Page 123 - CW E-Magazine (1-10-2024)

P. 123

Point of View

Can the caustic soda industry raise exports to tackle

the likely new supply from vinyl producers?

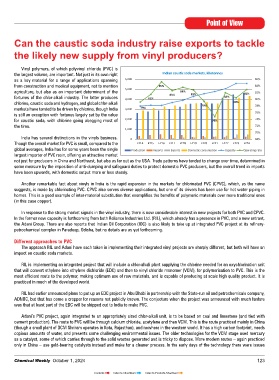

Vinyl polymers, of which polyvinyl chloride (PVC) is

the largest volume, are important. Not just in its own right Indian caustic soda markets, kilotonnes

as a key material for a range of applications spanning 6,000 86%

from construction and medical equipment, not to mention 85% 84%

agriculture, but also as an important determinant of the 5,000 84% 83% 83% 82%

fortunes of the chlor-alkali industry. The latter produces 4,000 81% 83% 82% 80%

chlorine, caustic soda and hydrogen, and global chlor-alkali 79% 80% 78%

markets have tended to be driven by chlorine, though India 3,000 79%

is still an exception with fortunes largely set by the value 76%

for caustic soda, with chlorine going abegging most of 2,000 75% 74%

the time. 72%

1,000

70%

India has several distinctions in the vinyls business. 0 68%

Though the overall market for PVC is small, compared to the FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24

global averages, India has for some years been the single Production Imports Exports Domestic consumption Capacity Operating rate

largest importer of PVC resin, offering an attractive market

not just for producers in China and Northeast, but also as far out as the USA. Trade patterns have tended to change over time, determined in

some measure by the imposition of anti-dumping and safeguard duties to protect domestic PVC producers, but the overall trend in imports

have been upwards, with domestic output more or less steady.

Another remarkable fact about vinyls in India is the rapid expansion in the markets for chlorinated PVC (CPVC), which, as the name

suggests, is made by chlorinating PVC. CPVC also serves diverse applications, but one of its drivers has been use for hot water piping in

homes. This is a good example of inter-material substitution that exemplifies the benefits of polymeric materials over more traditional ones

(in this case copper).

In response to the strong market signals in the vinyl industry, there is now considerable interest in new projects for both PVC and CPVC.

In the former new capacity is forthcoming from both Reliance Industries Ltd. (RIL), which already has a presence in PVC, and a new entrant,

the Adani Group. There are also reports that Indian Oil Corporation (IOC) is also likely to take up at integrated PVC project at its refinery-

petrochemical complex in Paradeep, Odisha, but no details are as yet forthcoming.

Different approaches to PVC

The approach RIL and Adani have each taken in implementing their integrated vinyl projects are sharply different, but both will have an

impact on caustic soda markets.

RIL is implementing an integrated project that will include a chlor-alkali plant supplying the chlorine needed for an oxychlorination unit

that will convert ethylene into ethylene dichloride (EDC) and then to vinyl chloride monomer (VCM), for polymerisation to PVC. This is the

most efficient route to the polymer, making optimum use of raw materials, and is capable of producing at scale high quality product. It is

practiced in much of the developed world.

RIL had earlier announced plans to put up an EDC project in Abu Dhabi in partnership with the State-run oil and petrochemicals company,

ADNOC, but that has come a cropper for reasons not publicly known. The conjecture when the project was announced with much fanfare

was that at least part of the EDC will be shipped out to India to make PVC.

Adani’s PVC project, again integrated to an appropriately sized chlor-alkali unit, is to be based on coal and limestone (and tied with

cement production). The route to PVC will be through calcium chloride, acetylene and then VCM. This is the route practiced mainly in China

(though a small plant of DCM Shriram operates in Kota, Rajasthan), and nowhere in the western world. It has a high carbon footprint, needs

copious amounts of water, and presents some challenging environmental issues. The older technologies for the VCM stage used mercury

as a catalyst, some of which carries through to the solid wastes generated and is tricky to dispose. More modern routes – again practiced

only in China – use gold-bearing catalysts instead and make for a cleaner process. In the early days of the technology there were issues

Chemical Weekly October 1, 2024 123

Contents Index to Advertisers Index to Products Advertised