Page 184 - CW E-Magazine (12-11-2024)

P. 184

Special Report Special Report

Generics Outlook: Small molecules and biosimilars

mall-molecule drugs dominate which includes 18% combined growth

the global generics market, but in the EU4 (France, Germany, Italy, PATRICIA VAN ARNUM

Sprojected growth rate for bio- and Spain) and the UK, while the US Editorial Director, DCAT

similar is double that of small-mole- has contributed less than 5% to global

cule drugs. growth. Non-core markets have expe- Germany, Italy and Spain) and the UK

rienced stronger growth than the US, combined are the leading markets for

Market outlook including the Commonwealth of Inde- biosimilars with a 37% market share,

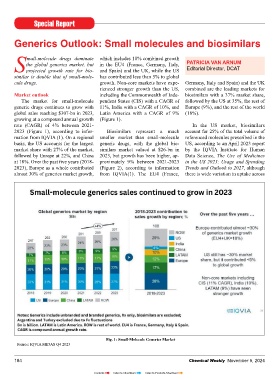

The market for small-molecule pendent States (CIS) with a CAGR of followed by the US at 35%, the rest of

generic drugs continues to grow with 11%, India with a CAGR of 10%, and Europe (9%), and the rest of the world

global sales reaching $307-bn in 2023, Latin America with a CAGR of 9% (18%).

growing at a compound annual growth (Figure 1).

rate (CAGR) of 4% between 2021- In the US market, biosimilars

2023 (Figure 1), according to infor- Biosimilars represent a much account for 25% of the total volume of

mation from IQVIA (1). On a regional smaller market than small-molecule referenced molecules prescribed in the

basis, the US accounts for the largest generic drugs, with the global bio- US, according to an April 2023 report

market share with 27% of the market, similars market valued at $26-bn in by the IQVIA Institute for Human

followed by Europe at 22%, and China 2023, but growth has been higher, ap- Data Science, The Use of Medicines

at 18%. Over the past fi ve years (2018- proximately 9% between 2021-2023 in the US 2023: Usage and Spending

2023), Europe as a whole contributed (Figure 2), according to information Trends and Outlook to 2027, although

almost 30% of generics market growth, from IQVIA(1). The EU4 (France, there is wide variation in uptake across

Fig.2: Global Biosimilars Market

Source: IQVIA Thought Leadership; IQVIA MIDAS Q4 2023, Rx only

molecules refl ecting differences in accessible as immunology drugs, such the total to $33.4-bn in the past several

strategies adopted by originator and as adalimumab (reference product, years, according to the IQVIA report.

biosimilar manufacturers, payer and AbbVie’s Humira), ustekinumab (refe-

pharmacy benefi t managers’ (PBM) rence product, Johnson & Johnson’s Small-molecule brand losses were

decisions, as well as clinician and Stelara), and tocilizumab (reference much less than historic averages as

patient preferences. The impact from product, Roche’s Actemra) face bio- few products with higher spending lost

losses of exclusivity for biologics and similar competition. exclusivity, and defl ationary effects

the introduction of biosimilars has in- of earlier expiries were not as strong.

creased in the past several years, with Most of the impact from losses of Small molecules contributed $49.4-bn

brand sales of those products dropping exclusivity in 2020 through 2022 in in brand losses to loss of exclusivity

by $33-bn over the past several years the US market was from biosimilars over the past several years, down from

compared to $4-bn over the prior years introduced in the prior three years, $68.4-bn in prior years.

and refl ecting a growing role for bio- including three molecules in the onco-

similars(2). logy market – bevacizumab (reference REFERENCE

product, Roche’s Avastin), rituximab 1. P. Van Arnum, “Global Pharma

Biosimilars represent 7% of the (reference product, Roche’s and Bio- Industry Outlook: The Ups and

total biologics volume in the US with gen’s Rixutan), and trastuzumab (ref- Downs & Projections Near Term,”

an additional 20% of volume accessible erence product, Roche’s Herceptin), DCAT Value Chain Insights, May

to biosimilars (i.e., originator medi- which have contributed to a signifi cant 30, 2024.

cines for which a biosimilar is on the increase in brand losses due to loss 2. P. Van Arnum, “Generics Outlook:

market), according to the IQVIA of exclusivity. Biologic brand losses Biologics Patent Cliff Looming,”

Fig. 1: Small-Molecule Generics Market report. Beginning in 2023, an additional were $8-bn each in 2020 and 2021 and DCAT Value Chain Insights, June

Source: IQVIA MIDAS Q4 2023 4% of volume was expected to become $9-bn in 2022 in the US market, lifting 29, 2023.

184 Chemical Weekly November 5, 2024 Chemical Weekly November 5, 2024 185

Contents Index to Advertisers Index to Products Advertised