Page 191 - CW E-Magazine (3-10-2023)

P. 191

Special Report Special Report

ONGC’s proposed investment in OPaL – Unasked cism about the government’s move to ever, government did not want to pro- loss incurred by public sector units are

privatise BPCL, since it was viewed as ceed with only single bid available.

effectively loss incurred by the gov-

question an attempt to provide the profi t mak- ernment. OPaL management has been

given adequate time to deal with the

ing company on a platter to Indian and When BPCL sale viewed in favour,

foreign private investors. The question why not OPaL? issue and it is time now to call a spade

t is reported that Oil and Natural Gas high density polyethy- N.S. VENKATARAMAN is not related only to the private sec- Obviously, Government of India a spade.

Corporation (ONGC) will infuse lene (HDPE), linear tor taking over a public sector unit, but has no objection in principle to priva-

Iabout Rs. 15,000-crore in ONGC low density poly- Director why the government should give up a tise public sector units, as seen in the While inviting bids for privatising

Nandini Consultancy Centre

Petro-additions Ltd. (OPaL) as part of a ethylene (LLDPE), Chennai - 600090 profi t-making public sector unit, which case of BPCL. OPaL, it is inevitable that the govern-

fi nancial restructuring exercise. ONGC polypropylene (PP), Email: nsvenkatchennai@gmail.com provides impressive returns to the gov- ment has to provide some concessions

currently holds 49.36% stake in OPaL, benzene, butadiene, ernment year after year. In such condition, it would be appro- such as facilitating writing off the huge

which operates a mega petrochemical carbon black feed- priate to privatise the loss-incurring interest burden, etc. This is the price the

plant at Dahej in Gujarat. GAIL (India) stock (CBFS) and pyrolysis gasoline In this scenario, the question is The planned sale received three OPaL, instead of further investing as government has to pay for mismanag-

Ltd. has 49.21% interest in OPaL and (pygas). All the products are extremely whether ONGC should pump further bids. However, the government had to much as Rs. 15,000-crore by another ing a large public sector unit like OPaL

Gujarat State Petrochemical Corpora- important ones and with high relevance money of Rs. 15,000 crore in this pro- stall the privatisation of BPCL since public sector unit (ONGC), which has for several years.

tion (GSPC) has the remaining 1.43%. for the country’s industrial and eco- ject and whether alternate options have two bidders walked out due to volati- several other responsibilities to fulfi l

nomic growth. There are domestic sup- been examined without committing lity in the global oil market and unac- and are in the work-in-process stage In the case of loss-making private

Loss incurred and strong product ply gap for some of the products, which further money by a public sector unit ceptable terms of the bid issued by the now. sector units, the promoters would be

basket lead to heavy imports. Therefore, OPaL like ONGC. government. The Vedanta group alone hauled up and would face even humilia-

OPaL is reported to have incurred does not have issues in the marketing stayed in the bid and offered to buy Government of India should be tion. But, in the case of loss-incurring

losses in the past due to lopsided capital front. ONGC’s primary responsibility 53% of the government’s equity, by pragmatic in taking decisions with re- public sector units, no one seems to be

structure with high-debt servicing cost. India’s production of crude oil and offering to spend around $12-bn. How- gard to privatisation of sick units, as responsible!

It is said that cost overrun due to delay Apart from the relevance of the natural gas is not increasing to any signi-

in implementation of the project is the products, the operating standards and fi cant extent and ONGC is the principal

primary reason for it incurring losses. product specifi cation of ONGC are of player in India with the responsibility Chemical Weekly Buyers’ Guide

Obviously, delay in implementation reasonably good standards and there is to boost the production of crude oil and

and commissioning of the project must no issue on this front also. natural gas by drilling more wells and www.cwbg.in

have happened due to various reasons optimising the yield. www.cwbg.in

and perhaps, including some hidden ONGC’s proposal

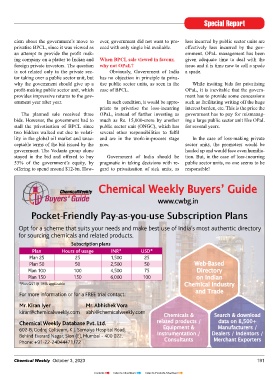

reasons which have not been shared It is reported that ONGC would A legitimate question is whether the Pocket-Friendly Pay-as-you-use Subscription Plans

adequately. make additional investment that would focus of ONGC should entirely remain

convert OPaL into virtually a subsi- on oil drilling and enhancing produc- Opt for a scheme that suits your needs and make best use of India’s most authentic directory

Accumulated losses touched diary of ONGC. While ONGC would tion of crude oil and natural gas, or for sourcing chemicals and related products.

Rs.13,000-crore as on March 31, 2023. spend Rs. 15,000-crore in OPaL, there should it’s funds be spent for revamp- Subscription plans

As noted by the company’s auditors, is no information in the public domain ing a loss-incurring unit, with manage-

OPaL is “facing negative working capi- as to what would be the strategy to ment time and attention being diverted Plan Hours of usage INR* USD*

tal of Rs. 70,750-mn as of that date. revamp the unit and place it on the path in managing OPaL also. Plan 25 25 1,500 25

Net worth of the company has reduced of profi tability. This information is par- Plan 50 50 2,500 50 Web-Based

to Rs. 6,208-mn as at March 31, 2023, ticularly necessary, since the product Privatisation proposal of BPCL Plan 100 100 4,500 75 Directory

as compared to Rs. 45,837-mn as on range of OPaL are extremely important Recently, Government of India Plan 150 150 6,000 100 on Indian

March 31, 2022. In spite of these events and apparently there are no technical announced big plans for privatising *Plus GST @ 18% applicable Chemical Industry

or conditions, which may cast doubt on snags in operating the projects. Mere Bharat Petroleum Corporation Ltd. and Trade

the ability of the company to continue change of product mix by OPaL as part (BPCL) and invited bids. The gov- For more information or for a FREE trial contact:

as a going concern, the management is of revamping plan will not provide any ernment had announced BPCL sale in Mr. Kiran Iyer Mr. Abhishek Vora

of the opinion that going concern basis signifi cant reduction in loss. 2019 as it sought to raise record funds

of accounting is appropriate in view of by offering majority stakes in state- kiran@chemicalweekly.com abhi@chemicalweekly.com Chemicals & Search & download

the cash fl ow forecasts and the plant There is considerable public curio- owned companies to boost a slowing Chemical Weekly Database Pvt. Ltd. related products / data on 8,500+

management has put in place along sity about the future of this large project economy. 602-B, Godrej Coliseum, K.J. Somaiya Hospital Road, Equipment & Manufacturers /

with other facts.” and why ONGC wants to make such Instrumentation / Dealers / Indentors /

a large investment in revamping what BPCL is a profi t making company. Behind Everard Nagar, Sion (E), Mumbai - 400 022. Consultants Merchant Exporters

The product basket of OPaL include appears to be a ‘fi nancially sick unit.’ There has been considerable valid criti- Phone: +91-22-24044471 72

190 Chemical Weekly October 3, 2023 Chemical Weekly October 3, 2023 191

Contents Index to Advertisers Index to Products Advertised