as an alternative

in an online discussion forum on PVC But PVC is gaining ground and is be- to concrete and duct iron. The main

market trends organised by additives ing preferred in new urban construction advantage of O-PVC is that the installa-

manufacturer, Baerlocher India Pvt. Ltd. thanks to the several performance and tion is quick and trenchless. “15 States

on October 17. aesthetic benefi ts it brings. “Almost in India have approved O-PVC pipes,

70% of new urban buildings are now and by FY30 the potential for use in this

According to Mr. Tibrewal, 2.45- using uPVC. This is an approximately application is about 600-ktpa,” he noted.

mtpa new PVC resin manufacturing Rs. 7,100-crore market (in 2023), with

capacity is expected to come up in India strong competition from cheaper im- Another area offering scope in India

by 2028 – 1.2-mtpa from RIL, 1-mtpa ports from China,” Mr. Tibrewal added. is PVC’s use as membrane. These can

by the Adani Group, and 0.25-mtpa be cost-effi cient roofi ng systems and

by Indian Oil Corporation. “This will Wire & cable is a Rs. 9,300-crore come with the advantages of fast instal-

reduce, but not eliminate, imports of market in 2023, and about 75% is used lation, leak-proof, and energy effi cient.

PVC into India. By FY28, imports will in building and construction, with There is some use for grain storage, and

come down to 1.9-mtpa,” he noted. automotives and appliances accounting a potential use is for canal lining.

for 10% each.

Nearly one-third of imports of PVC On the issue of PVC recycling,

resin into India is presently from China, PVC use for calendered products Mr. Tibrewal noted that only about 5%

though Japan is also a major supplier, is another Rs. 7,800-crore market in of annual PVC consumption annually

with 17% share of exports, as companies 2023, and in this fl ooring is a new seg- resurfaces as waste after service life,

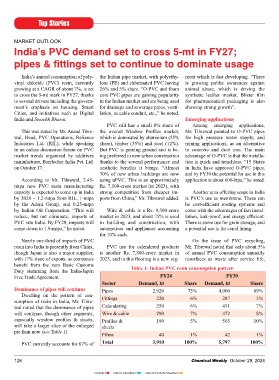

benefi t from the zero Basic Customs Table 1: Indian PVC resin consumption pattern

Duty stemming from the India-Japan

Free Trade Agreement. FY24 FY30

Sector Demand, kt Share Demand, kt Share

Dominance of pipes will continue Pipes 2,920 75% 4,000 69%

Dwelling on the pattern of con-

sumption of resin in India, Mr. Tibre- Fittings 220 6% 287 5%

wal noted that the dominance of pipes Calendaring 250 6% 431 7%

will continue, though other segments, Wire & cable 290 7% 472 8%

especially window profi les & sheets, Profi les & 190 5% 565 10%

will take a larger slice of the enlarged sheets

pie than now (see Table 1).

Films 40 1% 42 1%

PVC currently accounts for 67% of Total 3,910 100% 5,797 100%

126 Chemical Weekly October 29, 2024

Contents Index to Advertisers Index to Products Advertised